- United States

- /

- Software

- /

- NasdaqGS:PLTR

Palantir Technologies (NasdaqGS:PLTR) Partners with BlueForge to Modernize Shipbuilding for U.S. Navy

Reviewed by Simply Wall St

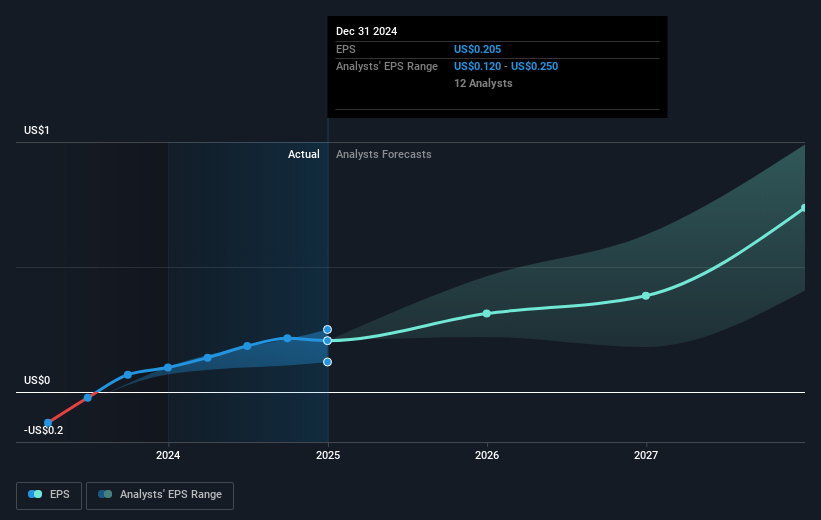

Palantir Technologies (NasdaqGS:PLTR) made headlines with the launch of the "Warp Speed for Warships" initiative alongside BlueForge Alliance, aiming to modernize shipbuilding. This collaboration likely added positive sentiment to Palantir's 49% price increase last quarter, aligning with the tech sector's broader upward trend. While the market overall rose by 14% in the past year, Palantir's removal from and addition to various Russell Indexes may have slightly influenced trading dynamics. Quarter earnings showcased robust growth, with sales and net income significantly higher year-on-year, which further solidified investor confidence in the company's trajectory.

Over the last three years, Palantir Technologies has delivered a very large total shareholder return, indicating substantial growth that outpaced many typical investment returns in the software industry. In contrast, over the past year, Palantir outperformed both the US market's 13.9% increase and the software industry’s 18.5% rise, demonstrating its resilience and investor appeal despite a competitive landscape.

The introduction of initiatives like "Warp Speed for Warships" and strategic partnerships are poised to support Palantir's revenue and earnings forecasts, potentially reinforcing its growth trajectory. With second-quarter revenue guidance ranging from US$934 million to US$938 million and full-year expectations of US$3.89 billion to US$3.902 billion, the company continues to project confidence. The stock's advancement has brought its current share price close to the street's price target, suggesting that future price movements might depend on continued execution and market dynamics.

Dive into the specifics of Palantir Technologies here with our thorough balance sheet health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PLTR

Palantir Technologies

Palantir Technologies Inc. builds and deploys software platforms for the intelligence community to assist in counterterrorism investigations and operations in the United States, the United Kingdom, and internationally.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives