- United States

- /

- Entertainment

- /

- NasdaqCM:CURI

Promising Penny Stocks To Consider In October 2025

Reviewed by Simply Wall St

As the U.S. stock market navigates a landscape of mixed earnings reports and geopolitical developments, investors are keenly observing the impact on major indices like the Dow Jones, Nasdaq, and S&P 500. In this climate of uncertainty and opportunity, penny stocks—though an outdated term—remain relevant as they often represent smaller or emerging companies with potential for significant growth. By focusing on those with strong financials and clear growth prospects, investors can uncover valuable opportunities in these lesser-known stocks.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $1.87 | $409.32M | ✅ 4 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.72 | $640.14M | ✅ 4 ⚠️ 0 View Analysis > |

| LexinFintech Holdings (LX) | $3.69 | $668.01M | ✅ 4 ⚠️ 1 View Analysis > |

| Global Self Storage (SELF) | $4.935 | $56.69M | ✅ 5 ⚠️ 1 View Analysis > |

| Sensus Healthcare (SRTS) | $3.21 | $53.76M | ✅ 4 ⚠️ 2 View Analysis > |

| Performance Shipping (PSHG) | $2.01 | $24.86M | ✅ 4 ⚠️ 2 View Analysis > |

| Golden Growers Cooperative (GGRO.U) | $5.00 | $77.45M | ✅ 2 ⚠️ 5 View Analysis > |

| BAB (BABB) | $0.99 | $7.19M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.60 | $82.02M | ✅ 3 ⚠️ 2 View Analysis > |

| Universal Safety Products (UUU) | $4.92 | $11.06M | ✅ 2 ⚠️ 3 View Analysis > |

Click here to see the full list of 365 stocks from our US Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

CuriosityStream (CURI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: CuriosityStream Inc. is a media and entertainment company that offers factual content through various channels, with a market cap of $257.79 million.

Operations: The company generates revenue of $60.84 million from its media and entertainment offerings focused on factual content.

Market Cap: $257.79M

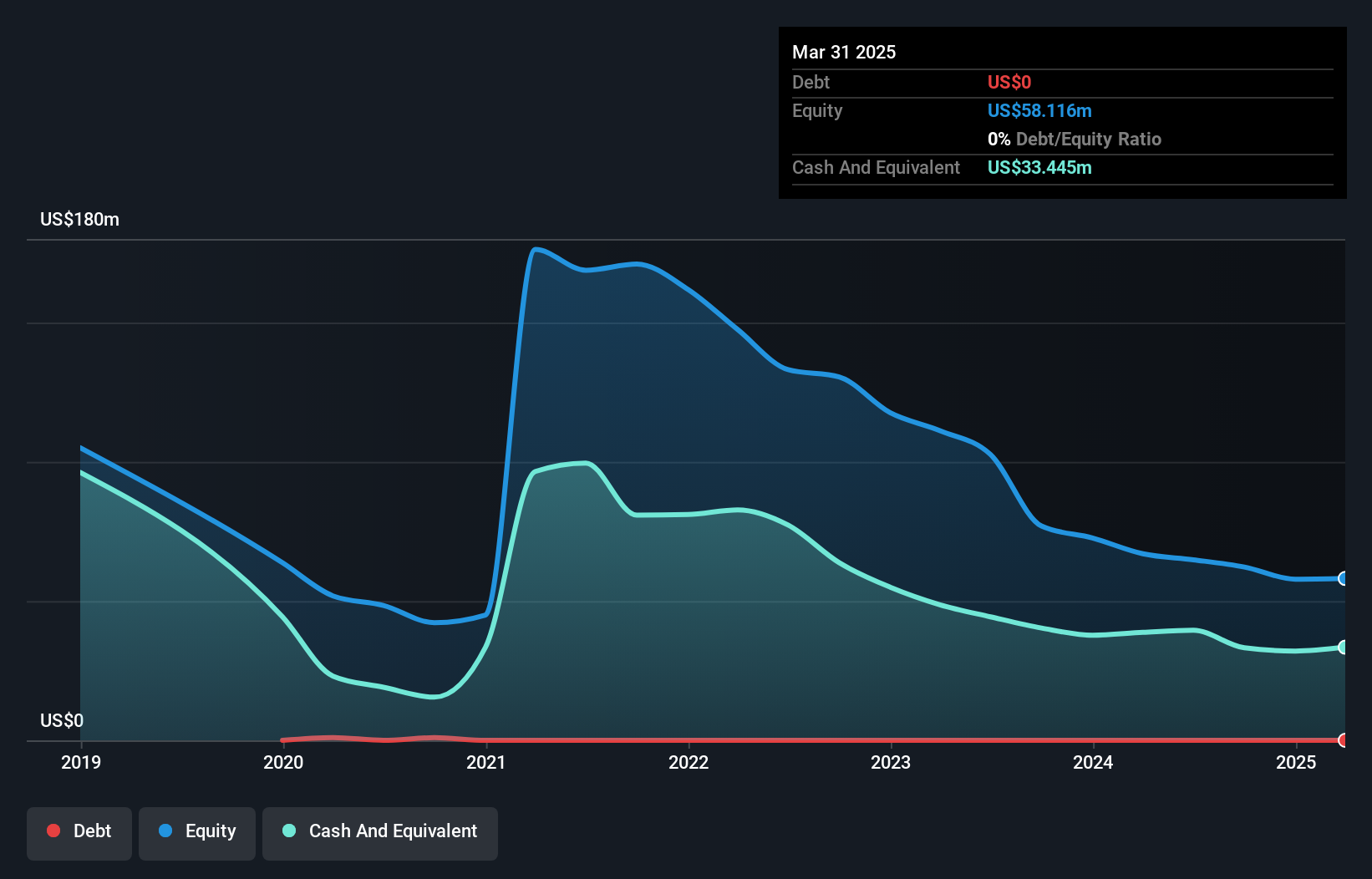

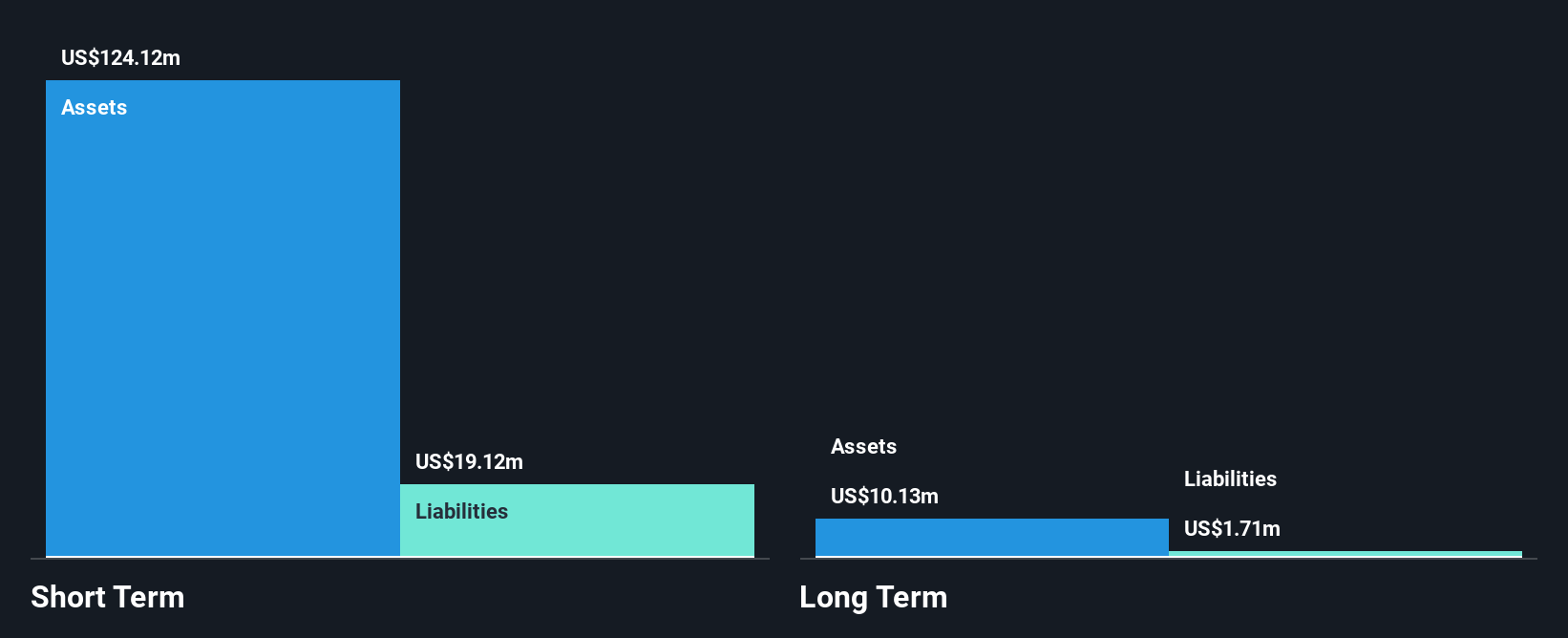

CuriosityStream Inc., with a market cap of US$257.79 million, is navigating the penny stock landscape with strategic expansions and partnerships. Despite being unprofitable, it boasts a cash runway exceeding three years due to positive free cash flow growth and no debt burden. Recent licensing agreements across traditional media and AI platforms highlight growing demand for its factual content, while its inclusion in the S&P Global BMI Index reflects broader recognition. However, significant insider selling raises caution. The company’s dividend yield is not well covered by earnings or free cash flows, adding another layer of risk for investors.

- Jump into the full analysis health report here for a deeper understanding of CuriosityStream.

- Gain insights into CuriosityStream's future direction by reviewing our growth report.

SunCar Technology Group (SDA)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: SunCar Technology Group Inc. operates in the People's Republic of China, offering cloud and mobile app-based auto eInsurance, technology, and auto services through its subsidiaries, with a market cap of approximately $212.18 million.

Operations: The company's revenue is primarily derived from its auto service segment, generating $219.06 million, followed by the auto eInsurance service at $194.65 million and technology service contributing $47.29 million.

Market Cap: $212.18M

SunCar Technology Group, with a market cap of US$212.18 million, is making strides in the penny stock arena by leveraging AI technology through a partnership with Volcano Engine to enhance its auto services and insurance offerings. While it remains unprofitable with a negative return on equity, its cash runway extends beyond three years due to positive free cash flow growth. Recent revenue guidance withdrawal raises caution despite improved half-year revenues and reduced net losses compared to last year. Strategic collaborations, such as those with NIO Inc., aim to bolster its position in China's automotive sector amidst evolving digital strategies.

- Click here and access our complete financial health analysis report to understand the dynamics of SunCar Technology Group.

- Learn about SunCar Technology Group's future growth trajectory here.

Talkspace (TALK)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Talkspace, Inc. is a virtual behavioral healthcare company that connects patients with licensed mental health providers in the United States and has a market cap of approximately $452.16 million.

Operations: The company generates revenue of $202.61 million from its Healthcare Facilities & Services segment.

Market Cap: $452.16M

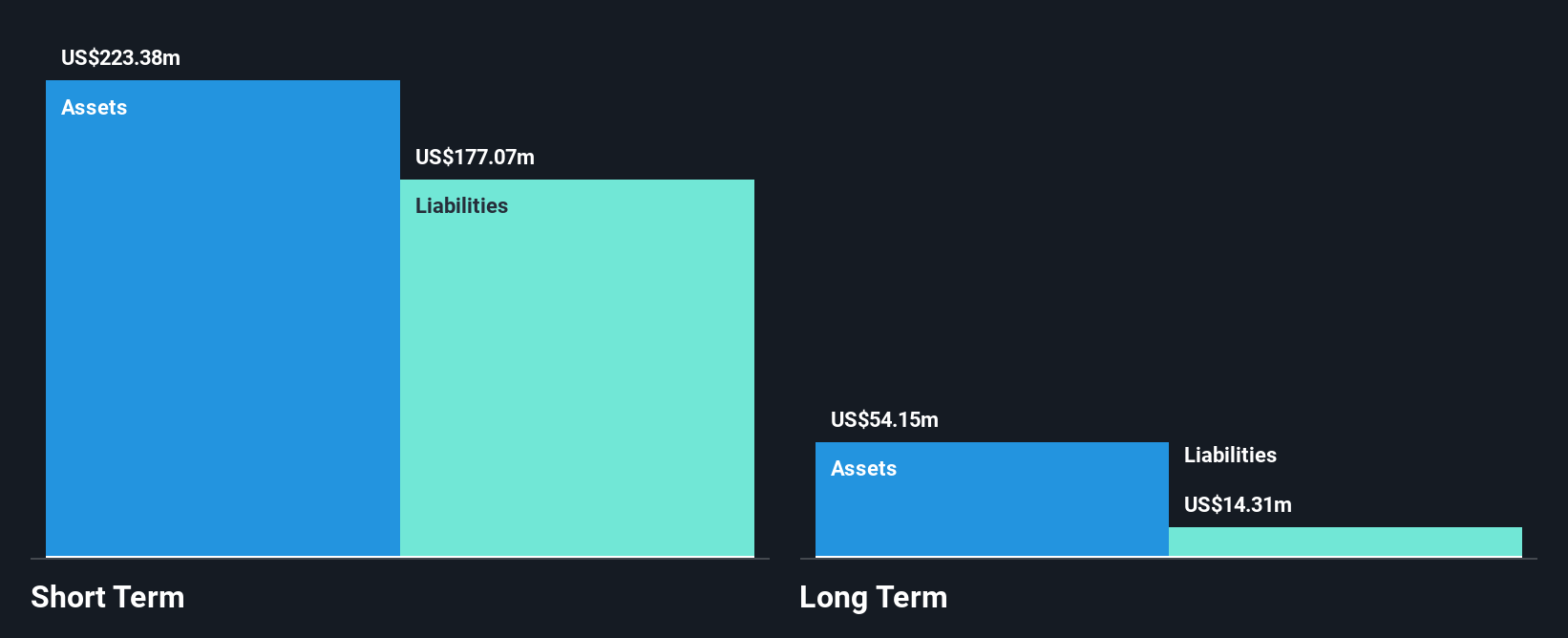

Talkspace, Inc., with a market cap of US$452.16 million, has shown promising growth in the penny stock market by achieving profitability this year and reporting third-quarter revenue of US$59.38 million, up from US$47.4 million a year ago. The company benefits from an experienced board and management team, no debt obligations, and strong short-term asset coverage over liabilities. Despite a low return on equity at 2.5%, Talkspace's innovative partnerships like Express Access enhance its service offering in mental healthcare delivery, potentially driving future growth as it continues to expand its revenue base significantly year-over-year.

- Dive into the specifics of Talkspace here with our thorough balance sheet health report.

- Understand Talkspace's earnings outlook by examining our growth report.

Summing It All Up

- Jump into our full catalog of 365 US Penny Stocks here.

- Ready To Venture Into Other Investment Styles? These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:CURI

CuriosityStream

A media and entertainment company, provides factual content through multiple channels.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives