- United States

- /

- Semiconductors

- /

- NasdaqGS:NVDA

NVIDIA (NVDA) Teams Up With Eaton To Revolutionize AI Data Center Power Management

Reviewed by Simply Wall St

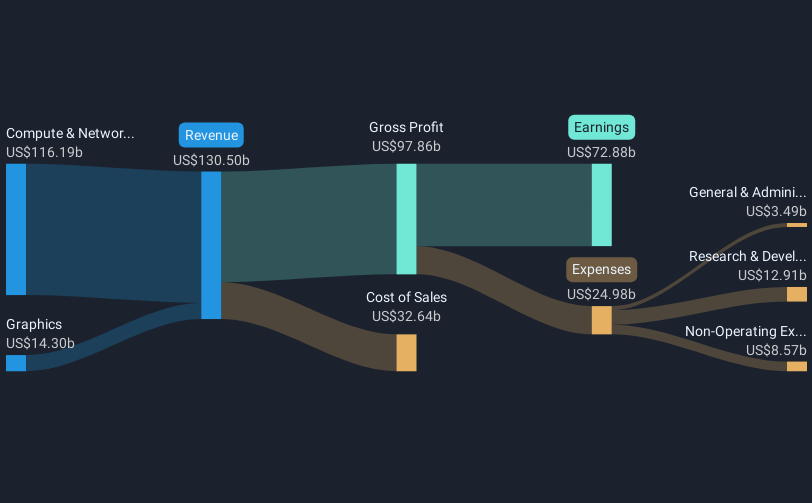

Eaton's recent collaboration with NVIDIA (NVDA) to advance HVDC power infrastructure in AI data centers highlights the ongoing synergy between the tech and power sectors. This strategic partnership aligns with NVIDIA's broader efforts to capitalize on AI and data center expansion, reflected in the company's impressive 63% share price increase over the last quarter. Significant earnings growth and innovative ventures, such as the partnership for the Stargate UAE AI infrastructure, likely reinforced this upward trend. While general market conditions were volatile, NVIDIA's specific initiatives and strong financial performance likely added weight to the company's share price performance amidst a broader mixed market scenario.

The collaboration between Eaton and NVIDIA to advance HVDC power infrastructure in AI data centers could enhance NVIDIA's growth narrative by potentially increasing its data center revenue and expanding market presence in AI capabilities. This partnership might also lead to heightened investor interest, further reinforcing NVIDIA's position within the tech industry.

Over the past five years, NVIDIA's total shareholder return, including dividends, has been exceptionally large at 1558.16%. This demonstrates a substantial long-term return for investors, significantly outpacing industry and broader market performance over a short term, as its 1-year return surpasses the US Semiconductor industry, which gained 20.5%, and the general US Market, which returned 10%.

The ongoing initiatives, like the Eaton partnership, could augment NVIDIA's revenue and earnings forecasts, leveraging AI and data center integrations. With analysts forecasting robust annual revenue growth of 19.6% and earnings growth of 20.5% over the next few years, such collaborations might support these projections by diversifying and strengthening core business segments. Currently, NVIDIA's shares trade at US$170.70, closely aligned with the consensus analyst price target of US$177.72, reflecting a minor 4.1% discount. This indicates that the stock price is approaching perceived fair value, which could justify further evaluation of NVIDIA's market potential and financial health given its recent alliances and strategic expansions.

Examine NVIDIA's past performance report to understand how it has performed in prior years.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NVIDIA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NVDA

NVIDIA

A computing infrastructure company, provides graphics and compute and networking solutions in the United States, Singapore, Taiwan, China, Hong Kong, and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives