- United States

- /

- Transportation

- /

- NYSE:NSC

Norfolk Southern (NYSE:NSC) Board Appoints Richard Anderson As Independent Chair

Reviewed by Simply Wall St

Norfolk Southern (NYSE:NSC) experienced a notable change in leadership with the appointment of Richard H. Anderson as Independent Chair of the Board, succeeding the previous chairman who resigned for personal reasons. During the last quarter, the company's share price rose 8%, which aligns moderately with the market's upward trend over the same period. This move could have been bolstered by multiple factors, including record Q1 earnings, significant share buyback activity, and the introduction of the RailGreen sustainability initiative. Nevertheless, given the broader market's gains, these events may have concurrently supported the overall upward momentum of NSC shares.

Norfolk Southern has 1 possible red flag we think you should know about.

The recent appointment of Richard H. Anderson as Independent Chair of Norfolk Southern's Board could reinforce investor confidence given Anderson's industry experience. This leadership change aligns with the company's ongoing PSR 2.0 transformation, focusing on operational efficiencies and cost reductions. Such efforts aim to strengthen margins and earnings, despite existing pressures from factors like storm restoration costs and competitive pricing in intermodal services.

Over the past five years, Norfolk Southern's total shareholder return, encompassing both share price appreciation and dividends, reached 59.93%. In contrast, the company's one-year performance surpassed the US Transportation industry's return of 5.1%, indicating its robust position within the sector. These figures highlight steady long-term growth, although challenges in coal pricing and trade policies remain.

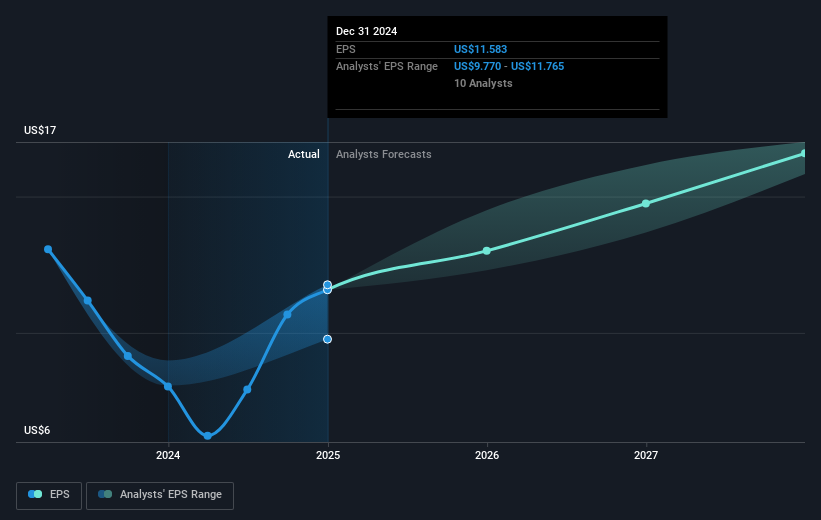

The company's share price, now at US$218.63, shows room to grow towards the consensus price target of US$258.04, a 15.2% potential increase. Analyst forecasts suggest a 4% revenue growth annually with constant earnings at US$3.3 billion, implying a future PE ratio of 21.8x. The anticipated share buybacks could also support EPS sustainability. However, any deviations from these forecasts due to market or operational risks might impact achieving this target.

Gain insights into Norfolk Southern's historical outcomes by reviewing our past performance report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Norfolk Southern might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NSC

Norfolk Southern

Engages in the rail transportation of raw materials, intermediate products, and finished goods in the United States.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives