- Poland

- /

- Metals and Mining

- /

- WSE:KTY

NCAB Group And 2 Other European Stocks That May Be Priced Below Intrinsic Value Estimates

Reviewed by Simply Wall St

Amid concerns about global growth following weak U.S. jobs data and a stronger euro, the pan-European STOXX Europe 600 Index ended slightly lower, with mixed performances across major stock indexes. In this environment, identifying stocks that may be undervalued relative to their intrinsic value can offer potential opportunities for investors looking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Truecaller (OM:TRUE B) | SEK43.60 | SEK85.68 | 49.1% |

| Trifork Group (CPSE:TRIFOR) | DKK88.70 | DKK171.82 | 48.4% |

| Rusta (OM:RUSTA) | SEK64.00 | SEK127.40 | 49.8% |

| Getinge (OM:GETI B) | SEK212.50 | SEK423.41 | 49.8% |

| Figeac Aero Société Anonyme (ENXTPA:FGA) | €9.80 | €19.40 | 49.5% |

| Digital Workforce Services Oyj (HLSE:DWF) | €3.47 | €6.80 | 49% |

| Atea (OB:ATEA) | NOK142.00 | NOK279.70 | 49.2% |

| Aquafil (BIT:ECNL) | €1.962 | €3.85 | 49% |

| Alfio Bardolla Training Group (BIT:ABTG) | €1.96 | €3.81 | 48.6% |

| adidas (XTRA:ADS) | €178.80 | €352.27 | 49.2% |

Here's a peek at a few of the choices from the screener.

NCAB Group (OM:NCAB)

Overview: NCAB Group AB (publ) is involved in the manufacture and sale of printed circuit boards (PCBs) across Sweden, the Nordic region, Europe, North America, and Asia with a market cap of approximately SEK9.39 billion.

Operations: The company's revenue segments are divided as follows: East generates SEK224 million, Europe contributes SEK1.74 billion, the Nordic region accounts for SEK838 million, and North America brings in SEK822 million.

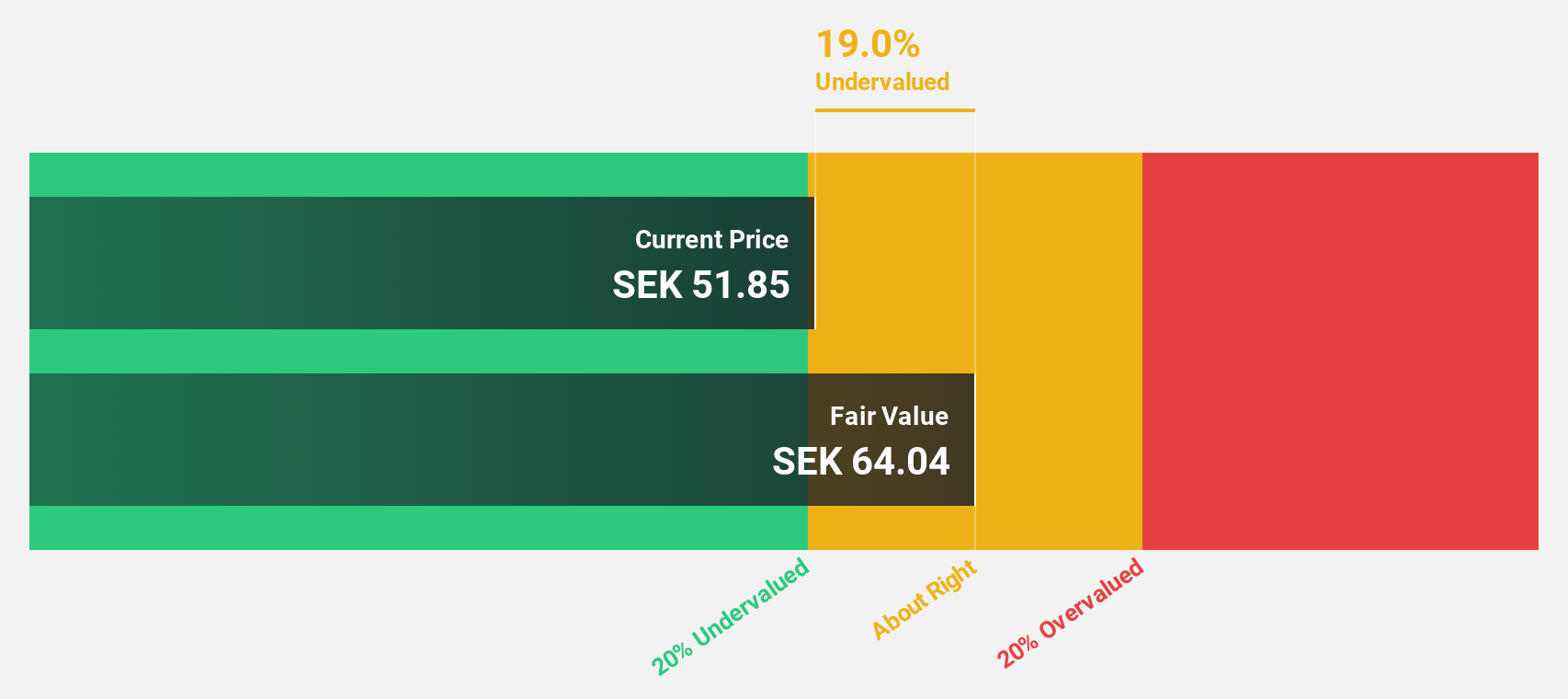

Estimated Discount To Fair Value: 13%

NCAB Group, trading at SEK50.2, is 13% below its estimated fair value of SEK57.73, indicating potential undervaluation based on cash flows despite recent profit margin declines from 9% to 5.1%. While revenue growth (8.3% annually) outpaces the Swedish market average, high debt levels may pose a risk. Earnings are expected to grow significantly at nearly 30% per year over the next three years, surpassing market expectations and highlighting future profitability potential amidst current financial challenges.

- The analysis detailed in our NCAB Group growth report hints at robust future financial performance.

- Click here and access our complete balance sheet health report to understand the dynamics of NCAB Group.

Grupa Pracuj (WSE:GPP)

Overview: Grupa Pracuj S.A. operates an HR technology platform in Poland, Ukraine, and Germany with a market cap of PLN4.75 billion.

Operations: The company generates revenue from its Staffing & Outsourcing Services segment, which amounts to PLN789.68 million.

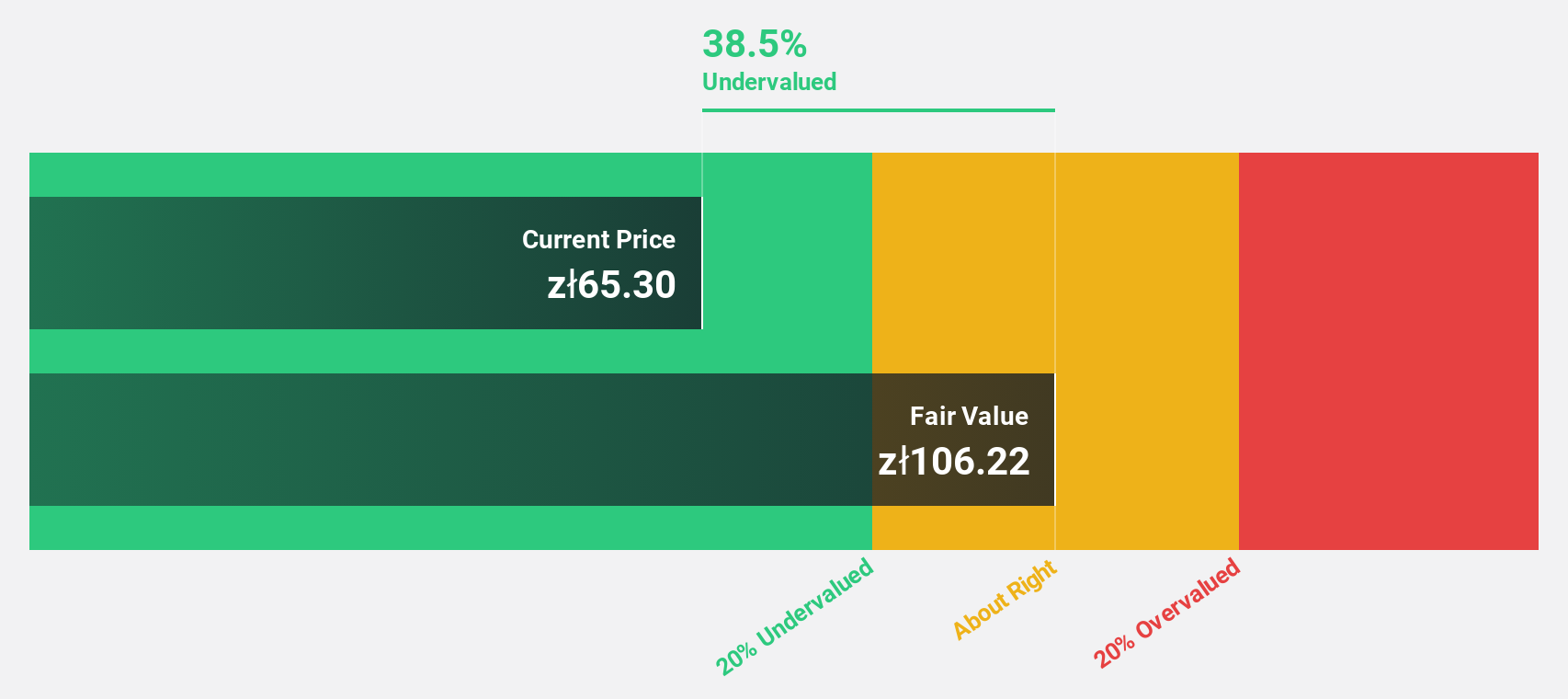

Estimated Discount To Fair Value: 31.7%

Grupa Pracuj, trading at PLN69, is 31.7% below its estimated fair value of PLN101.02, highlighting potential undervaluation based on cash flows. Recent earnings results show a strong performance with net income rising to PLN54.81 million for Q2 2025 from PLN41.2 million a year ago. Despite an unstable dividend track record, the company’s earnings are projected to grow faster than the Polish market at 13.2% annually, supported by robust revenue growth forecasts outpacing market averages.

- Our comprehensive growth report raises the possibility that Grupa Pracuj is poised for substantial financial growth.

- Click to explore a detailed breakdown of our findings in Grupa Pracuj's balance sheet health report.

Grupa Kety (WSE:KTY)

Overview: Grupa Kety S.A. operates through its subsidiaries to manufacture and sell aluminum profiles and components both in Poland and internationally, with a market cap of PLN9.08 billion.

Operations: Grupa Kety's revenue segments include Extracted Products at PLN1.99 billion, Flexible Packaging at PLN1.17 billion, and Aluminum Systems (including SAB & SUB) at PLN2.80 billion.

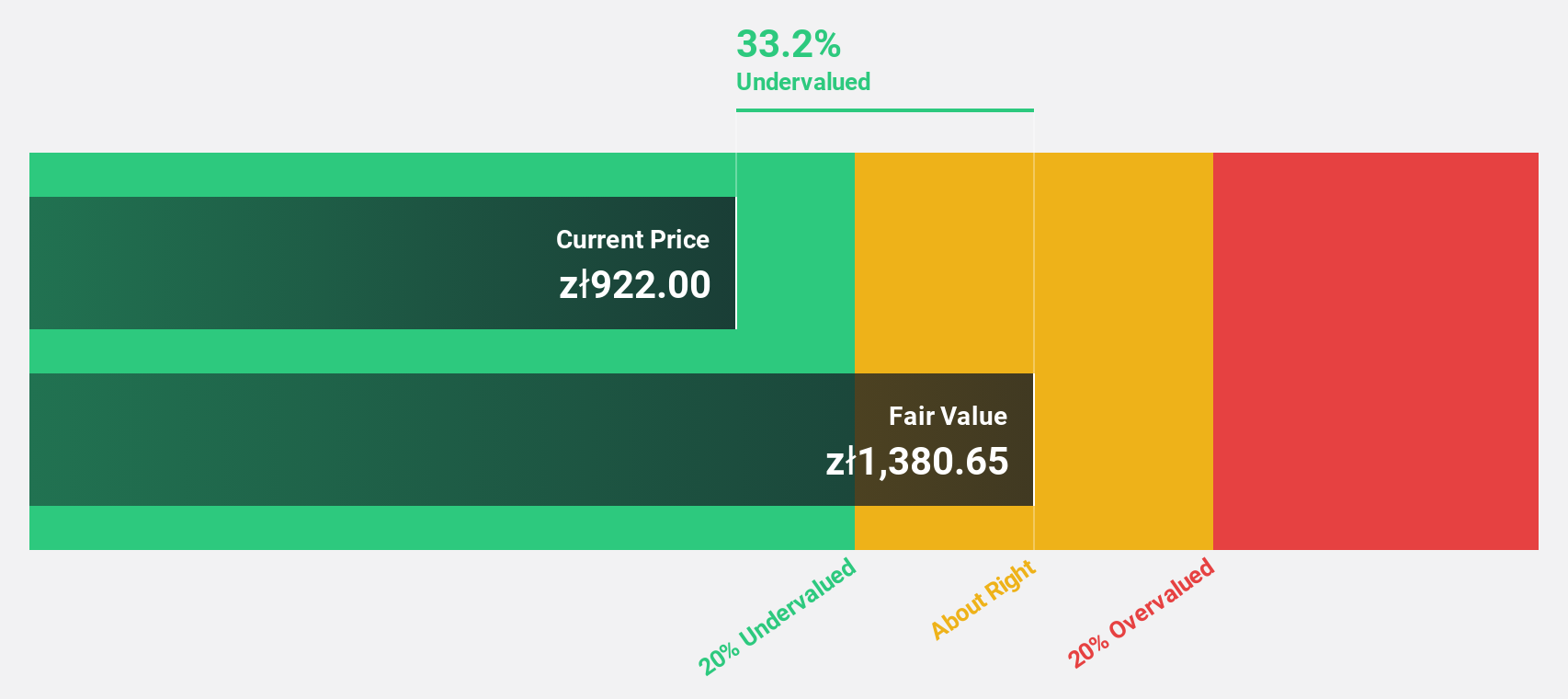

Estimated Discount To Fair Value: 33.2%

Grupa Kety, trading at PLN924, is 33.2% below its estimated fair value of PLN1,383.8, suggesting undervaluation based on cash flows. Although it carries a high level of debt and its dividend yield of 6.01% isn't well covered by earnings or free cash flows, the company’s revenue and earnings are forecast to grow faster than the Polish market at 9% and 13.5% annually respectively. Recent Q2 results show stable sales growth with net income slightly up from last year.

- Our earnings growth report unveils the potential for significant increases in Grupa Kety's future results.

- Click here to discover the nuances of Grupa Kety with our detailed financial health report.

Turning Ideas Into Actions

- Dive into all 215 of the Undervalued European Stocks Based On Cash Flows we have identified here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:KTY

Grupa Kety

Through its subsidiaries, manufactures and sells aluminum profiles and components in Poland and internationally.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives