- United States

- /

- Semiconductors

- /

- NasdaqGS:NXPI

NXP Semiconductors (NXPI) Reports Lower Q2 Earnings, Provides Q3 Revenue Guidance

Reviewed by Simply Wall St

NXP Semiconductors (NXPI) demonstrated a robust stock price increase of 31% over the last quarter, potentially influenced by several key events. Despite a decline in Q2 revenues and net income compared to the previous year, the company remained optimistic, reflecting its upgraded Q3 revenue projections between $3,050 million to $3,250 million. Additionally, NXPI's commitment to shareholder value through its buyback program, repurchasing over a million shares, likely added positive momentum. While the broader market, including the S&P 500, recorded flat movements, these decisive actions by NXP Semiconductors might have added specific weight to its notable share price improvement amidst a broader earnings-driven market.

Be aware that NXP Semiconductors is showing 1 warning sign in our investment analysis.

The recent updates regarding NXP Semiconductors' forward-looking guidance and share repurchase activities could signal improved shareholder confidence, possibly influencing the company's narrative around its growth strategies, particularly in the automotive and AI computing sectors. Over the past five years, the company's total return, which includes share price and dividends, amounts to 106.40%, highlighting a significant appreciation in shareholder value. Despite this substantial long-term gain, NXP has underperformed the US Semiconductor industry with a return of 26.9% over the past year, compared to a broader market return of 13.7%.

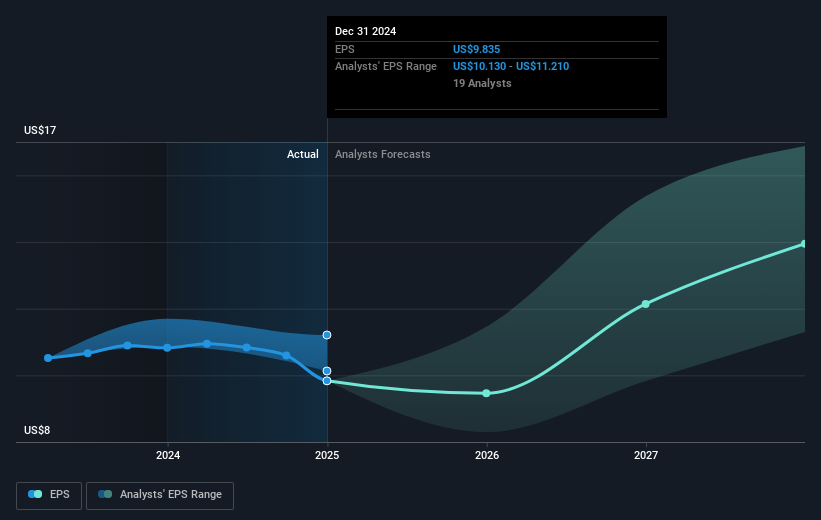

The recent acquisitions and projected revenue growth between $3.05 billion and $3.25 billion for Q3 highlight potential uplift in revenue and earnings forecasts, contingent on successful integration and execution. The current share price of US$228.27 offers an 8.87% discount to the consensus price target of US$248.52, which could reflect potential upside if analysts' expectations materialize. With expected earnings growth of 11.8% annually, NXP's price movements will likely continue to be scrutinized in relation to these targets, especially as it positions itself within the evolving global semiconductor landscape.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NXP Semiconductors might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NXPI

NXP Semiconductors

Offers various semiconductor products in China, the United States, Germany, Japan, Singapore, South Korea, Mexico, the Netherlands, Taiwan, and internationally.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives