- United States

- /

- Biotech

- /

- NasdaqGS:NTRA

Natera (NasdaqGS:NTRA) Showcases 94% Sensitivity In Pan-Cancer Signatera Genome Study

Reviewed by Simply Wall St

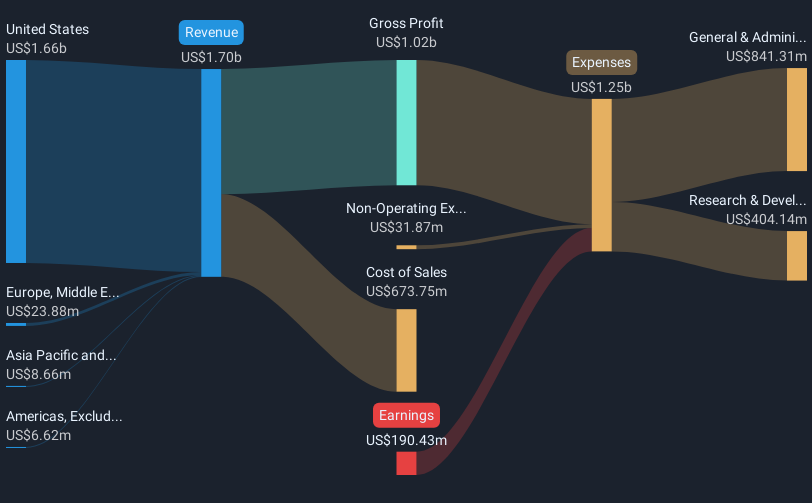

Natera (NasdaqGS:NTRA) recently presented compelling findings from a pan-cancer study of the Signatera Genome assay at the ASCO Annual Meeting, showcasing high sensitivity and specificity rates. The study's promising results, alongside a revenue rise to $502 million in Q1 2025, would have bolstered investor confidence. Over the last quarter, Natera's share price increased by 13%, a move that aligns with the market's 12% rise over the past year. Other developments, such as the company's participation in various congresses and expanded assay availability, would have added weight to Natera's positive market performance.

The presentation of Natera's findings at the ASCO Annual Meeting could amplify confidence in the Signatera assay's potential market adoption, which may positively influence future revenue projections. With the company's recent share price increase of 13% in the short term aligning closely with the 12% market rise over the past year, it's essential to also consider Natera's longer-term performance. Over the past three years, Natera has delivered a remarkable total return of 349.23%, underscoring the robust upward momentum in its share price. This performance not only outpaces the biotechnology industry, which saw a decline of 13.1% in the past year, but also surpasses the broader US market's annual return of 11.5%.

The positive reception of Natera's diagnostic advancements may enhance revenue and earnings forecasts, especially as increased diagnostic volumes and strategic expansion into new health segments drive growth. Analysts estimate revenue to grow by approximately 14.6% annually over the next three years. With the current share price at US$157.16, the analyst consensus price target of US$191.91 represents an 18.1% potential upside. However, for this potential to be realized, Natera's projected 2028 earnings and associated trading multiples, such as a 1195.9x PE ratio, must align with analyst expectations. Despite these uncertainties, the optimism surrounding Natera's technology suggests a promising trajectory if the company successfully navigates regulatory and competitive challenges.

Gain insights into Natera's historical outcomes by reviewing our past performance report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Natera might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NTRA

Natera

A diagnostics company, provides molecular testing services worldwide.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives