- United States

- /

- Pharma

- /

- NYSE:PFE

Pfizer (PFE) and Greenstone Face US$71 Million Settlement in Antitrust Lawsuit

Reviewed by Simply Wall St

Pfizer (PFE) recently announced proposed class action settlements totaling approximately $71 million related to allegations of antitrust violations, while also facing a patent infringement lawsuit over its COVID-19 antiviral, Paxlovid. Despite these legal challenges, Pfizer's share price remained largely flat over the past month, reflecting broader market stability amidst record highs in major U.S. stock indexes. Meanwhile, positive developments in their COVID-19 vaccine trials and FDA approvals may have countered some weight from the ongoing legal issues, resulting in a balanced share price movement in line with the generally upbeat market outlook.

Pfizer has 2 warning signs we think you should know about.

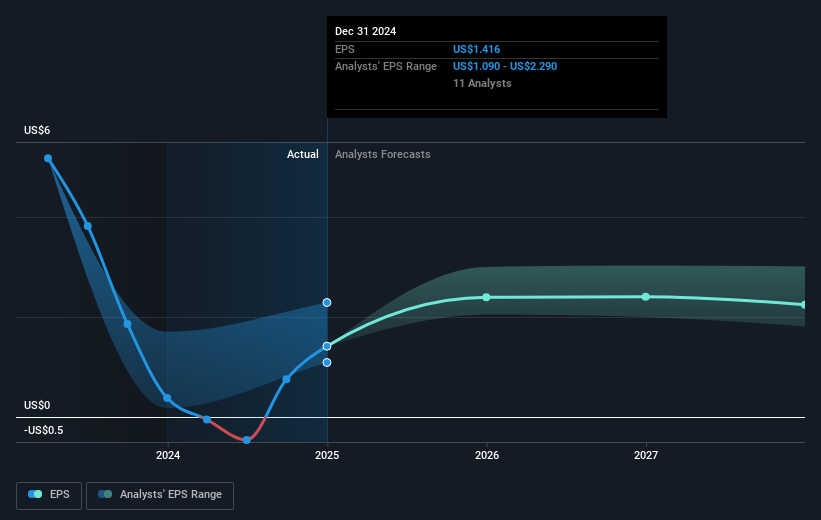

Pfizer's recent legal challenges, including $71 million in class action settlements and a patent infringement lawsuit over Paxlovid, have highlighted some of the regulatory and legal pressures impacting the pharmaceutical industry. These issues, alongside rising regulatory scrutiny and aggressive drug pricing negotiations, could potentially affect Pfizer’s revenue and earnings forecasts. The anticipated constraints on revenue growth due to these pressures are a crucial factor in assessing Pfizer’s financial outlook, especially as the company relies extensively on its R&D pipeline to offset declining revenues from aging drugs.

Over the past five years, Pfizer's total shareholder return, including dividends, experienced a 10.65% decline, highlighting challenges in sustaining long-term growth in shareholder value. In comparison, the company's performance over the past year saw it underperform the broader U.S. market, which returned 19.1%, and the U.S. Pharmaceuticals industry, which returned 11.2%, indicating specific company hurdles as opposed to general market trends.

In terms of share price movement, the current price is significantly below the consensus analyst price target of US$28.86, suggesting potential upside if forecasts hold. However, the bearish analyst price target of US$24.0 closely resembles today's share price of US$24.57, indicating an alignment with more cautious outlooks. Events such as potential further regulatory changes could adjust revenue or profit estimates and, by extension, influence price targets and market valuations going forward.

Assess Pfizer's previous results with our detailed historical performance reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PFE

Pfizer

Pfizer Inc. discovers, develops, manufactures, markets, distributes, and sells biopharmaceutical products in the United States and internationally.

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Community Narratives