- United States

- /

- Biotech

- /

- NasdaqGS:RXRX

Recursion Pharmaceuticals (RXRX) Price Surges 9% Over Past Month

Reviewed by Simply Wall St

Recursion Pharmaceuticals (RXRX) experienced a price increase of 9% over the past month, positioning it against the backdrop of a broader market decline driven by geopolitical tensions and weak jobs data. Despite these broader market headwinds, which saw significant tech stock declines due to tariff concerns and disappointing economic indicators, Recursion managed to outperform. The company’s stock movement appeared isolated from these wider trends, which implies internal factors or developments might have played a part, although specific catalysts weren't highlighted during this period. This performance is noteworthy given the current market's overall downward trend of 2.7%.

Recursion Pharmaceuticals' recent 9% monthly share price increase amidst broader market declines may suggest that internal developments, rather than external factors, are influencing investor sentiment. Over the past year, however, the company's total shareholder return was a decline of 19.09%, highlighting a contrast to the short-term positive movement. Comparatively, RXRX underperformed the US Biotechs industry, which saw an 8.4% decline over the same period, and also lagged behind the US market return of 17.7%.

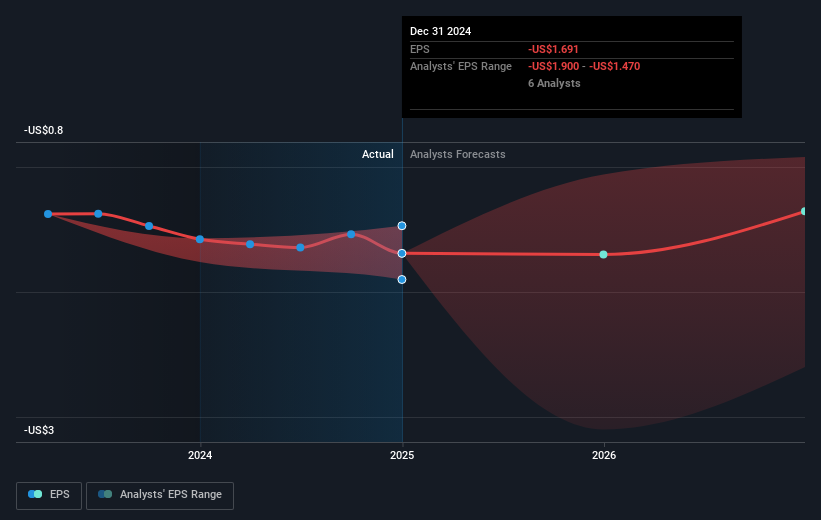

The heightened interest in the stock could be linked to enthusiasm around its AI-driven drug discovery programs, including REC-617 and REC-994 trials, which suggest potential future revenue growth. Yet, Recursion's lack of profitability and reliance on successful trial outcomes may introduce uncertainty into earnings forecasts. The company's expected revenue growth of 39.9% annually for the next three years could be influenced by the new developments and partnerships, possibly providing support to the optimistic forecasts.

The current share price of US$5.68 remains below the consensus analyst price target of US$7.14, indicating a potential upside of 25.7%. This price target reflects expectations of significant future revenue and earnings improvements. However, analysts' forecasts include assumptions such as increased profit margins and successful translation of ongoing projects into commercial revenues, underscoring the importance of navigating the risks and uncertainties outlined in their analysis. Investors may need to weigh these factors carefully when considering the company’s ability to meet future targets.

Evaluate Recursion Pharmaceuticals' prospects by accessing our earnings growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:RXRX

Recursion Pharmaceuticals

Operates as a clinical-stage biotechnology company, engages in the decoding biology and chemistry by integrating technological innovations across biology, chemistry, automation, data science, and engineering to industrialize drug discovery in the United States.

Flawless balance sheet low.

Similar Companies

Market Insights

Community Narratives