- India

- /

- Paper and Forestry Products

- /

- NSEI:ORIENTPPR

One Day Left To Buy Orient Paper & Industries Limited (NSE:ORIENTPPR) Before The Ex-Dividend Date

Regular readers will know that we love our dividends at Simply Wall St, which is why it's exciting to see Orient Paper & Industries Limited (NSE:ORIENTPPR) is about to trade ex-dividend in the next day or two. You can purchase shares before the 19th of August in order to receive the dividend, which the company will pay on the 26th of September.

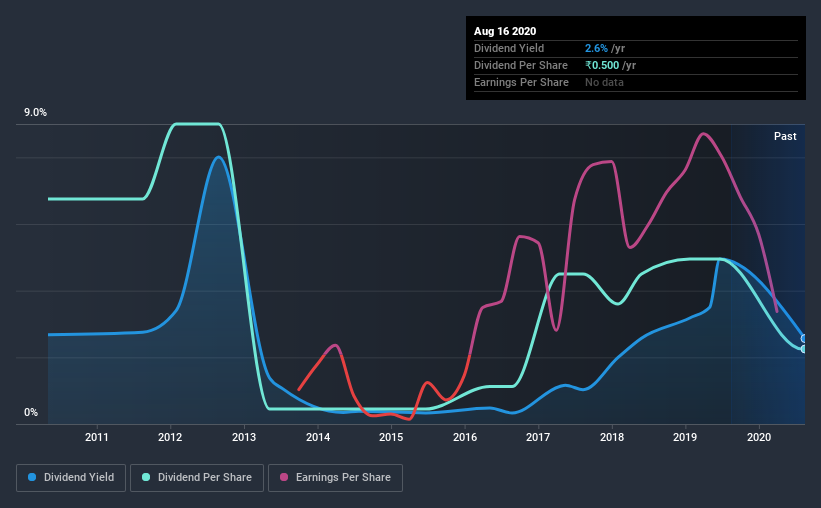

Orient Paper & Industries's upcoming dividend is ₹0.50 a share, following on from the last 12 months, when the company distributed a total of ₹0.50 per share to shareholders. Based on the last year's worth of payments, Orient Paper & Industries has a trailing yield of 2.6% on the current stock price of ₹19.5. If you buy this business for its dividend, you should have an idea of whether Orient Paper & Industries's dividend is reliable and sustainable. So we need to investigate whether Orient Paper & Industries can afford its dividend, and if the dividend could grow.

View our latest analysis for Orient Paper & Industries

If a company pays out more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. Orient Paper & Industries is paying out an acceptable 53% of its profit, a common payout level among most companies. Yet cash flow is typically more important than profit for assessing dividend sustainability, so we should always check if the company generated enough cash to afford its dividend. Dividends consumed 73% of the company's free cash flow last year, which is within a normal range for most dividend-paying organisations.

It's encouraging to see that the dividend is covered by both profit and cash flow. This generally suggests the dividend is sustainable, as long as earnings don't drop precipitously.

Click here to see how much of its profit Orient Paper & Industries paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Companies with consistently growing earnings per share generally make the best dividend stocks, as they usually find it easier to grow dividends per share. Investors love dividends, so if earnings fall and the dividend is reduced, expect a stock to be sold off heavily at the same time. It's encouraging to see Orient Paper & Industries has grown its earnings rapidly, up 35% a year for the past five years. Management appears to be striking a nice balance between reinvesting for growth and paying dividends to shareholders. Earnings per share have been growing quickly and in combination with some reinvestment and a middling payout ratio, the stock may have decent dividend prospects going forwards.

Another key way to measure a company's dividend prospects is by measuring its historical rate of dividend growth. Orient Paper & Industries has seen its dividend decline 10% per annum on average over the past 10 years, which is not great to see. Orient Paper & Industries is a rare case where dividends have been decreasing at the same time as earnings per share have been improving. It's unusual to see, and could point to unstable conditions in the core business, or more rarely an intensified focus on reinvesting profits.

Final Takeaway

Is Orient Paper & Industries worth buying for its dividend? It's good to see earnings are growing, since all of the best dividend stocks grow their earnings meaningfully over the long run. However, we'd also note that Orient Paper & Industries is paying out more than half of its earnings and cash flow as profits, which could limit the dividend growth if earnings growth slows. Overall we're not hugely bearish on the stock, but there are likely better dividend investments out there.

On that note, you'll want to research what risks Orient Paper & Industries is facing. In terms of investment risks, we've identified 3 warning signs with Orient Paper & Industries and understanding them should be part of your investment process.

A common investment mistake is buying the first interesting stock you see. Here you can find a list of promising dividend stocks with a greater than 2% yield and an upcoming dividend.

When trading Orient Paper & Industries or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:ORIENTPPR

Orient Paper & Industries

Manufactures and sells paper and paper-related products in India and internationally.

Slightly overvalued with worrying balance sheet.

Similar Companies

Market Insights

Community Narratives