- United Kingdom

- /

- Metals and Mining

- /

- AIM:AAZ

October 2025 UK Penny Stocks With Growth Potential

Reviewed by Simply Wall St

The United Kingdom's stock market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines due to weak trade data from China, highlighting global economic uncertainties. Despite these broader market concerns, investors often seek opportunities in niche areas such as penny stocks, which can offer potential growth when selected carefully. While the term "penny stocks" may seem outdated, it remains relevant for identifying smaller or newer companies that combine affordability with promising financial health.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.55 | £519.77M | ✅ 4 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £2.13 | £172.08M | ✅ 4 ⚠️ 2 View Analysis > |

| Ingenta (AIM:ING) | £0.945 | £14.27M | ✅ 2 ⚠️ 3 View Analysis > |

| Northern Bear (AIM:NTBR) | £1.08 | £14.86M | ✅ 4 ⚠️ 2 View Analysis > |

| System1 Group (AIM:SYS1) | £2.40 | £30.45M | ✅ 3 ⚠️ 3 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.5625 | $327M | ✅ 4 ⚠️ 2 View Analysis > |

| LSL Property Services (LSE:LSL) | £2.49 | £255.26M | ✅ 4 ⚠️ 1 View Analysis > |

| Spectra Systems (AIM:SPSY) | £1.465 | £70.76M | ✅ 3 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.12 | £178.75M | ✅ 4 ⚠️ 2 View Analysis > |

| Braemar (LSE:BMS) | £2.49 | £75.87M | ✅ 3 ⚠️ 3 View Analysis > |

Click here to see the full list of 294 stocks from our UK Penny Stocks screener.

We'll examine a selection from our screener results.

Anglo Asian Mining (AIM:AAZ)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Anglo Asian Mining PLC, with a market cap of £228.68 million, owns and operates gold, silver, and copper producing properties in the Republic of Azerbaijan.

Operations: The company generates $67.14 million in revenue from its mining operations.

Market Cap: £228.68M

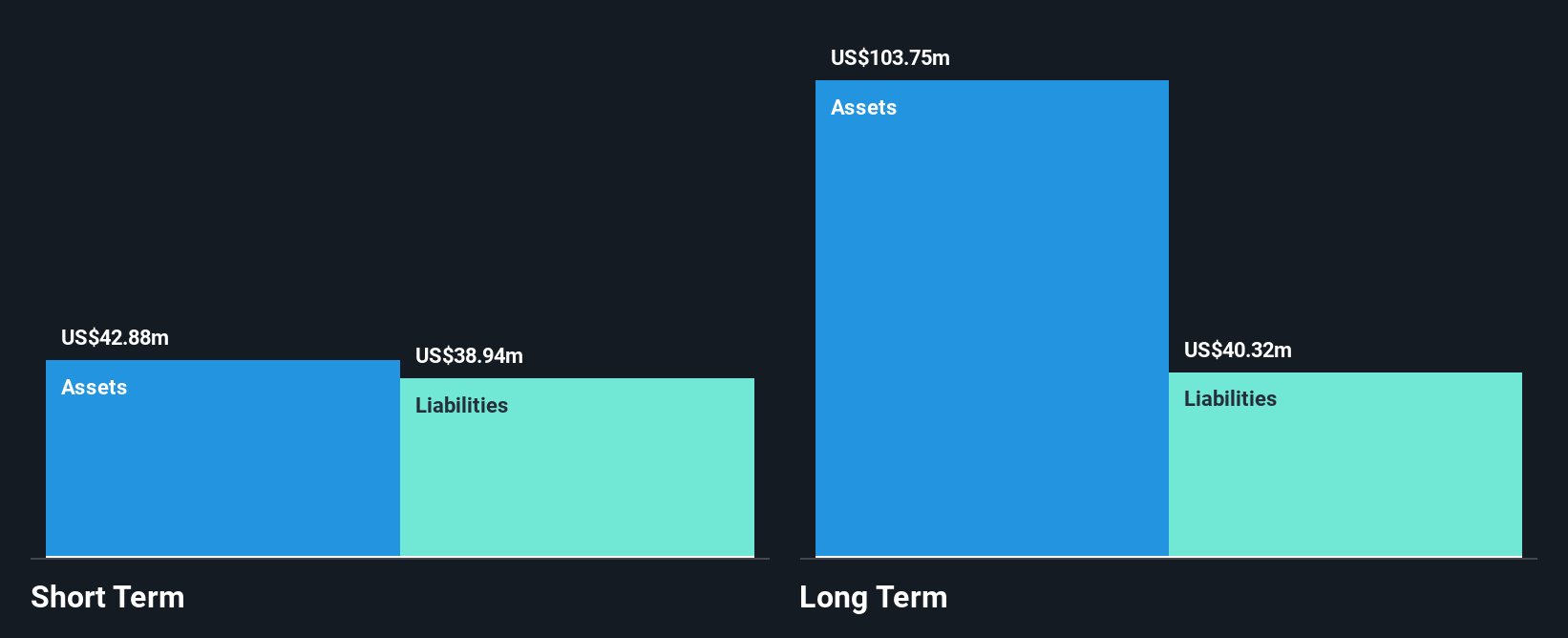

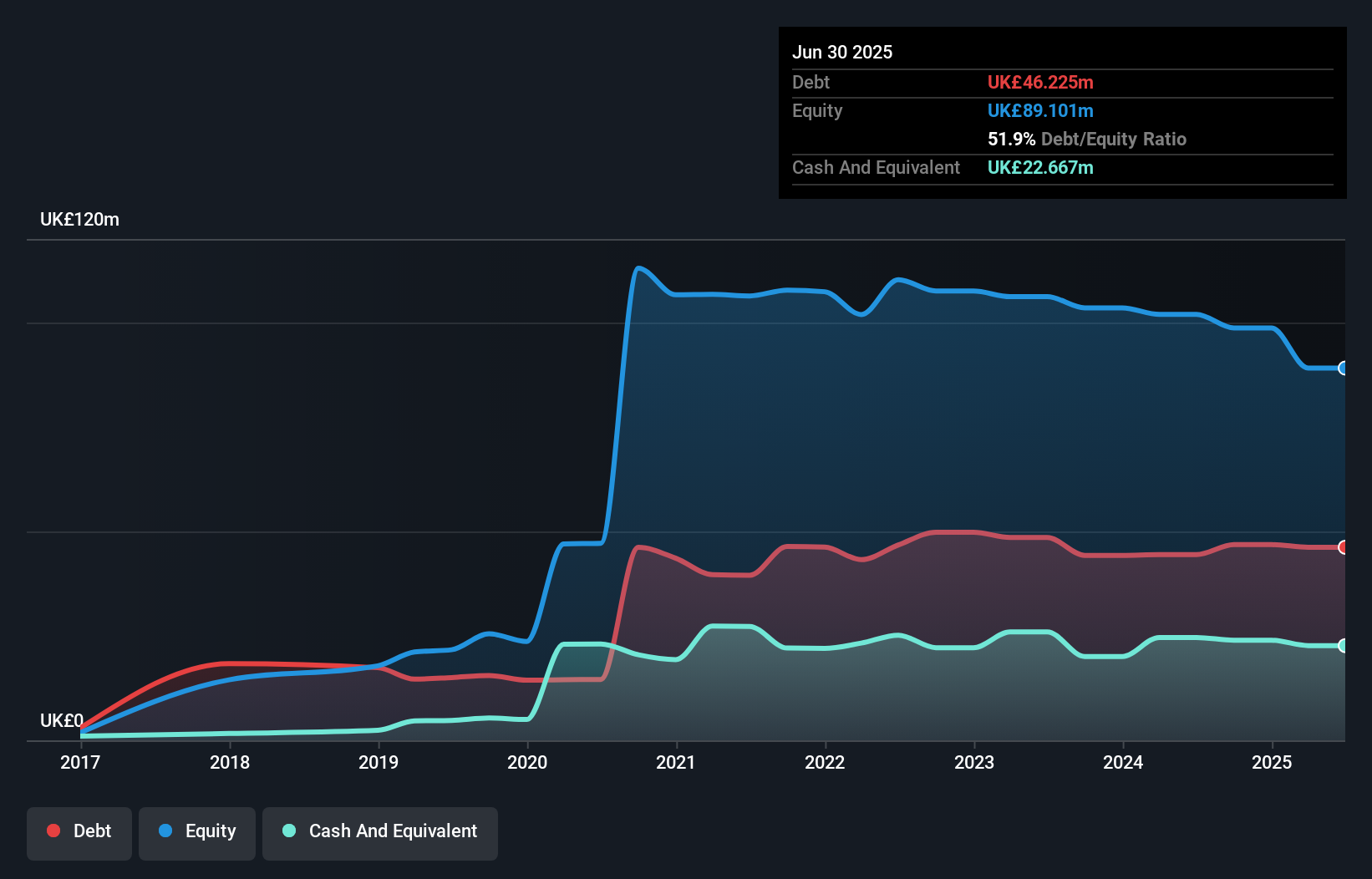

Anglo Asian Mining has shown significant production growth with copper, gold, and silver outputs increasing notably over the past year. Despite being unprofitable with a negative return on equity of -12.16%, the company reported improved sales and net income for the first half of 2025 compared to losses in 2024. Its debt is well-covered by operating cash flow, and short-term assets exceed liabilities, indicating financial stability. The share price remains volatile but trades below estimated fair value, while no meaningful shareholder dilution has occurred recently. The board is experienced with an average tenure of 16.2 years.

- Unlock comprehensive insights into our analysis of Anglo Asian Mining stock in this financial health report.

- Examine Anglo Asian Mining's earnings growth report to understand how analysts expect it to perform.

Solid State (AIM:SOLI)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Solid State plc, with a market cap of £90.95 million, designs, manufactures, distributes and supplies electronic equipment across the United Kingdom, Europe, Asia, North America and other international markets.

Operations: The company's revenue is derived from two main segments: the Systems Division, contributing £69.77 million, and the Components Division, generating £55.30 million.

Market Cap: £90.95M

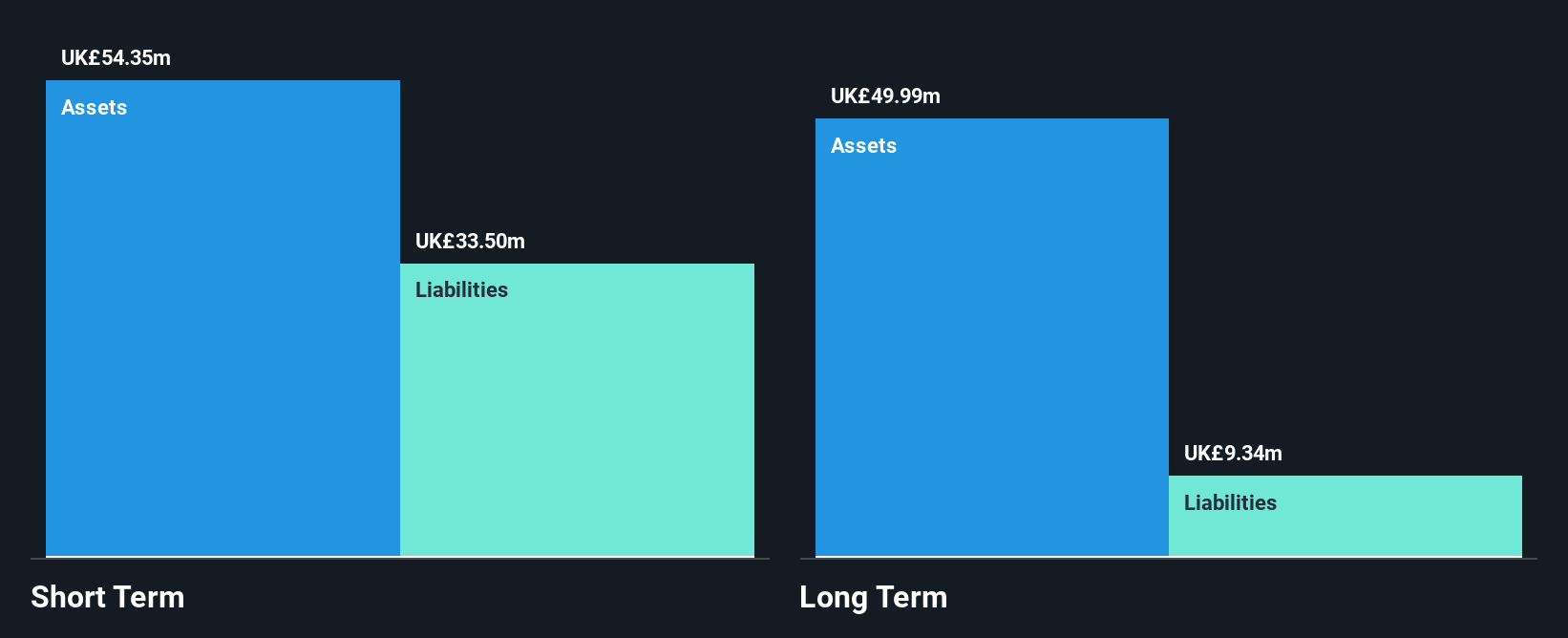

Solid State plc, with a market cap of £90.95 million, trades at a good value below its estimated fair value and relative to peers. Despite experiencing a large one-off loss of £2.8M impacting recent financial results, the company maintains satisfactory debt levels and covers interest payments well with EBIT. Short-term assets exceed both short and long-term liabilities, indicating sound liquidity management. However, the company's return on equity is low at 0.8%, and profit margins have declined from last year’s 5.4% to 0.4%. The board and management team are experienced, enhancing governance stability amidst earnings volatility challenges.

- Jump into the full analysis health report here for a deeper understanding of Solid State.

- Explore Solid State's analyst forecasts in our growth report.

INSPECS Group (AIM:SPEC)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: INSPECS Group plc is a company that designs, produces, sells, markets, and distributes fashion eyewear, lenses, and OEM products across multiple continents including the United Kingdom and has a market cap of £63.04 million.

Operations: The company's revenue is primarily derived from its Frames and Optics segment, which generated £173.22 million, followed by the Manufacturing segment contributing £21.05 million.

Market Cap: £63.04M

INSPECS Group, with a market cap of £63.04 million, faces challenges as it navigates investor activism and strategic decisions. Recent proposals from multiple parties suggest potential divestments to enhance shareholder value. The company is unprofitable but maintains a satisfactory net debt to equity ratio of 26.4% and has sufficient cash runway for over three years due to positive free cash flow growth. Despite its seasoned management team and board, INSPECS' share price remains highly volatile, with short-term assets exceeding both short-term (£69.2M) and long-term liabilities (£45.6M), reflecting sound liquidity management amidst ongoing financial pressures.

- Dive into the specifics of INSPECS Group here with our thorough balance sheet health report.

- Gain insights into INSPECS Group's past trends and performance with our report on the company's historical track record.

Where To Now?

- Discover the full array of 294 UK Penny Stocks right here.

- Ready To Venture Into Other Investment Styles? Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:AAZ

Anglo Asian Mining

Owns and operates gold, silver, and copper producing properties in the Republic of Azerbaijan.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives