- United States

- /

- Mortgage REITs

- /

- NYSE:PMT

PennyMac Mortgage Investment Trust (NYSE:PMT) Investors Should Think About This Before Buying It For Its Dividend

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Is PennyMac Mortgage Investment Trust (NYSE:PMT) a good dividend stock? How would you know? Dividend paying companies with growing earnings can be highly rewarding in the long term. Yet sometimes, investors buy a stock for its dividend and lose money because the share price falls by more than they earned in dividend payments.

With a nine-year payment history and a 8.6% yield, many investors probably find PennyMac Mortgage Investment Trust intriguing. It sure looks interesting on these metrics - but there's always more to the story . Before you buy any stock for its dividend however, you should always remember Warren Buffett's two rules: 1) Don't lose money, and 2) Remember rule #1. We'll run through some checks below to help with this.

Explore this interactive chart for our latest analysis on PennyMac Mortgage Investment Trust!

Payout ratios

Dividends are usually paid out of company earnings. If a company is paying more than it earns, then the dividend might become unsustainable - hardly an ideal situation. As a result, we should always investigate whether a company can afford its dividend, measured as a percentage of a company's net income after tax. PennyMac Mortgage Investment Trust paid out 76% of its profit as dividends, over the trailing twelve month period. Paying out a majority of its earnings limits the amount that can be reinvested in the business. This may indicate a commitment to paying a dividend, or a dearth of investment opportunities.

Remember, you can always get a snapshot of PennyMac Mortgage Investment Trust's latest financial position, by checking our visualisation of its financial health.

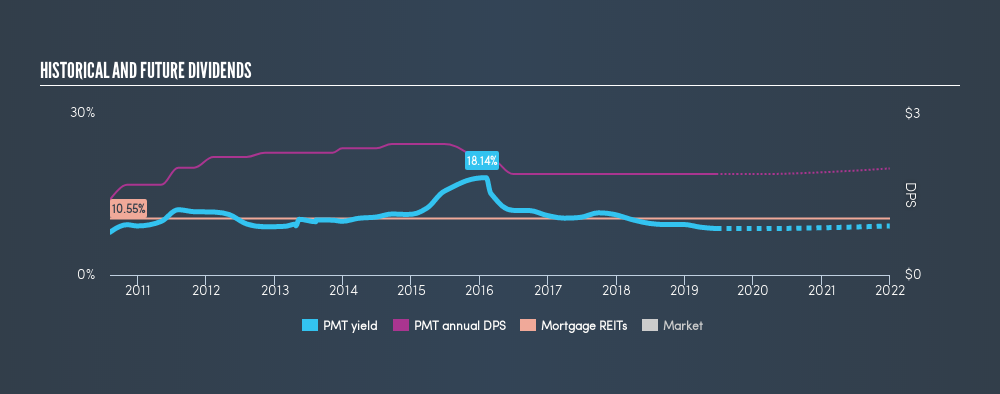

Dividend Volatility

From the perspective of an income investor who wants to earn dividends for many years, there is not much point buying a stock if its dividend is regularly cut or is not reliable. Looking at the last decade of data, we can see that PennyMac Mortgage Investment Trust paid its first dividend at least nine years ago. Although it has been paying a dividend for several years now, the dividend has been cut at least once by more than 20%, and we're cautious about the consistency of its dividend across a full economic cycle. During the past nine-year period, the first annual payment was US$1.40 in 2010, compared to US$1.88 last year. This works out to be a compound annual growth rate (CAGR) of approximately 3.3% a year over that time. The growth in dividends has not been linear, but the CAGR is a decent approximation of the rate of change over this time frame.

We're glad to see the dividend has risen, but with a limited rate of growth and fluctuations in the payments, we don't think this is an attractive combination.

Dividend Growth Potential

With a relatively unstable dividend, it's even more important to evaluate if earnings per share (EPS) are growing - it's not worth taking the risk on a dividend getting cut, unless you might be rewarded with larger dividends in future. Over the past five years, it looks as though PennyMac Mortgage Investment Trust's EPS have declined at around 4.7% a year. If earnings continue to decline, the dividend may come under pressure. Every investor should make an assessment of whether the company is taking steps to stabilise the situation.

We'd also point out that PennyMac Mortgage Investment Trust issued a meaningful number of new shares in the past year. Regularly issuing new shares can be detrimental - it's hard to grow dividends per share when new shares are regularly being created.

Conclusion

To summarise, shareholders should always check that PennyMac Mortgage Investment Trust's dividends are affordable, that its dividend payments are relatively stable, and that it has decent prospects for growing its earnings and dividend. PennyMac Mortgage Investment Trust's payout ratio is within an average range for most market participants. Earnings per share are down, and PennyMac Mortgage Investment Trust's dividend has been cut at least once in the past, which is disappointing. With this information in mind, we think PennyMac Mortgage Investment Trust may not be an ideal dividend stock.

Given that earnings are not growing, the dividend does not look nearly so attractive. Businesses can change though, and we think it would make sense to see what analysts are forecasting for the company.

We have also put together a list of global stocks with a market capitalisation above $1bn and yielding more 3%.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NYSE:PMT

PennyMac Mortgage Investment Trust

Through its subsidiary, primarily invests in residential mortgage-related assets in the United States.

Slight with moderate growth potential.

Similar Companies

Market Insights

Community Narratives