- United States

- /

- Chemicals

- /

- NYSE:LYB

Market Trends Buoy LyondellBasell Industries (LYB) 2% In Last Month

Reviewed by Simply Wall St

LyondellBasell Industries (LYB) experienced a 2% increase in its share price over the past month, amidst a generally positive market backdrop with major indexes posting gains. While the company's movements aligned with broader market trends driven by robust earnings from tech giants like Microsoft and Meta, there were no specific catalysts solely affecting LYB distinctively. The market's overall resilience and investor optimism around economic growth could have provided a supportive backdrop, propelling the slight price increase for LyondellBasell as it mirrored the market's upward trajectory.

The recent 2% increase in LyondellBasell Industries’ share price this month aligns with broader market trends, possibly driven by encouraging earnings from technology giants. The market's positive sentiment could potentially bolster investor confidence in LyondellBasell, despite the absence of specific catalysts solely affecting the company. This upswing may influence the overall narrative of the company's strategic goals aimed at improving profitability through the Value Enhancement Program and continued cost reductions.

Over a five-year period, LyondellBasell's total shareholder return, including dividends, was 22.66%. This long-term performance offers context to its recent short-term gains. Over the past year, however, the company underperformed compared to both the US market and its industry peers, with a significant lag in returns. Analysts' revenue and earnings forecasts reflect cautious optimism. The projected decline in revenue by 6.6% annually over the next three years could be a concern, yet anticipated earnings growth suggests room for recovery amid strategic initiatives.

With a current share price just under US$58.85, LyondellBasell is trading below the consensus analyst price target of US$67.78, indicating room for potential price appreciation if earnings and profitability continue to improve in line with forecasts. The company's performance against the backdrops of its historical returns and market dynamics might offer investors insights into the alignment of LyondellBasell’s strategic plans with its market valuations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LYB

LyondellBasell Industries

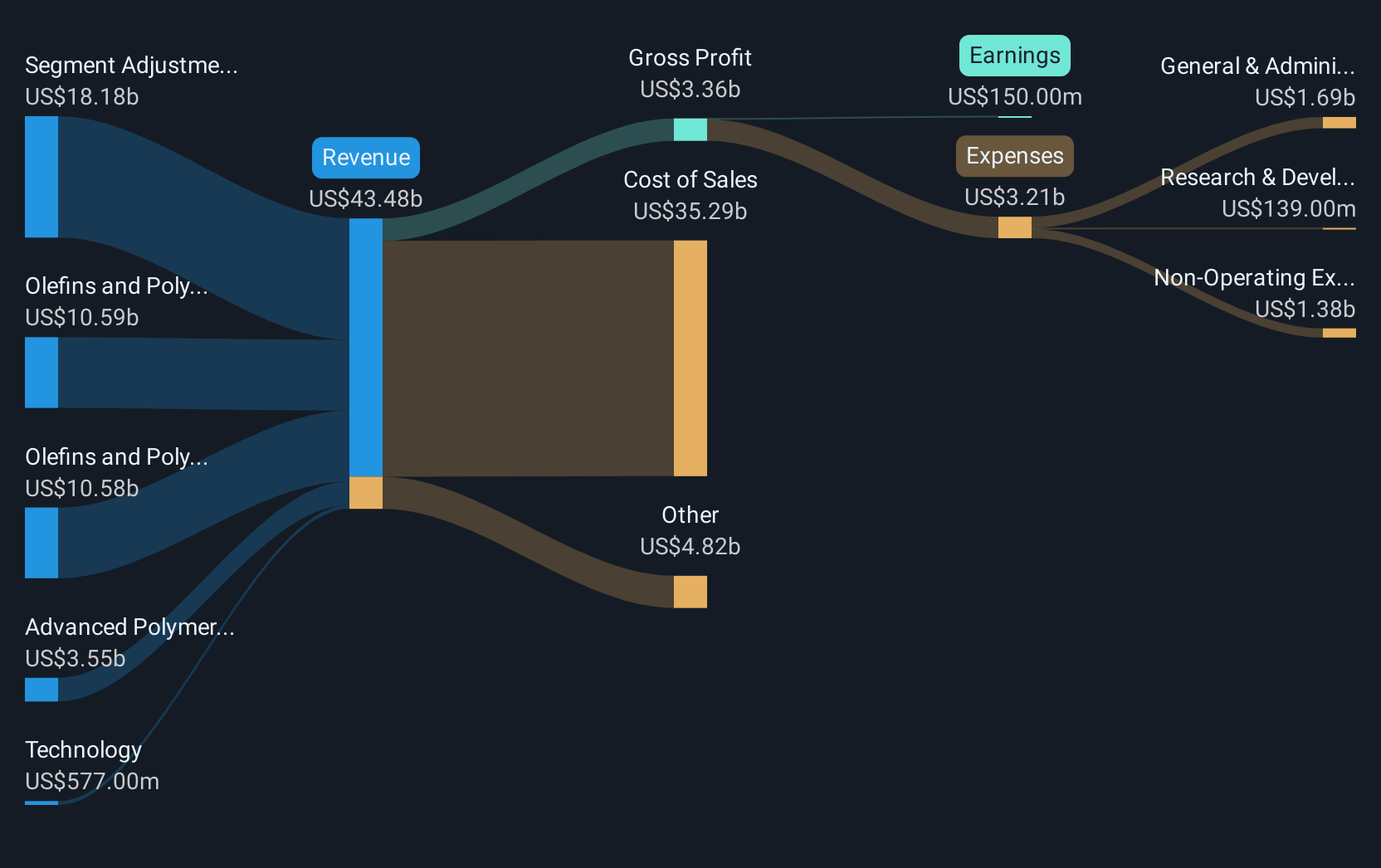

Operates as a chemical company in the United States, Germany, Mexico, Italy, Poland, France, Japan, China, the Netherlands, and internationally.

Average dividend payer slight.

Similar Companies

Market Insights

Community Narratives