- United States

- /

- Electronic Equipment and Components

- /

- NasdaqCM:RCAT

Red Cat Holdings (NasdaqCM:RCAT) Raises US$47 Million in Equity Offering

Reviewed by Simply Wall St

Red Cat Holdings (NasdaqCM:RCAT) recently completed a follow-on equity offering, raising $46.75 million, which could have positively influenced its share price by addressing liquidity concerns. However, the announcement of a class action lawsuit alleging exaggerated production and contract values introduced potential uncertainty. Concurrently, Red Cat’s support for U.S. executive orders advancing drone technology might bolster its strategic alignment, potentially offsetting some negative impacts. Despite these developments, the 27% price increase for the quarter is contrasted against the overall market's 10% annual rise, indicating Red Cat’s price move is notably divergent from broader market trends.

Over the last five years, Red Cat Holdings' total shareholder return has increased by a very large percentage, showing substantial growth when compared to its shorter-term market performance. Within the past year, Red Cat outpaced both the general US market and the US Electronic industry, which returned 10% and 15.4% respectively. This highlights the company's significant upward trend despite current challenges.

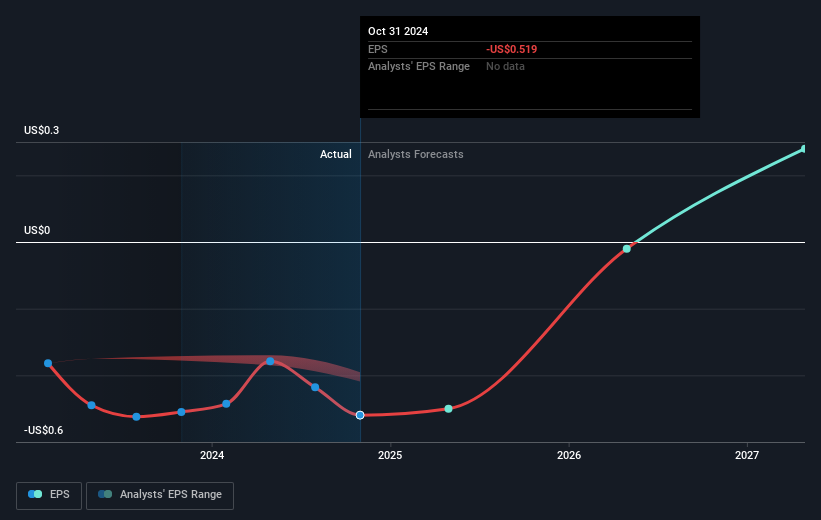

Recent corporate actions, such as the follow-on equity offering and support for technological regulations, could influence revenue positively, aligning with forecast revenue growth of over 100% per year. However, legal uncertainties might impact earnings projections, as the company remains unprofitable and is not expected to achieve profitability within the next three years. The share price remains volatile, yet analysts are consistent in forecasting a substantial increase, with a price target nearly doubling the current share price, suggesting market confidence in Red Cat's future potential despite present hurdles.

Understand Red Cat Holdings' earnings outlook by examining our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:RCAT

Red Cat Holdings

Provides products and solutions to drone industry in the United States.

Adequate balance sheet slight.

Similar Companies

Market Insights

Community Narratives