- United States

- /

- Capital Markets

- /

- NYSE:MS

Morgan Stanley (NYSE:MS) Sells US$1.23 Billion Debt Linked To Musk's X Holdings Corp

Reviewed by Simply Wall St

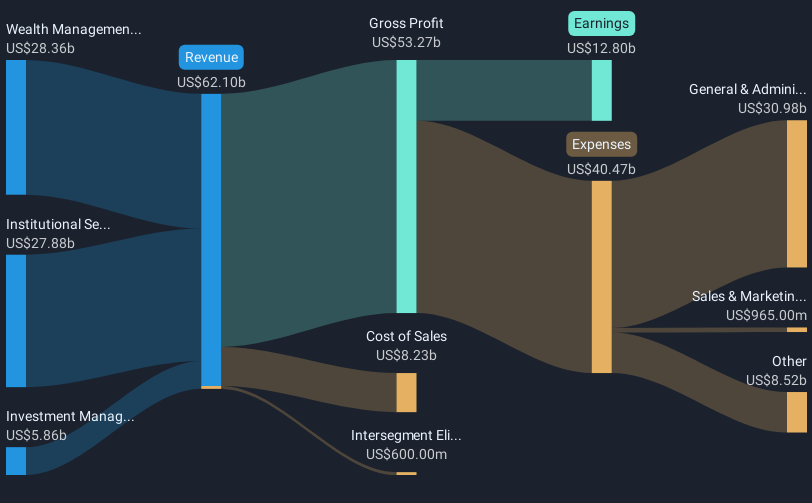

Morgan Stanley (NYSE: MS) has recently engaged in significant financial maneuvers, including selling $1.23 billion of debt linked to Elon Musk's acquisition of X Holdings Corp and reshuffling co-lead underwriters for its fixed-income offerings. These actions align with the broader market trends, where the Dow Jones, S&P 500, and Nasdaq have been buoyed by decreasing global trade tensions and encouraging U.S. economic data. The company's decisive financial steps may have complemented the market's positive sentiment, potentially contributing to its 20% price increase last month. The overall market environment was supportive, with key indexes on a winning streak.

You should learn about the 2 risks we've spotted with Morgan Stanley.

Morgan Stanley's recent maneuvers, such as selling US$1.23 billion of debt linked to Elon Musk's acquisition activities and altering its fixed-income team, align with its robust positioning in equity and Asian markets. These actions could bolster its asset management operations, a core component of its stability amidst market fluctuations. This strategic pivot may influence future revenue and earnings forecasts positively, contributing to the company's anticipated growth trajectory in M&A and IPO activities.

Over the past five years, Morgan Stanley has achieved an impressive total return of 274.85%, reflecting its robust growth strategy. In comparison, its one-year performance also exceeded the US Capital Markets industry, underscoring its strong market presence. This consistent performance suggests that the company is effectively leveraging its market opportunities.

The recent share price increase of 20% might reflect market confidence in these strategic offerings, yet it is trading close to the analyst consensus price target of US$124.13, representing a 4.7% increase from the current share price of US$118.33. Though this indicates a relatively modest premium, it does highlight underlying confidence in Morgan Stanley's potential to meet or exceed revenue and earnings expectations. The company's shares, assessed as good value based on its Price-To-Earnings Ratio compared to industry averages, suggest it remains competitively positioned in the capital markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MS

Morgan Stanley

A financial holding company, provides various financial products and services to governments, financial institutions, and individuals in the Americas, Asia, Europe, Middle East, and Africa.

Solid track record average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion