- United States

- /

- Semiconductors

- /

- NasdaqGS:NVDA

NVIDIA (NVDA) Cosmos Reason Powers New Era Of Urban Intelligence In Taiwan

Reviewed by Simply Wall St

Linker Vision's recent breakthrough in Physical AI, leveraging NVIDIA (NVDA) technology, has garnered attention for potentially transforming urban and industrial environments. Over the last quarter, NVIDIA's share price increased by 36%, a movement that aligns with broader market trends, as major indexes, including the tech-heavy Nasdaq, reached record highs. With NVIDIA reporting substantial revenue and net income growth in its recent earnings, and its robust collaborations, such as the one with Linker Vision, these strategic advancements would have contributed positively to the bullish sentiment supporting the company's ascent during this period.

Every company has risks, and we've spotted 1 risk for NVIDIA you should know about.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

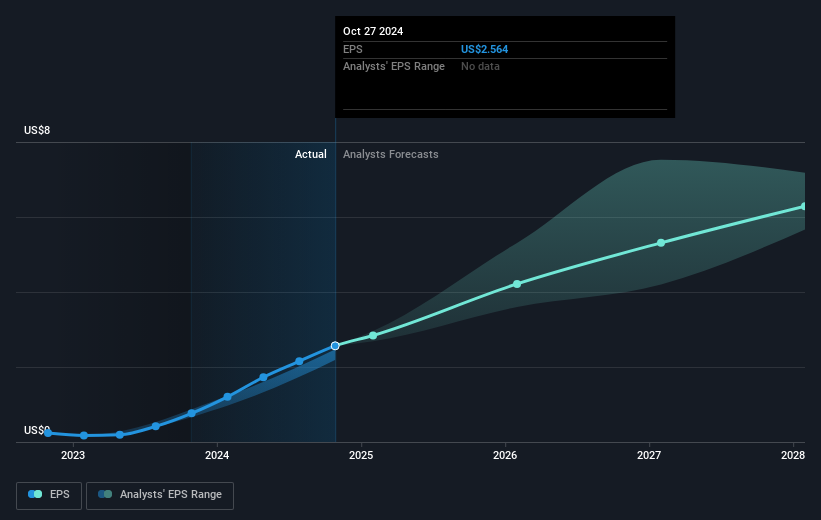

The breakthrough in Physical AI by Linker Vision, utilizing NVIDIA's technology, could reinforce the narratives around NVIDIA's growth prospects, particularly in automotive and urban environments. This partnership, alongside NVIDIA's collaborations with Toyota and Uber, further solidifies its position in AI-driven sectors, potentially leading to diversification into new revenue streams. Expansion in the data center and automotive sectors aligns with the expected increase in revenue and earnings, although regulatory and operational challenges remain. These developments could support revenue forecasts, which project annual growth of 19.7% over the next three years, alongside earnings growth anticipated to reach US$164.60 billion by August 2028.

Over the past five years, NVIDIA's total shareholder return, including dividends, was very large at 1413.89%. This long-term performance highlights a significant appreciation compared to its more recent one-year return, which exceeded both the US market's 19.6% return and the US Semiconductor industry's 44.6% return. This contrast indicates robust performance over different timeframes, positioning NVIDIA as a leader in the industry.

With the current share price at US$183.16, the slight 0.67% discount to the consensus price target of US$184.38 suggests market sentiment is relatively aligned with analyst expectations. However, the narrowed gap also underscores the importance of NVIDIA achieving the projected growth rates to meet these valuations. As NVIDIA navigates potential regulatory issues and manufacturing costs, its ability to capitalize on AI and automotive innovations will be key in maintaining this trajectory.

Our valuation report here indicates NVIDIA may be overvalued.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NVIDIA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NVDA

NVIDIA

A computing infrastructure company, provides graphics and compute and networking solutions in the United States, Singapore, Taiwan, China, Hong Kong, and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives