- United States

- /

- Biotech

- /

- NasdaqCM:MLTX

MoonLake Immunotherapeutics (MLTX) Q2 Net Loss Widens to US$55 Million

Reviewed by Simply Wall St

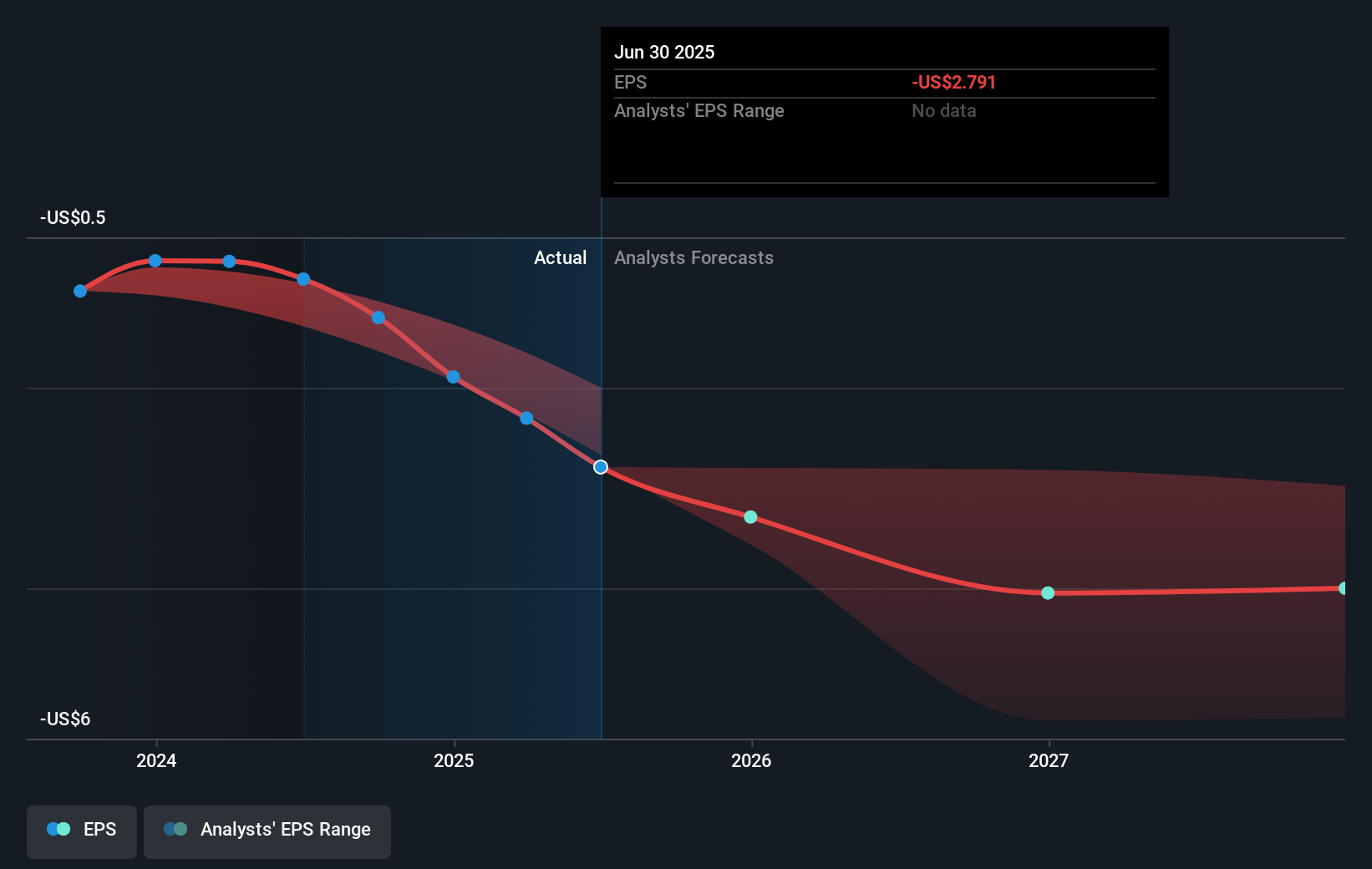

During the last quarter, MoonLake Immunotherapeutics (MLTX) reported a significant increase in net losses, with a net loss of $55 million for the second quarter, up from $24 million in the same period in 2024. This coincided with a broader market trend where tech stocks led the Nasdaq to record highs, and the S&P 500 saw growth. Despite the increase in losses, MoonLake's stock price rose by 19.02% over the quarter, moving in line with the overall market's upward trend of 19% over the past year, potentially buoyed by investor optimism and favorable broader market conditions.

Over the past three years, MoonLake Immunotherapeutics has witnessed a very large total shareholder return of 613.98%. Despite its substantial net losses, the company's share performance has sharply contrasted with the past year's negative performance of the US Biotech industry, outpacing the industry's return by a substantial margin. However, while MoonLake outperformed, the stock underperformed the broader US market's 19.9% return over the last year. This impressive three-year performance indicates strong investor interest, possibly driven by MoonLake's innovative product pipeline and potential acquisition interest.

The increased net losses reported in recent quarters and the substantial rise in basic loss per share highlight ongoing challenges, potentially impacting future revenue and earnings forecasts. The share price movement, which saw a rise of 19.02% last quarter, aligns with recent investor optimism despite these financial challenges. However, the current stock price of US$52.62 is still below the consensus analyst price target of US$76.36, suggesting room for potential growth if the company can achieve milestones or new developments in its clinical programs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:MLTX

MoonLake Immunotherapeutics

A clinical stage biotechnology company, focuses on developing therapies for inflammatory skin and joint diseases.

Excellent balance sheet with very low risk.

Market Insights

Community Narratives