- United States

- /

- Semiconductors

- /

- NasdaqGS:MRVL

Marvell Technology (NasdaqGS:MRVL) Sees Net Income Rise to US$178 Million

Reviewed by Simply Wall St

Marvell Technology (NasdaqGS:MRVL) has recently seen a share price increase of 21%, which can be associated with a series of positive developments. The company's recent earnings announcement showed a substantial recovery, with net income rising to $178 million from a prior loss, alongside significant sales growth. Additionally, Marvell's expansion in AI infrastructure packaging and its partnership with NVIDIA, which are advancing its competitive edge in the tech sector, likely supported this upward momentum. These factors may have added weight to Marvell's outperformance compared to the broader market, which increased by 1.8% over the last month.

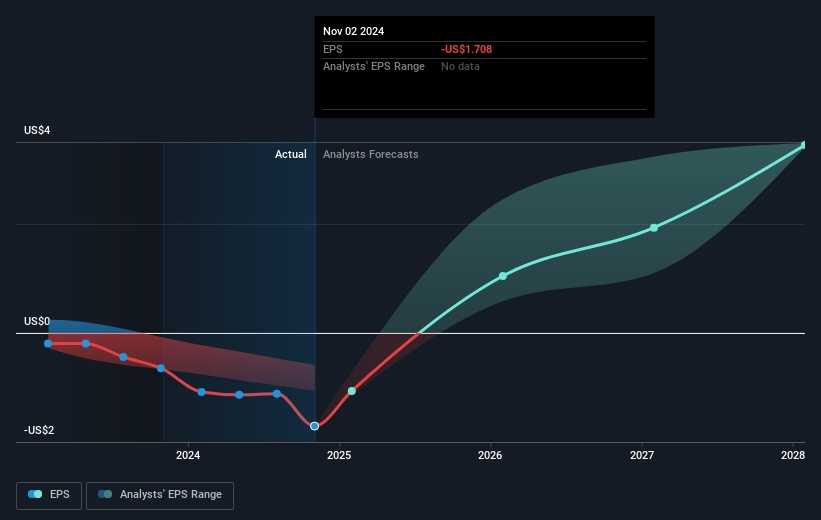

The recent positive developments for Marvell Technology, including a notable partnership with NVIDIA and advancements in AI infrastructure packaging, may significantly influence the company's narrative by propelling future growth. These strategic moves could bolster Marvell's revenue and earnings forecasts, particularly in the AI domain, where there is strong demand. In light of these factors, analysts' expectations for Marvell to eventually reach a revenue of $11.7 billion and earnings of $2.6 billion by 2028 appear optimistic, considering the projected ramp-up in custom AI silicon programs and technological advancements.

Over the last five years, Marvell's total shareholder return, encompassing share price and dividends, was 107.17%. This demonstrates solid long-term performance. However, when considering the one-year period, the company's return underperformed the US Semiconductor industry, which saw a 10.8% increase. Despite Marvell's recent positive upturn, this illustrates that the company may still face challenges, especially given its heavy reliance on the data center market.

Regarding valuation, Marvell's current share price is at a discount to the analysts' consensus price target of $103.36 but still remains above some fair value estimates, which may reflect differing opinions among analysts about potential future growth. Although the recent share price appreciation of 21% underscores positive sentiment, it leaves a significant gap to the price target, suggesting that continued strong performance and execution will be key to closing this gap.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MRVL

Marvell Technology

Provides data infrastructure semiconductor solutions, spanning the data center core to network edge.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives