As major Gulf markets gain momentum on optimism around a potential U.S. Federal Reserve rate cut, the Middle Eastern financial landscape is experiencing renewed investor interest. The term 'penny stocks' might feel like a relic of past market eras, but the potential they represent is as real as ever. Typically referring to smaller or relatively new companies, these stocks can provide a mix of affordability and growth potential when paired with strong financials.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Maharah for Human Resources (SASE:1831) | SAR4.80 | SAR2.14B | ✅ 2 ⚠️ 3 View Analysis > |

| Thob Al Aseel (SASE:4012) | SAR3.61 | SAR1.44B | ✅ 2 ⚠️ 1 View Analysis > |

| Alarum Technologies (TASE:ALAR) | ₪4.75 | ₪337.29M | ✅ 3 ⚠️ 1 View Analysis > |

| Mega Polietilen Köpük Sanayi ve Ticaret Anonim Sirketi (IBSE:MEGAP) | TRY4.90 | TRY1.35B | ✅ 2 ⚠️ 3 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.12 | AED2.22B | ✅ 5 ⚠️ 3 View Analysis > |

| Al Wathba National Insurance Company PJSC (ADX:AWNIC) | AED3.30 | AED683.1M | ✅ 2 ⚠️ 3 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED2.97 | AED392.7M | ✅ 2 ⚠️ 4 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED2.84 | AED12.16B | ✅ 2 ⚠️ 3 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.842 | AED510.93M | ✅ 2 ⚠️ 2 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.831 | ₪210.46M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 81 stocks from our Middle Eastern Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Duran Dogan Basim ve Ambalaj Sanayi (IBSE:DURDO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Duran Dogan Basim ve Ambalaj Sanayi A.S., along with its subsidiaries, offers packaging products across Turkey and various international markets including Europe, the United States, the Middle East, Africa, and the Asia Pacific, with a market capitalization of TRY2.12 billion.

Operations: The company's revenue is primarily derived from its Packaging & Containers segment, which generated TRY1.91 billion.

Market Cap: TRY2.12B

Duran Dogan Basim ve Ambalaj Sanayi A.S. operates with a market cap of TRY2.12 billion and primarily generates revenue from its Packaging & Containers segment, reporting TRY1.91 billion in sales. Despite being unprofitable, the company has managed to reduce its debt-to-equity ratio from 212.1% to 48% over five years, although it remains high at 46%. Short-term liabilities are covered by assets, but the company faces challenges with volatility and negative return on equity (-9.44%). Recent earnings show a slight improvement in net loss compared to last year but highlight ongoing financial struggles amidst stable yet high weekly volatility (9%).

- Jump into the full analysis health report here for a deeper understanding of Duran Dogan Basim ve Ambalaj Sanayi.

- Gain insights into Duran Dogan Basim ve Ambalaj Sanayi's past trends and performance with our report on the company's historical track record.

Ihlas Yayin Holding (IBSE:IHYAY)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Ihlas Yayin Holding A.S. operates in Turkey through its subsidiaries, focusing on media, publishing, and advertising businesses with a market cap of TRY1.32 billion.

Operations: The company's revenue is primarily derived from Journalism and Printing Works at TRY1.79 billion, followed by News Agencies contributing TRY398.31 million, and TV Services and Other generating TRY274.53 million.

Market Cap: TRY1.32B

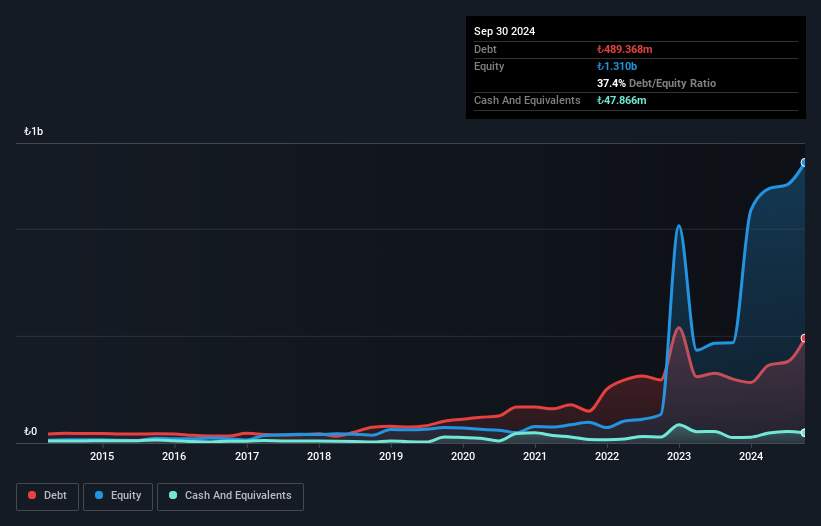

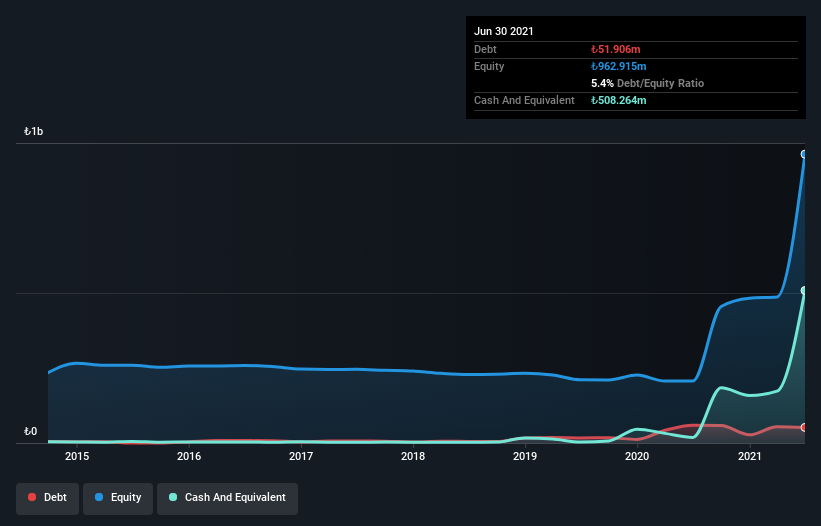

Ihlas Yayin Holding A.S., with a market cap of TRY1.32 billion, operates primarily in media and publishing, generating significant revenues from Journalism and Printing Works (TRY1.79 billion). Despite its revenue streams, the company remains unprofitable with a net loss of TRY104.45 million for Q2 2025. Short-term assets exceed liabilities, but long-term liabilities remain uncovered by assets (TRY1.5 billion). The debt-to-equity ratio has improved significantly over five years to 1.1%, yet cash runway is limited to less than a year if cash flow trends continue. Shareholder dilution has been minimal recently amidst stable weekly volatility at 7%.

- Take a closer look at Ihlas Yayin Holding's potential here in our financial health report.

- Assess Ihlas Yayin Holding's previous results with our detailed historical performance reports.

Alinma Retail REIT Fund (SASE:4345)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Alinma Retail REIT Fund is a real estate investment trust focused on retail properties, with a market cap of SAR531 million.

Operations: The fund generates revenue primarily from its real estate rental segment, amounting to SAR187.74 million.

Market Cap: SAR531M

Alinma Retail REIT Fund, with a market cap of SAR531 million, primarily earns revenue from its real estate rental segment, totaling SAR187.74 million. The fund has become profitable over the past year and maintains a satisfactory net debt to equity ratio of 23.8%, with its debt well covered by operating cash flow at 31.3%. Short-term assets surpass short-term liabilities but fall short in covering long-term liabilities (SAR263.3M). Despite low return on equity at 1%, interest payments are comfortably covered by EBIT at 6.3 times coverage. Recent dividend distribution totaled SAR21.24 million for early 2025.

- Navigate through the intricacies of Alinma Retail REIT Fund with our comprehensive balance sheet health report here.

- Examine Alinma Retail REIT Fund's past performance report to understand how it has performed in prior years.

Seize The Opportunity

- Take a closer look at our Middle Eastern Penny Stocks list of 81 companies by clicking here.

- Want To Explore Some Alternatives? The latest GPUs need a type of rare earth metal called Terbium and there are only 29 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:IHYAY

Ihlas Yayin Holding

Through its subsidiaries, engages in media, publishing, and advertising businesses in Turkey.

Adequate balance sheet with low risk.

Market Insights

Community Narratives