- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:META

Meta Platforms (NasdaqGS:META) Secures 20-Year Clean Energy Deal With Constellation

Reviewed by Simply Wall St

Meta Platforms (NasdaqGS:META) has marked a significant step towards sustainability with its recent 20-year power purchase agreement with Constellation, ensuring the provision of clean energy and reinforcing its commitment to 100% clean energy usage. Over the past month, the company experienced a 12% increase in share price, a move that aligns with broader market performance, which climbed by 12% over the past year. The power purchase agreement, together with the company's engagement in AI innovations and efforts to tackle online hate, underpins its dedication to growth and sustainability, potentially reinforcing investor confidence amidst favorable market conditions.

Be aware that Meta Platforms is showing 1 risk in our investment analysis.

Find companies with promising cash flow potential yet trading below their fair value.

The recent 20-year power purchase agreement between Meta Platforms and Constellation highlights a commitment to sustainability that might bolster investor sentiment. This deal, coupled with Meta's initiatives in AI and online safety, could potentially influence revenue and earnings forecasts positively. AI-driven ad targeting and enhanced business messaging could lead to an increase in revenue, although AI infrastructure investments may pose initial pressures on net margins. Despite these challenges, such strategic positioning allows Meta to strengthen its business ecosystem and could support long-term financial growth.

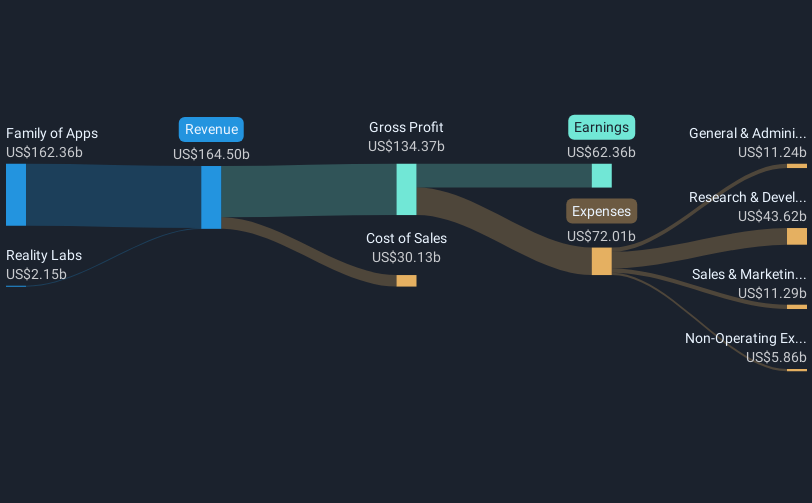

Over a longer-term period of three years, Meta's total shareholder return, including both share price gains and dividends, was 247.01%, indicating an impressive growth trajectory. This remarkable return compares favorably against the US Interactive Media and Services industry, which saw 22.9% growth over the past year, suggesting Meta's superior performance relative to its peers. In addition, with a current share price of US$587.31, the stock trades at nearly a 16.6% discount to the analyst consensus price target of US$703.89. This potential upside captures market expectations for continued growth, providing a context for evaluating Meta’s future performance. Meta's earnings are anticipated to grow at 9.19% annually, demonstrating a more moderate pace compared to the broader market's 14.4%. Nonetheless, the company’s recent initiatives could redefine its growth trajectory and influence estimates across various financial metrics.

Understand Meta Platforms' earnings outlook by examining our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:META

Meta Platforms

Engages in the development of products that enable people to connect and share with friends and family through mobile devices, personal computers, virtual reality and mixed reality headsets, augmented reality, and wearables worldwide.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives