- United Kingdom

- /

- Consumer Durables

- /

- AIM:PMP

Portmeirion Group PLC's (LON:PMP) Fundamentals Look Pretty Strong: Could The Market Be Wrong About The Stock?

Portmeirion Group (LON:PMP) has had a rough three months with its share price down 37%. However, stock prices are usually driven by a company’s financials over the long term, which in this case look pretty respectable. Particularly, we will be paying attention to Portmeirion Group's ROE today.

ROE or return on equity is a useful tool to assess how effectively a company can generate returns on the investment it received from its shareholders. In simpler terms, it measures the profitability of a company in relation to shareholder's equity.

See our latest analysis for Portmeirion Group

How Is ROE Calculated?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Portmeirion Group is:

12% = UK£5.8m ÷ UK£48m (Based on the trailing twelve months to December 2019).

The 'return' is the profit over the last twelve months. One way to conceptualize this is that for each £1 of shareholders' capital it has, the company made £0.12 in profit.

What Has ROE Got To Do With Earnings Growth?

Thus far, we have learnt that ROE measures how efficiently a company is generating its profits. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Generally speaking, other things being equal, firms with a high return on equity and profit retention, have a higher growth rate than firms that don’t share these attributes.

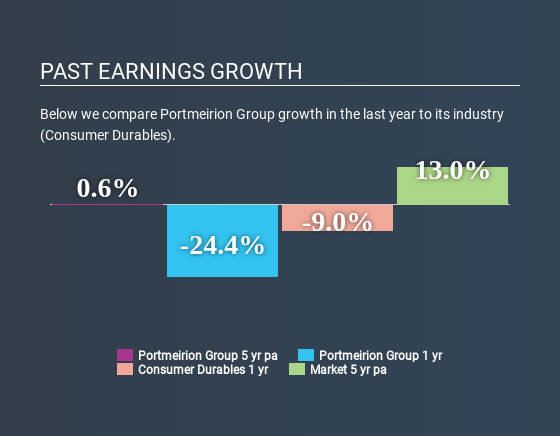

A Side By Side comparison of Portmeirion Group's Earnings Growth And 12% ROE

At first glance, Portmeirion Group seems to have a decent ROE. And on comparing with the industry, we found that the the average industry ROE is similar at 13%. Despite this, Portmeirion Group's five year net income growth was quite flat over the past five years. Based on this, we feel that there might be other reasons which haven't been discussed so far in this article that could be hampering the company's growth. For example, it could be that the company has a high payout ratio or the business has allocated capital poorly, for instance.

We then compared Portmeirion Group's net income growth with the industry and found that the company's growth figure is lower than the average industry growth rate of 16% in the same period, which is a bit concerning.

Earnings growth is a huge factor in stock valuation. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). Doing so will help them establish if the stock's future looks promising or ominous. Is Portmeirion Group fairly valued compared to other companies? These 3 valuation measures might help you decide.

Is Portmeirion Group Efficiently Re-investing Its Profits?

Portmeirion Group doesn't pay any dividend, meaning that potentially all of its profits are being reinvested in the business. However, this doesn't explain why the company hasn't seen any growth. So there might be other factors at play here which could potentially be hampering growth. For example, the business has faced some headwinds.

Conclusion

Overall, we feel that Portmeirion Group certainly does have some positive factors to consider. Yet, the low earnings growth is a bit concerning, especially given that the company has a high rate of return and is reinvesting ma huge portion of its profits. By the looks of it, there could be some other factors, not necessarily in control of the business, that's preventing growth. So far, we've only made a quick discussion around the company's earnings growth. You can do your own research on Portmeirion Group and see how it has performed in the past by looking at this FREE detailed graph of past earnings, revenue and cash flows.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About AIM:PMP

Portmeirion Group

Manufactures, markets, and distributes ceramics, home fragrances, and associated homeware products in the United Kingdom, South Korea, North America, and internationally.

Mediocre balance sheet low.

Similar Companies

Market Insights

Community Narratives