- United States

- /

- Retail REITs

- /

- NYSE:O

Realty Income (NYSE:O) Announces Monthly Dividend Increase To US$0.27 Per Share

Reviewed by Simply Wall St

Realty Income (NYSE:O) recently announced an increase in its monthly cash dividend, raising it from $0.2685 to $0.2690 per share, just as the company's share price registered a 2% rise over the past week. This dividend boost, signaling confidence in continued stable returns, occurred amid a generally positive market environment, with broader indexes such as the S&P 500 and Nasdaq achieving notable gains due to optimistic inflation data and positive updates on US-China trade negotiations. While Realty Income's performance aligns with the overall market increase, the dividend increase likely added some support to its recent share price appreciation.

The recent dividend increase by Realty Income to $0.2690 per share underscores management's confidence in delivering continued stable returns. This move, alongside a 2% rise in the share price over the past week, aligns with generally positive market conditions attributed to favorable inflation data and trade negotiations. The audio in the broader narrative highlights Realty Income’s strategic expansion in Europe and the US, with a focus on rent uplifts and capital efficiency. Such initiatives could foster improved revenue and earnings potential.

Over the longer term, Realty Income's total return—including dividends—was 19.93% over five years, reflecting steady value creation. However, over the past year, the company's stock exceeded the US Retail REITs industry return of 8.1%, showcasing its resilience in a competitive field. The current share price at approximately US$56.79 remains 7.5% below the consensus analyst price target of US$61.38, indicating potential room for appreciation as the market evaluates Realty Income’s growth initiatives.

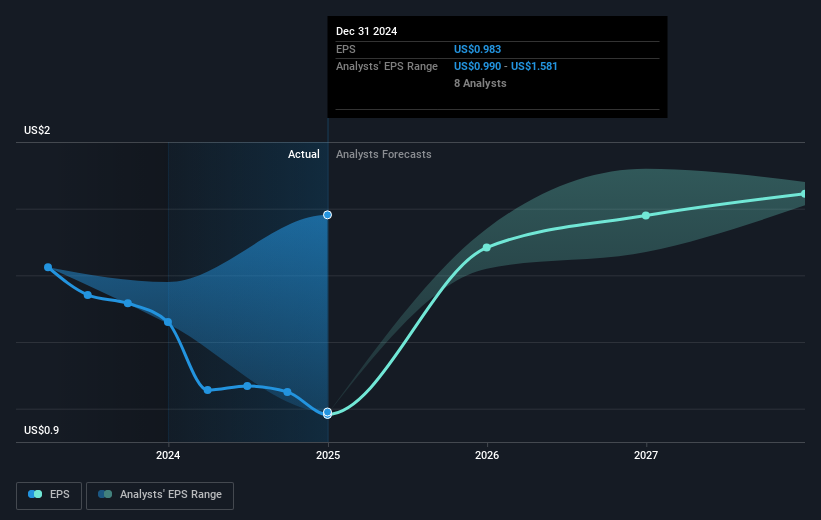

The introduction of new investments and international ventures highlights potential catalysts for revenue and earnings growth, with a projected revenue increase to US$5.9 billion by 2028 from current levels of US$5.40 billion. However, risks remain, particularly relating to European geopolitical dynamics and the economic strength of core nondiscretionary tenant sectors. Analysts' expectations also suggest differing views, with a more conservative earnings forecast of US$1.3 billion, despite optimism over the projected US$1.6 billion by May 2028. These developments necessitate close attention to evolving market conditions and company-specific strategies.

Our valuation report unveils the possibility Realty Income's shares may be trading at a premium.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:O

Realty Income

Realty Income (NYSE: O), an S&P 500 company, is real estate partner to the world's leading companies.

6 star dividend payer and slightly overvalued.

Similar Companies

Market Insights

Community Narratives