- United States

- /

- Software

- /

- NasdaqGS:PLTR

Palantir Technologies (PLTR) Expands AI Solutions In Public Safety And Clinical Trials

Reviewed by Simply Wall St

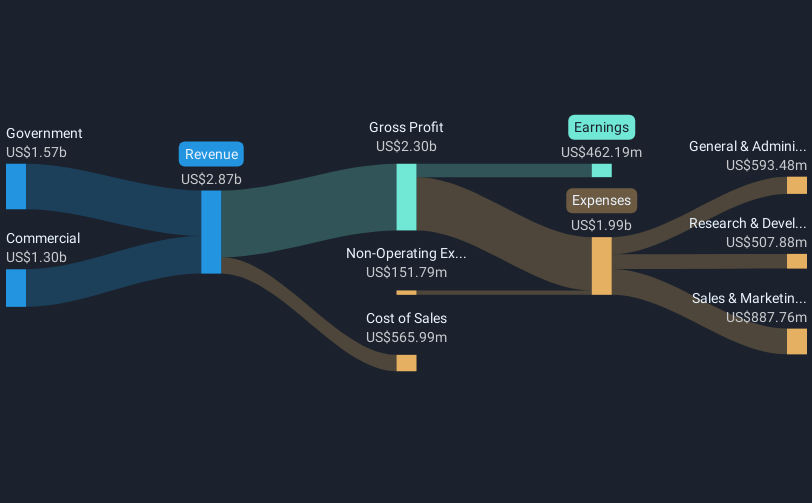

Palantir Technologies (PLTR) recently announced two key partnerships that could be influential in its impressive 64% price move over the last quarter. A partnership with Knightscope to advance AI-driven public safety in the federal marketplace and another with Velocity Clinical Research to streamline clinical trial payment processes highlight Palantir's ongoing expansion. These collaborations align with broader market trends of AI integration and operational efficiency. Such initiatives, combined with solid earnings growth and positive market conditions, seem to have supported the company's stock performance, amid flat recent market movements and overall economic resilience.

Every company has risks, and we've spotted 1 risk for Palantir Technologies you should know about.

Over the past three years, Palantir Technologies (PLTR) has delivered a very large total shareholder return of 1367.97%. This remarkable performance surpasses the industry average, with the company’s one-year return exceeding the US Software industry's 26.1% return. In terms of the broader market, Palantir's one-year return also surpassed the US market, which saw a 14.1% increase. This context underscores the company's ability to significantly outperform both its industry peers and the market overall over the long term.

The recent strategic partnerships mentioned in the introduction align with the company's efforts to enhance revenue and earnings growth prospects. Collaborations in AI-driven sectors and federal marketplace expansion are likely to contribute positively to forecasted revenues, projected to grow 22.4% annually. Earnings are also poised for significant growth, expected to rise by 30.6% per year. However, while the share price has experienced substantial movement, currently trading at US$153.99, it is important to note that it is above the consensus analyst price target of US$104.96, indicating a possible re-evaluation may be needed by investors in light of fair value considerations.

Assess Palantir Technologies' future earnings estimates with our detailed growth reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PLTR

Palantir Technologies

Palantir Technologies Inc. builds and deploys software platforms for the intelligence community to assist in counterterrorism investigations and operations in the United States, the United Kingdom, and internationally.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives