- United States

- /

- Electric Utilities

- /

- NYSE:OKLO

Oklo (OKLO) Joins Russell Indexes Enhancing Market Visibility

Reviewed by Simply Wall St

Oklo (OKLO) has recently experienced significant developments, including its addition to various Russell Indexes and several high-profile collaborations, which have likely played roles in its share price increase of 171% last quarter. The index inclusions enhance market visibility, while partnerships with Hexium and TerraPower position the company at the forefront of nuclear advancement. Additionally, the company's investment in radioisotope production and a $400 million follow-on equity offering underscore its expansion efforts. In the context of a flat market over the past week and an 11% market increase over the year, these actions collectively emphasize Oklo's robust growth trajectory.

Over the past year, Oklo's shares have delivered a very large total return of 615.71%, outperforming both the general US market's 11.4% increase and the 17.4% gain within the US Electric Utilities industry. This stark contrast highlights Oklo's remarkable trajectory despite its current financial challenges.

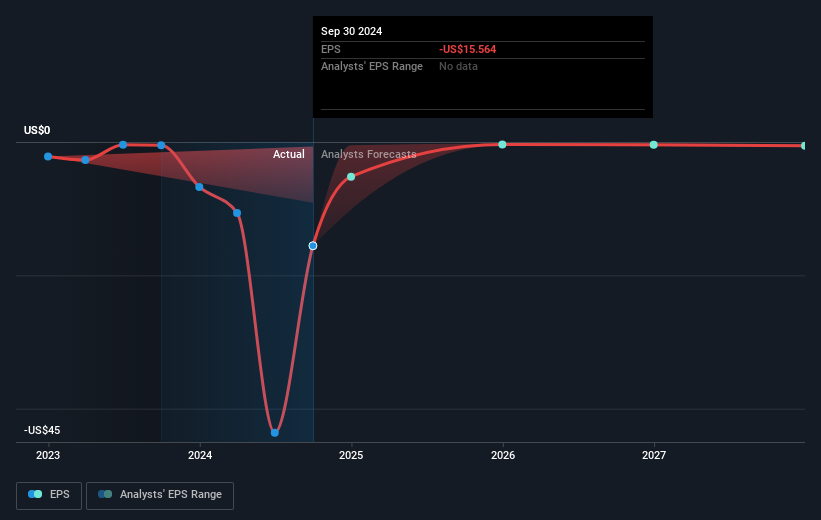

The company's recent strategic moves, such as collaborations with Hexium and TerraPower, are crucial in contextualizing its growth prospects. However, with zero revenue and net losses, these initiatives have yet to translate into positive earnings forecasts. Analysts' price targets place Oklo's shares at US$59.74, slightly lower than its current trading price of US$62.41, reflecting market skepticism regarding immediate profitability.

Jump into the full analysis health report here for a deeper understanding of Oklo.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OKLO

Oklo

Develops advanced fission power plants to provide clean, reliable, and affordable energy at scale to the customers in the United States.

Flawless balance sheet moderate.

Similar Companies

Market Insights

Community Narratives