- United Kingdom

- /

- Healthtech

- /

- AIM:CRW

Need To Know: Craneware plc (LON:CRW) Insiders Have Been Buying Shares

We often see insiders buying up shares in companies that perform well over the long term. Unfortunately, there are also plenty of examples of share prices declining precipitously after insiders have sold shares. So shareholders might well want to know whether insiders have been buying or selling shares in Craneware plc (LON:CRW).

What Is Insider Buying?

It's quite normal to see company insiders, such as board members, trading in company stock, from time to time. However, such insiders must disclose their trading activities, and not trade on inside information.

We would never suggest that investors should base their decisions solely on what the directors of a company have been doing. But logic dictates you should pay some attention to whether insiders are buying or selling shares. For example, a Harvard University study found that 'insider purchases earn abnormal returns of more than 6% per year'.

Check out our latest analysis for Craneware

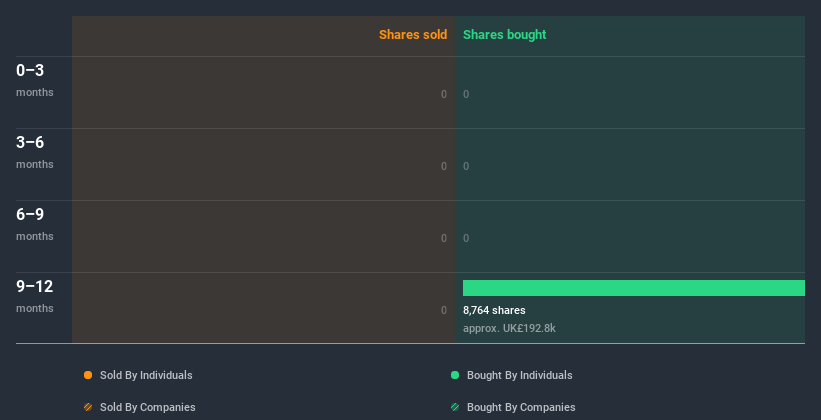

Craneware Insider Transactions Over The Last Year

The Co-Founder Keith Neilson made the biggest insider purchase in the last 12 months. That single transaction was for UK£100k worth of shares at a price of UK£22.00 each. So it's clear an insider wanted to buy, even at a higher price than the current share price (being UK£17.00). While their view may have changed since the purchase was made, this does at least suggest they have had confidence in the company's future. To us, it's very important to consider the price insiders pay for shares. As a general rule, we feel more positive about a stock if insiders have bought shares at above current prices, because that suggests they viewed the stock as good value, even at a higher price.

While Craneware insiders bought shares during the last year, they didn't sell. The chart below shows insider transactions (by companies and individuals) over the last year. If you want to know exactly who sold, for how much, and when, simply click on the graph below!

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Insider Ownership of Craneware

For a common shareholder, it is worth checking how many shares are held by company insiders. A high insider ownership often makes company leadership more mindful of shareholder interests. It's great to see that Craneware insiders own 22% of the company, worth about UK£99m. This kind of significant ownership by insiders does generally increase the chance that the company is run in the interest of all shareholders.

So What Do The Craneware Insider Transactions Indicate?

The fact that there have been no Craneware insider transactions recently certainly doesn't bother us. However, our analysis of transactions over the last year is heartening. Insiders own shares in Craneware and we see no evidence to suggest they are worried about the future. If you are like me, you may want to think about whether this company will grow or shrink. Luckily, you can check this free report showing analyst forecasts for its future.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of interesting companies, that have HIGH return on equity and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

If you’re looking to trade Craneware, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About AIM:CRW

Craneware

Develops, licenses, and supports computer software for the healthcare industry in the United States.

Reasonable growth potential with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives