- United States

- /

- Banks

- /

- NYSE:PNC

PNC Financial Services Group (NYSE:PNC) Declares Increased Dividends Across Common And Preferred Stocks

Reviewed by Simply Wall St

PNC Financial Services Group (NYSE:PNC) recently increased its quarterly cash dividend for common stock by 6%, reflecting its commitment to shareholder value and reinforcing investor confidence. This move, along with the declared dividends for various preferred stock series, underscores the company's solid financial health. Over the last quarter, the company's share price moved 28%, aligning with broader market trends, which saw a year-on-year climb of 14%. The dividend increase and robust earnings, alongside index inclusions in June, may have bolstered the positive market sentiment, supporting the stock's appreciation.

The recent 6% dividend increase by PNC Financial Services Group highlights the company's efforts to enhance shareholder value and strengthen investor confidence. Over the last five years, PNC's total shareholder return, including dividends, was 139.12%, which offers a favorable context when compared to its 1-year performance. Over the last year, PNC's stock underperformed the US Banks industry, which saw a return of 31.2%. However, the company's recent actions suggest a positive outlook in maintaining robust returns, albeit with recent share price movements not fully reaching analyst expectations.

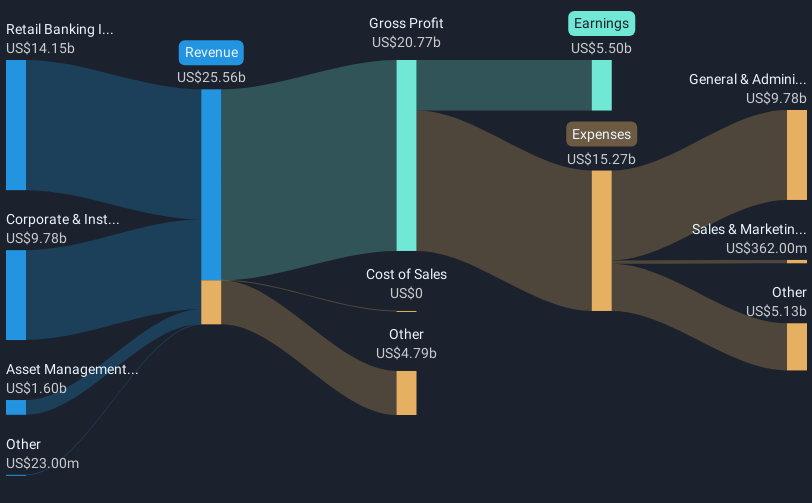

The company's focus on revenue expansion and controlled expenses, as highlighted in recent announcements, is expected to support growth in both revenue and earnings. With analysts forecasting a revenue increase to US$24.7 billion by May 2028 and earnings reaching US$7.5 billion, the updated dividend policy might further reinforce these growth trajectories. The forward-looking revenue and earnings assumptions could be enhanced by PNC's continued emphasis on customer acquisition and interest rate management strategies. Despite current economic uncertainties and industry volatility, these strategic initiatives aim to stabilize future margins and support earnings consistency.

In terms of share price, PNC's recent performance reflects a 16.91% discount to the analyst consensus price target of approximately US$199.89, with the current share price at US$163.53. This gap suggests potential upside if projected earnings and revenue targets are met, aligning with PNC's goal of achieving positive operating leverage. Investors might find this appealing, given the relative valuation against the estimated fair value. However, individual expectations and market conditions will ultimately determine the extent to which PNC can maintain or exceed its stated growth objectives.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PNC

PNC Financial Services Group

Operates as a diversified financial services company in the United States.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives