- United States

- /

- Insurance

- /

- NYSE:PRU

Prudential Financial (NYSE:PRU) Unveils ActiveIncome Solution Enhancing Retirement Income Options

Reviewed by Simply Wall St

Prudential Financial (NYSE:PRU) recently launched the innovative ActiveIncome product, reflecting its dedication to advancing retirement solutions. Over the last quarter, the company's stock price rose 15%, with events such as the addition to the Russell 1000 indices and the election of an independent director also likely influencing investor sentiment. Despite reporting a decline in Q1 earnings, Prudential's share repurchase program and dividend announcement may have offered some support against broader market trends, where indices like the S&P 500 reached new highs. Overall, these developments have underscored the company's efforts to maintain and potentially enhance shareholder value amidst market fluctuations.

You should learn about the 1 warning sign we've spotted with Prudential Financial.

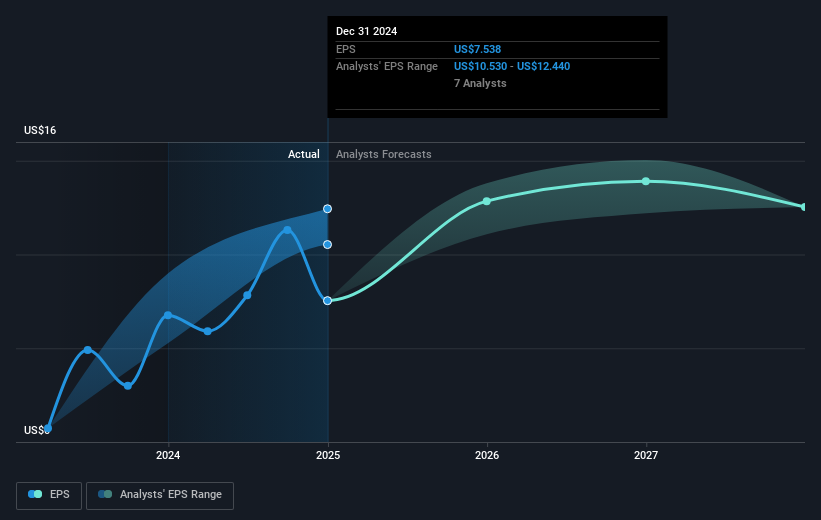

The recent developments at Prudential Financial, including its launch of the ActiveIncome product and the company's inclusion in the Russell 1000 indices, may positively influence its revenue and earnings forecasts. By targeting a diversified product mix, especially in markets like Japan, Prudential aims to enhance its revenue base and stabilize earnings despite challenges like U.S. block volatility and Japanese economic risks. The introduction of a share repurchase program and dividend announcement could bolster shareholder returns further. These strategies align with the company’s objective to optimize capital allocation and improve profit margins over time.

Prudential Financial's total shareholder return, combining share price growth and dividends, was 128.93% over the past five years. This reflects significant longer-term value creation for investors. However, over the past year, the company underperformed both the U.S. market, which witnessed a 13.7% rise, and the U.S. insurance industry, which saw a 16.4% increase. Currently, Prudential's share price is close to the analyst consensus price target of US$112.79, indicating a narrow 4.8% upside from the current price of US$107.4. This suggests that the market fairly values the company based on anticipated earnings and revenue growth over the upcoming years. Investors should consider these elements critically as part of their decision-making process.

Evaluate Prudential Financial's prospects by accessing our earnings growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PRU

Prudential Financial

Provides insurance, investment management, and other financial products and services in the United States, Japan and internationally.

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives