Middle Eastern Dividend Stocks Featuring Emirates NBD Bank PJSC And Two More

Reviewed by Simply Wall St

As Gulf markets edge slightly higher amid concerns over a potential U.S. government shutdown, investors in the Middle East are navigating a landscape influenced by global economic uncertainties and fluctuating oil prices. In such an environment, dividend stocks can offer a measure of stability and income, making them an appealing choice for those seeking consistent returns amidst market volatility.

Top 10 Dividend Stocks In The Middle East

| Name | Dividend Yield | Dividend Rating |

| Saudi Telecom (SASE:7010) | 9.55% | ★★★★★☆ |

| Saudi Awwal Bank (SASE:1060) | 6.10% | ★★★★★☆ |

| Riyad Bank (SASE:1010) | 6.25% | ★★★★★☆ |

| National General Insurance (P.J.S.C.) (DFM:NGI) | 7.09% | ★★★★★☆ |

| National Bank of Ras Al-Khaimah (P.S.C.) (ADX:RAKBANK) | 6.62% | ★★★★★☆ |

| Emirates NBD Bank PJSC (DFM:EMIRATESNBD) | 4.00% | ★★★★★☆ |

| Emaar Properties PJSC (DFM:EMAAR) | 7.46% | ★★★★★☆ |

| Delek Group (TASE:DLEKG) | 6.43% | ★★★★★☆ |

| Commercial Bank of Dubai PSC (DFM:CBD) | 5.15% | ★★★★★☆ |

| Anadolu Hayat Emeklilik Anonim Sirketi (IBSE:ANHYT) | 6.33% | ★★★★★☆ |

Click here to see the full list of 67 stocks from our Top Middle Eastern Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

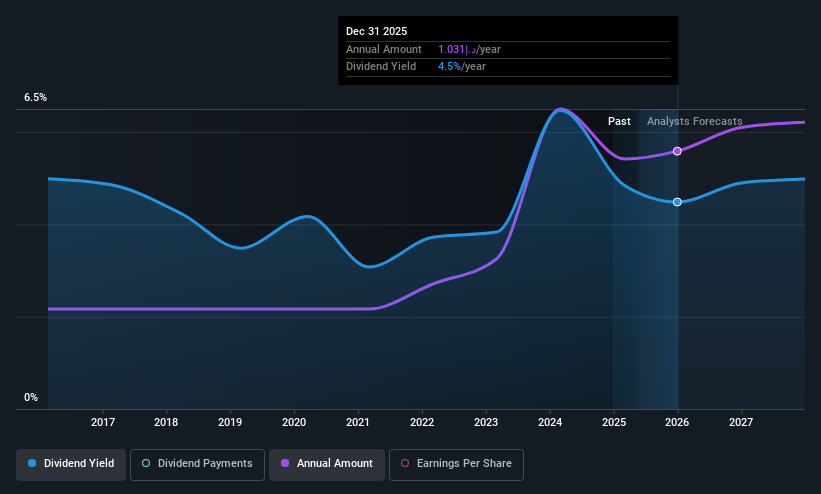

Emirates NBD Bank PJSC (DFM:EMIRATESNBD)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Emirates NBD Bank PJSC, along with its subsidiaries, offers a range of corporate, institutional, retail, treasury, and Islamic banking services and has a market capitalization of AED157.91 billion.

Operations: Emirates NBD Bank PJSC's revenue is primarily derived from its Retail Banking and Wealth Management segment at AED16.60 billion, followed by Deniz Bank at AED10.78 billion, Corporate and Institutional Banking at AED9.77 billion, and Global Markets and Treasury at AED2.56 billion.

Dividend Yield: 4%

Emirates NBD Bank PJSC offers a stable dividend profile with a payout ratio of 29.8%, ensuring dividends are well-covered by earnings. The bank's dividends have been reliable and growing over the past decade, though its 4% yield is below the top quartile in the AE market. Despite a high level of bad loans at 2.8%, its Price-To-Earnings ratio of 7.5x suggests good value compared to peers, supporting its attractiveness for dividend investors.

- Take a closer look at Emirates NBD Bank PJSC's potential here in our dividend report.

- Our valuation report unveils the possibility Emirates NBD Bank PJSC's shares may be trading at a discount.

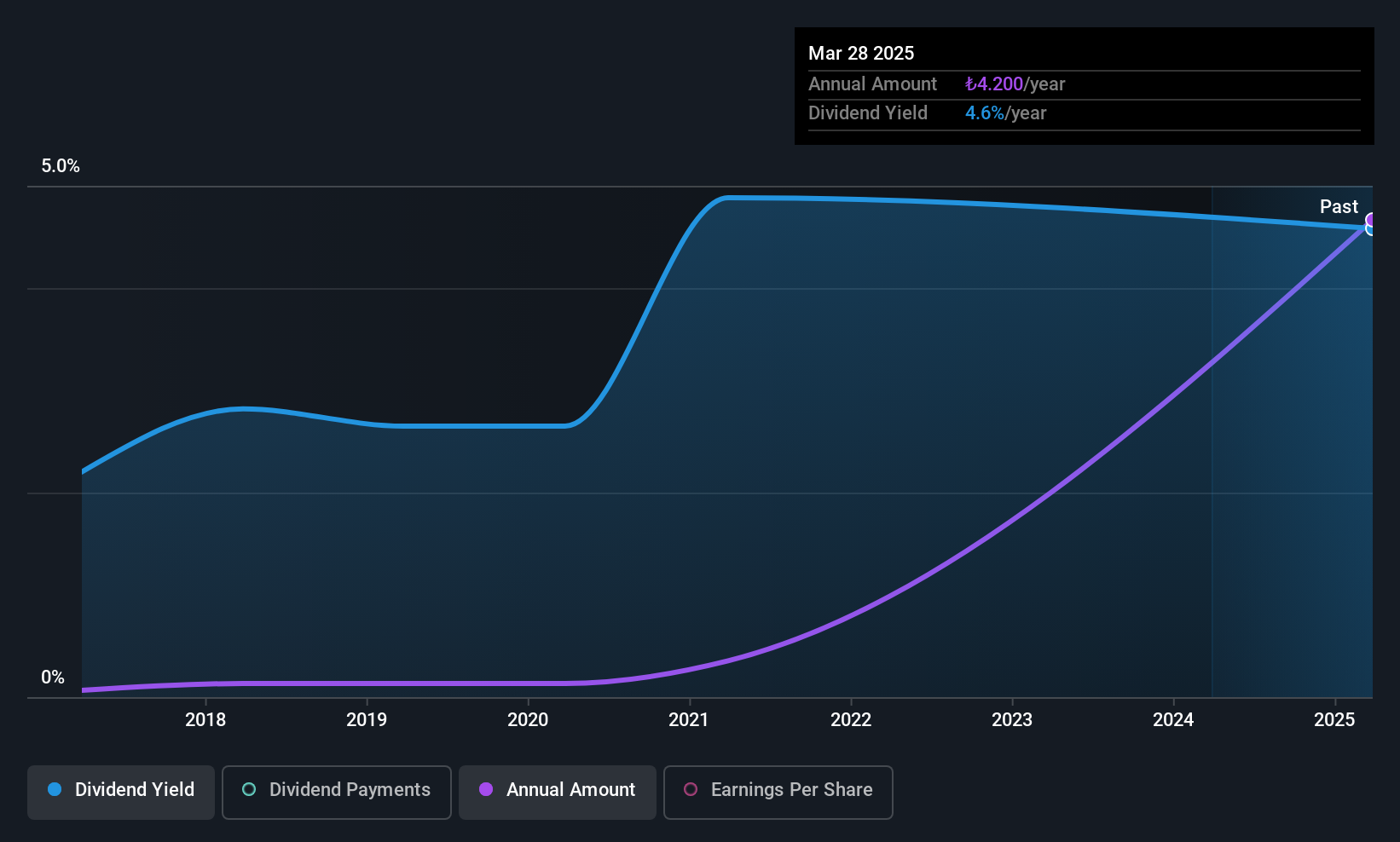

Anadolu Anonim Türk Sigorta Sirketi (IBSE:ANSGR)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Anadolu Anonim Türk Sigorta Sirketi provides non-life insurance products in Turkey and has a market cap of TRY43.20 billion.

Operations: Anadolu Anonim Türk Sigorta Sirketi's revenue segments include Motor Vehicles (TRY14.88 billion), Sickness/Health (TRY12.50 billion), Motor Vehicles Liability (TRY10.53 billion), and Fire and Natural Disasters (TRY5.80 billion).

Dividend Yield: 4.9%

Anadolu Anonim Türk Sigorta Sirketi's dividend yield of 4.86% ranks in the top 25% of Turkish dividend payers, yet its sustainability is questionable due to high cash payout ratios and unreliable past payments. While earnings have grown significantly, the dividends remain volatile with coverage issues from cash flows. Recent reports show a rise in quarterly net income to TRY 3.24 billion, though six-month figures declined year-on-year, impacting overall financial stability for consistent dividends.

- Get an in-depth perspective on Anadolu Anonim Türk Sigorta Sirketi's performance by reading our dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of Anadolu Anonim Türk Sigorta Sirketi shares in the market.

Lila Kagit Sanayi Ve Ticaret (IBSE:LILAK)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Lila Kagit Sanayi Ve Ticaret A.S. is a company that produces and sells roll papers primarily in Turkey, with a market capitalization of TRY17.57 billion.

Operations: Lila Kagit Sanayi Ve Ticaret A.S. generates revenue of TRY11.22 billion from its Paper & Paper Products segment.

Dividend Yield: 5%

Lila Kagit Sanayi Ve Ticaret's dividend yield of 5.04% places it among the top Turkish dividend payers, supported by a payout ratio of 63.3%, indicating earnings coverage. Despite a recent drop in sales to TRY 6.43 billion for the first half of 2025, net income rose to TRY 930.21 million, boosting earnings per share to TRY 1.577 from TRY 1.324 year-on-year. However, it's too early to assess the stability and growth potential of its dividends due to their recent initiation.

- Unlock comprehensive insights into our analysis of Lila Kagit Sanayi Ve Ticaret stock in this dividend report.

- Our expertly prepared valuation report Lila Kagit Sanayi Ve Ticaret implies its share price may be lower than expected.

Taking Advantage

- Unlock more gems! Our Top Middle Eastern Dividend Stocks screener has unearthed 64 more companies for you to explore.Click here to unveil our expertly curated list of 67 Top Middle Eastern Dividend Stocks.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:ANSGR

Anadolu Anonim Türk Sigorta Sirketi

Offers non-life insurance products in Turkey.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives