- United States

- /

- Luxury

- /

- NYSE:NKE

NIKE (NYSE:NKE) Announces Retirement Of Board Member Cathleen Benko

Reviewed by Simply Wall St

NIKE (NYSE:NKE) recently announced the retirement of long-standing board member Cathleen Benko, a move that comes amid several leadership changes, including the promotion of Tony Bignell to Chief Innovation Officer. Over the past month, NIKE's stock experienced a 4% decline, contrasting the flat market trend. These executive shifts highlight a broader strategic focus on innovation and communication, which may have added weight to market expectations. Additionally, the non-renewal of a business agreement with Straker Limited could have contributed to this decrease, reflecting ongoing transitions within the company. Overall, these developments present a mixed picture of NIKE’s near-term prospects.

Buy, Hold or Sell NIKE? View our complete analysis and fair value estimate and you decide.

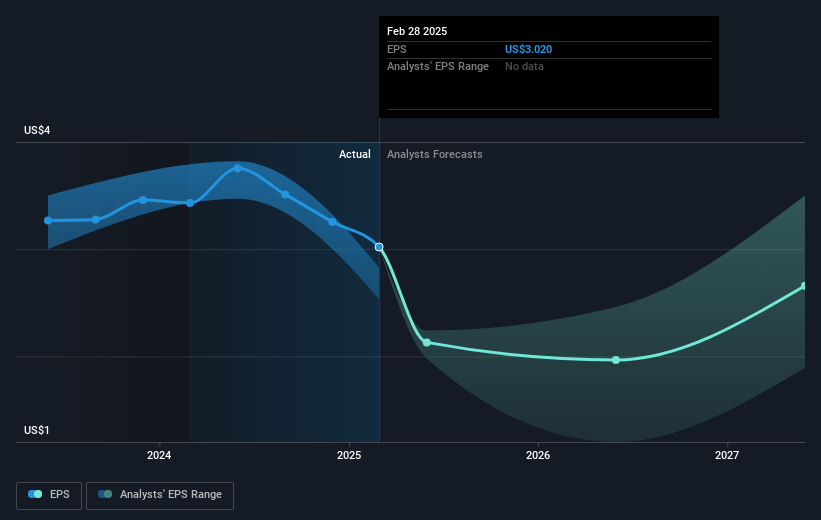

The recent leadership changes and strategic adjustments at NIKE, including board members transitioning and executive promotions, emphasize the company's focus on innovation and market adaptation. Over the past year, NIKE's total shareholder return, encompassing both share price and dividends, fell 35.87%. This downturn reflects investor concerns about short-term uncertainties, including the potential impact of leadership transitions and discontinued agreements on revenue and growth.

The company's performance has been weaker relative to the broader market, as it underperformed the US Luxury industry, which decreased 19.6% in the same period. The company's revised strategic focus, centered on sports performance products and reducing excess inventory, aims to stabilize margins and enhance revenue growth. However, analysts forecast modest revenue growth at 1.8% annually, with earnings anticipated to reach US$5 billion by May 2028.

Regarding stock valuation, NIKE's current share price of US$57.04 represents a significant discount to the analyst consensus price target of US$73.86, indicating potential upside if the company meets growth forecasts. Analysts expect increased profit margins from 9.4% to 9.8% over three years, aligning with the strategic emphasis on key markets and digital initiatives, although existing challenges may pose risks to achieving these targets. Steady investments in brand storytelling and market engagement are anticipated to reinforce brand loyalty and contribute to long-term growth prospects.

Review our growth performance report to gain insights into NIKE's future.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NIKE might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NKE

NIKE

Engages in the design, development, marketing, and sale of athletic footwear, apparel, equipment, accessories, and services worldwide.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives