- United States

- /

- Semiconductors

- /

- NasdaqGS:NVDA

NVIDIA (NVDA) Powers Next-Gen Intelligent In-Car Experiences With AIBOX Unveiled At IAA Mobility 2025

Reviewed by Simply Wall St

NVIDIA (NVDA) recently unveiled the AIBOX at IAA Mobility 2025, marking a significant step by integrating large AI models into vehicles in collaboration with ThunderSoft and Geely Auto. This innovation, alongside NVIDIA's strong earnings with Q2 sales of $46.74 billion and substantial net income growth, likely added weight to the company's 24% share price rise over the last quarter. The broader market's climb to record highs and expectations for Federal Reserve rate cuts also provided a supportive backdrop for NVIDIA's upward momentum, reflecting general investor optimism in high-performing tech stocks.

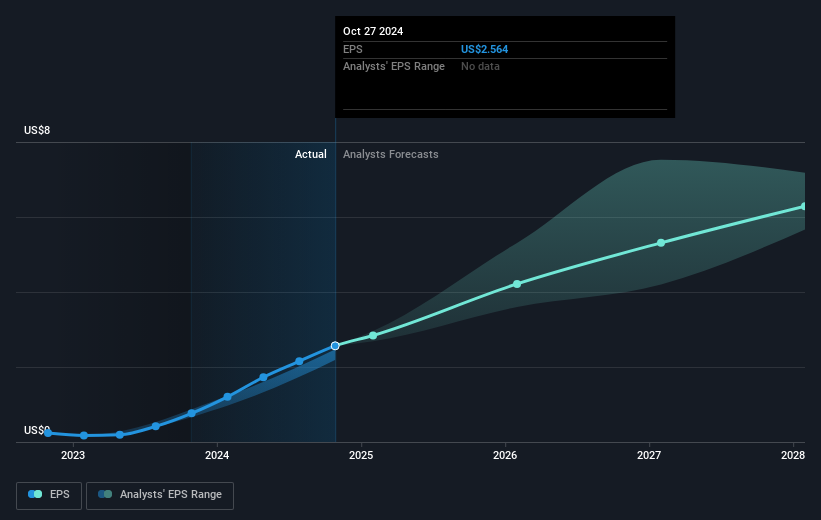

The introduction of NVIDIA's AIBOX at IAA Mobility 2025 is expected to deepen the integration of AI in vehicles, potentially raising future demand for NVIDIA's offerings. This aligns with the narrative's focus on surging AI adoption and diversified demand fueling long-term growth. The company's Q2 sales of $46.74 billion reflect robust performance, supporting analyst forecasts of substantial revenue and earnings growth driven by AI advancements and platform innovation.

Over the past five years, NVIDIA has delivered a very large total return of 1327.14%, underscoring strong investor confidence in its growth trajectory. While NVIDIA's shares rose 24% in the last quarter, further illustrating strong momentum, the semiconductor industry saw a negative return of 0.7% over the past year, whereas NVIDIA distinctly outperformed this with a 63.7% earnings growth over the same period.

Considering NVIDIA's current share price of US$177.33, it is trading below the consensus price target of approximately US$207.54. This suggests potential upside according to analyst expectations. Should NVIDIA continue to capitalize on AI-driven demand and technological leadership, the revenue and earnings forecasts may see further upward revisions, which could impact the stock's valuation and bring it closer to the target price. However, geopolitical and supply chain risks should be closely monitored as they could affect long-term projections.

Our valuation report here indicates NVIDIA may be overvalued.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NVIDIA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NVDA

NVIDIA

A computing infrastructure company, provides graphics and compute and networking solutions in the United States, Singapore, Taiwan, China, Hong Kong, and internationally.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives