MINISO Group Holding (MNSO) Gains 11% in a Week Amid Stable Market Conditions

Reviewed by Simply Wall St

MINISO Group Holding (MNSO) experienced a notable share price movement of 11%, widely attributed to the attention surrounding its recent operational developments. Last week, the company's positive trajectory might have been influenced by broader market dynamics, which included rising optimism tied to corporate earnings and stable economic indicators. While major indices, such as the S&P 500, showed marginal gains with investors eyeing Federal Reserve announcements and tech earnings, MINISO's distinctive price move suggests additional underlying factors specific to the company may have resonated with investors. This uptrend is especially significant amid a generally stable market backdrop.

We've discovered 1 risk for MINISO Group Holding that you should be aware of before investing here.

MINISO Group Holding's recent operational advancements have drawn significant investor attention, evidenced by the 11% share price increase. Over the last three years, MINISO's total return, including share price and dividends, surged 258.92%, reflecting robust long-term performance. In comparison, over the past year, MINISO exceeded the US market's return of 17.5% and underperformed the US Multiline Retail industry's 26.9% return.

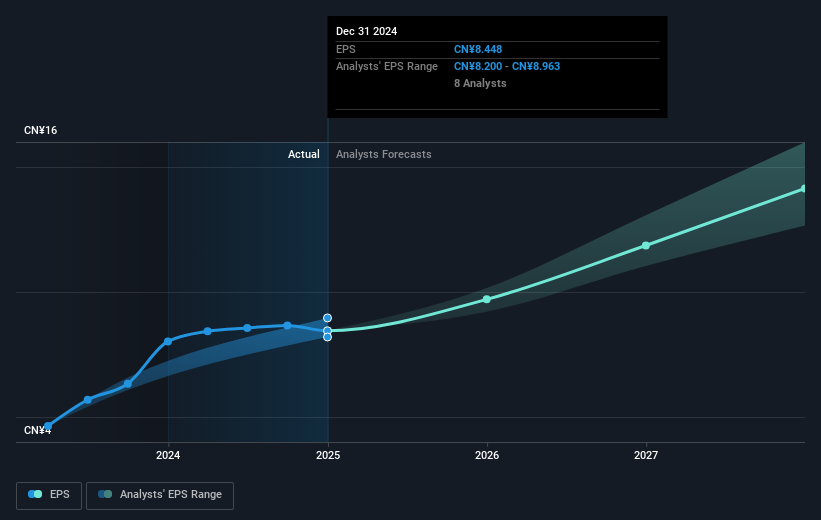

The company's expansion into US and European markets, combined with partnerships, could amplify revenue and earnings growth projections. Analysts forecast annual revenue growth of 19.1% over the next three years, with earnings anticipated to reach CN¥4.6 billion by mid-2028. The recent positive price movement, however, still leaves the current share price of US$19.60 at a discount to the consensus price target of US$22.37. This indicates ongoing investor optimism but also room for further growth to align with forecasts.

Evaluate MINISO Group Holding's prospects by accessing our earnings growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MNSO

MINISO Group Holding

An investment holding company, engages in the retail and wholesale of lifestyle products and pop toy products in China, rest of Asia, the Americas, Europe, Indonesia, and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives