- United States

- /

- Consumer Services

- /

- NYSE:CHGG

Promising Penny Stocks To Watch In July 2025

Reviewed by Simply Wall St

The market has climbed by 2.1% over the past week and 14% over the last year, with earnings forecasted to grow by 15% annually. For investors willing to explore beyond well-known companies, penny stocks—often associated with smaller or newer firms—can present intriguing opportunities. Despite being considered a somewhat outdated term, these stocks remain relevant today as they can offer a mix of affordability and growth potential when supported by strong financials.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Waterdrop (WDH) | $1.40 | $506.33M | ✅ 4 ⚠️ 0 View Analysis > |

| CuriosityStream (CURI) | $4.82 | $277.76M | ✅ 3 ⚠️ 3 View Analysis > |

| WM Technology (MAPS) | $0.92 | $153.23M | ✅ 4 ⚠️ 1 View Analysis > |

| Talkspace (TALK) | $2.77 | $463.46M | ✅ 4 ⚠️ 2 View Analysis > |

| Tuniu (TOUR) | $0.9326 | $95.78M | ✅ 3 ⚠️ 2 View Analysis > |

| Sequans Communications (SQNS) | $1.43 | $36.49M | ✅ 4 ⚠️ 4 View Analysis > |

| Cardno (COLD.F) | $0.1701 | $6.64M | ✅ 2 ⚠️ 4 View Analysis > |

| BAB (BABB) | $0.84976 | $6.13M | ✅ 2 ⚠️ 3 View Analysis > |

| TETRA Technologies (TTI) | $3.40 | $452.45M | ✅ 4 ⚠️ 2 View Analysis > |

| Tandy Leather Factory (TLF) | $3.15 | $26.81M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 422 stocks from our US Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Viomi Technology (VIOT)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Viomi Technology Co., Ltd, with a market cap of $113.22 million, develops and sells IoT-enabled smart home products in the People's Republic of China through its subsidiaries.

Operations: The company's revenue primarily comes from online retailers, amounting to CN¥2.12 billion.

Market Cap: $113.22M

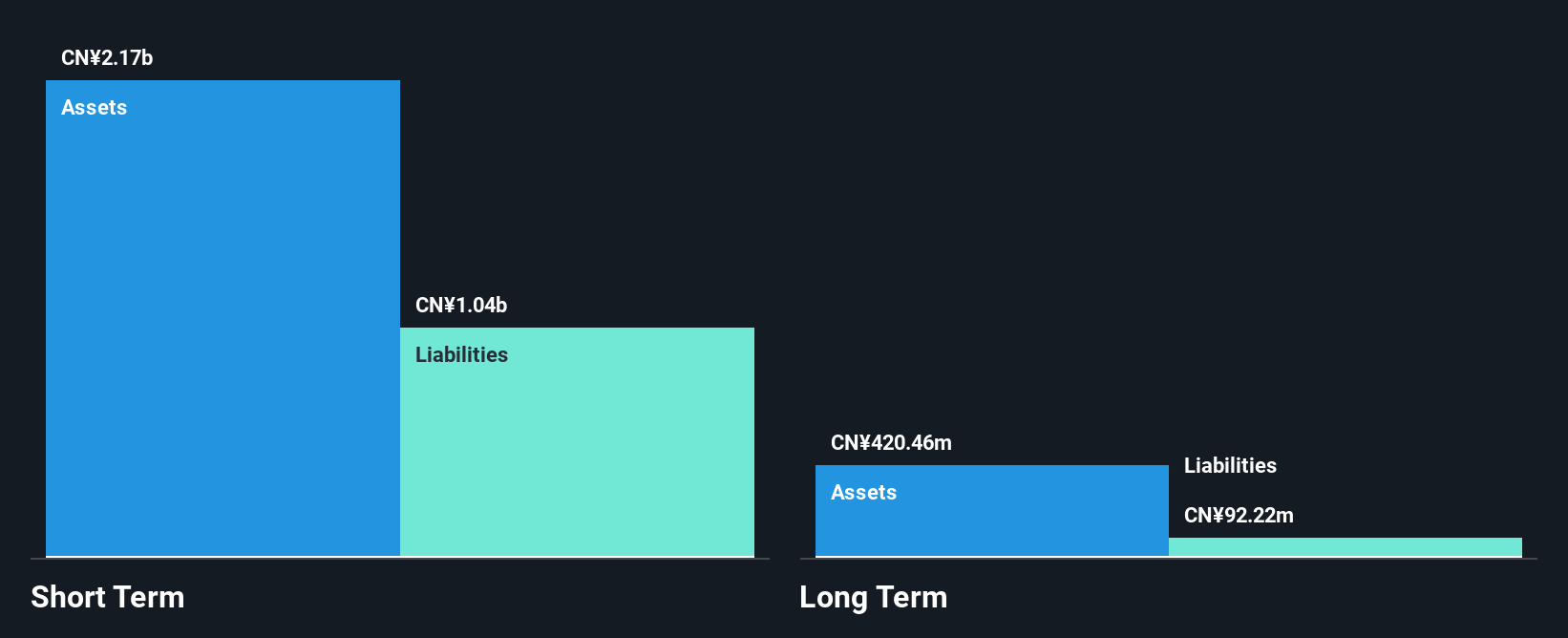

Viomi Technology, with a market cap of US$113.22 million, is navigating the penny stock landscape by focusing on its core strength in IoT-enabled smart home products. The company recently became profitable and boasts high-quality earnings, although its past five-year earnings have declined significantly. Viomi's short-term assets comfortably cover both short- and long-term liabilities, indicating financial stability. Despite an increase in debt to equity ratio over five years, Viomi has more cash than total debt and earns more interest than it pays. Recent strategic shifts include a focus on AI-driven water purification technology following a business reorganization in 2024.

- Get an in-depth perspective on Viomi Technology's performance by reading our balance sheet health report here.

- Assess Viomi Technology's future earnings estimates with our detailed growth reports.

Chegg (CHGG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Chegg, Inc. offers personalized learning support to students for academic and skill development success both in the United States and internationally, with a market cap of approximately $0.15 billion.

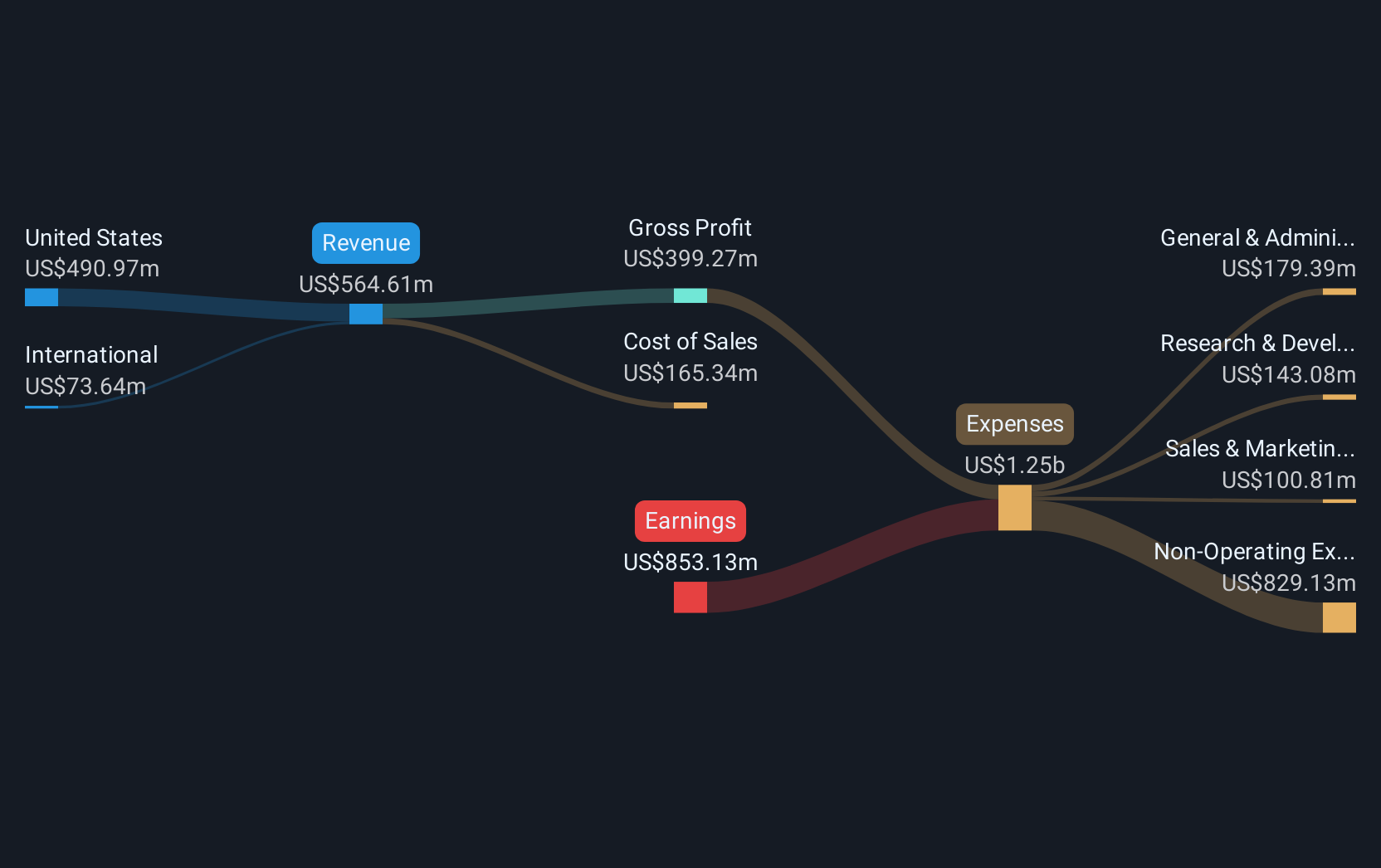

Operations: The company's revenue is primarily derived from its online retail segment, which generated $564.61 million.

Market Cap: $153.46M

Chegg, Inc., with a market cap of approximately US$0.15 billion, faces challenges typical of penny stocks, including high volatility and recent non-compliance with NYSE listing requirements due to low share prices. Despite being unprofitable and not expected to become profitable in the near term, Chegg has a sufficient cash runway exceeding three years owing to positive free cash flow. The company is innovating its product offerings with tools like Create and Solution Scout, aiming to enhance personalized learning experiences for students. However, it must address its negative return on equity and increasing net losses for sustainable growth.

- Navigate through the intricacies of Chegg with our comprehensive balance sheet health report here.

- Examine Chegg's earnings growth report to understand how analysts expect it to perform.

Liquidmetal Technologies (LQMT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Liquidmetal Technologies, Inc. is a materials technology company that designs, develops, and sells custom products and parts made from bulk amorphous alloys to various industries globally, with a market cap of $111.36 million.

Operations: The company's revenue is derived from developing and manufacturing products and applications using amorphous alloys, totaling $0.97 million.

Market Cap: $111.36M

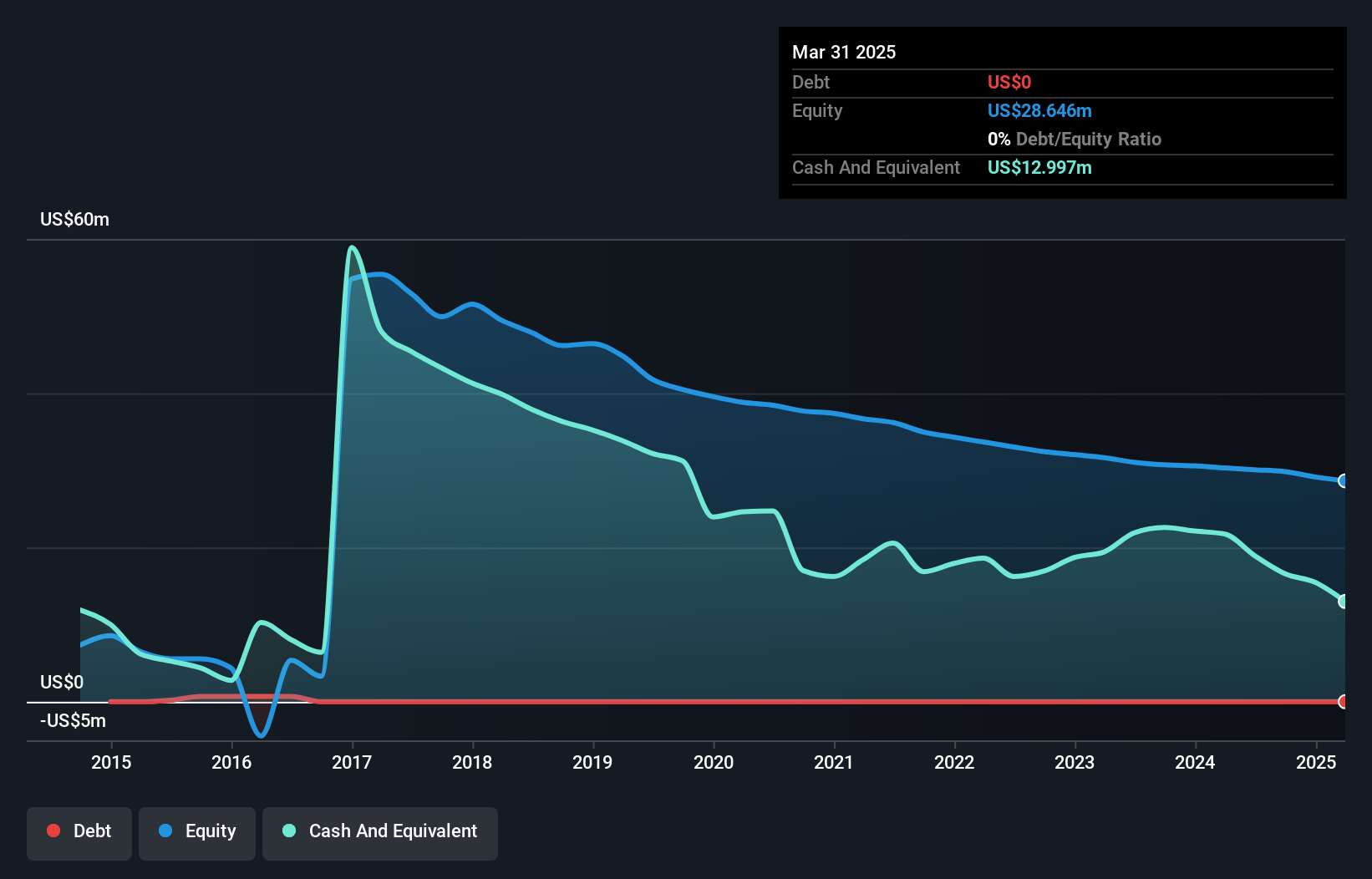

Liquidmetal Technologies, Inc., with a market cap of US$111.36 million, operates as a pre-revenue entity in the materials technology sector, generating less than US$1 million in revenue. The company is debt-free and has no long-term liabilities, providing financial stability despite its unprofitable status. Liquidmetal's short-term assets significantly exceed its liabilities, ensuring liquidity. Recent executive changes include Professor Lugee Li managing operations for its Hong Kong subsidiary to expand Asian business opportunities. Despite high share price volatility and negative return on equity, the firm maintains a cash runway exceeding three years due to stable free cash flow growth.

- Jump into the full analysis health report here for a deeper understanding of Liquidmetal Technologies.

- Gain insights into Liquidmetal Technologies' historical outcomes by reviewing our past performance report.

Summing It All Up

- Discover the full array of 422 US Penny Stocks right here.

- Curious About Other Options? Outshine the giants: these 22 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CHGG

Chegg

Provides individualized learning support to students that helps build essential academic, life, and job skills to achieve success in the United States and internationally.

Flawless balance sheet and good value.

Market Insights

Community Narratives