- United States

- /

- Software

- /

- NasdaqGS:PLTR

Palantir Technologies (NasdaqGS:PLTR) Partners With Fedrigoni For AI-Driven Digital Transformation

Reviewed by Simply Wall St

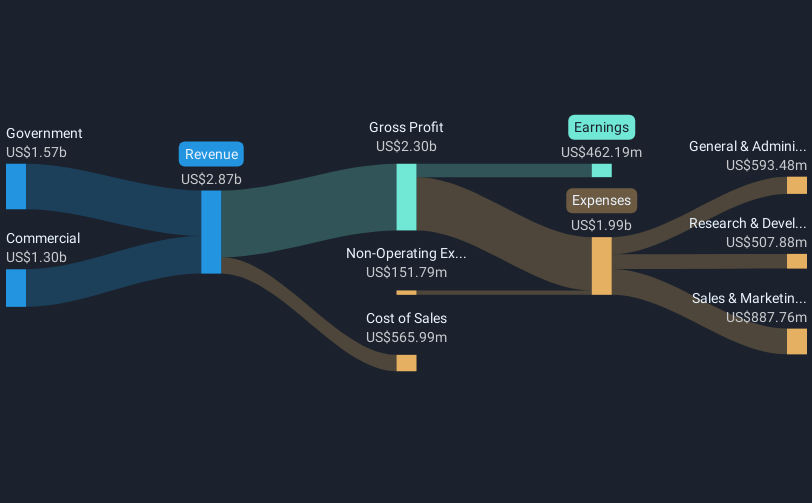

Palantir Technologies (NasdaqGS:PLTR) recently announced a multi-year partnership with Fedrigoni to accelerate digital transformation, which aligns with market trends toward AI integration and could have contributed to its 67% price increase last quarter. Alongside partnerships like those with TeleTracking and Bain & Company, which are set to enhance decision-making and technology adoption, Palantir's focus on AI-driven solutions resonated well as market interest in AI technologies spiked. In a period where the Nasdaq and S&P 500 gained modestly due to positive economic signals and trade developments, Palantir's focused advancements in AI may have provided added momentum.

You should learn about the 1 weakness we've spotted with Palantir Technologies.

Over the past three years, Palantir Technologies achieved a very large total return of 1535.59%, demonstrating significant long-term growth for its shareholders. In comparison, the company's one-year return exceeded the broader US Software industry, which saw a 21% gain.

The recent partnerships and strategic moves emphasized in the introduction, such as those with Fedrigoni and TeleTracking Technologies, are expected to positively influence both revenue and earnings forecasts. With anticipated annual earnings growth of 30.6% and revenue growth of 22.4%, Palantir aims to continue outperforming the market growth rates of 14.4% and 8.6%, respectively.

Currently trading above the consensus analyst price target of US$100.19, Palantir's stock price suggests that market expectations may already reflect these growth trajectories. While the company's elevated Price-To-Book Ratio compared to the industry average indicates a premium valuation, the return on equity at 10.5% is seen as low relative to ideal benchmarks. These elements should be considered when evaluating Palantir's future prospects and the sustainability of its current market position.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PLTR

Palantir Technologies

Palantir Technologies Inc. builds and deploys software platforms for the intelligence community to assist in counterterrorism investigations and operations in the United States, the United Kingdom, and internationally.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion