- United States

- /

- Insurance

- /

- NYSE:MKL

Markel Group (NYSE:MKL) Updates Bylaws With Series A Preferred Shares Redemption

Reviewed by Simply Wall St

On June 4, 2025, Markel Group (NYSE:MKL) amended its bylaws by removing provisions for its Series A Preferred Shares after redeeming them on June 1. This move indicates a shift in the company's capital structure strategy. The company's share price rose by 3% over the past month, which aligns with the general upward trajectory of the broader market that increased by 1.4% in the latest week. While these internal financial maneuvers could have supported Markel's price rise, the market's overall positive sentiment and improved trade talk developments likely also influenced this performance.

Be aware that Markel Group is showing 1 risk in our investment analysis.

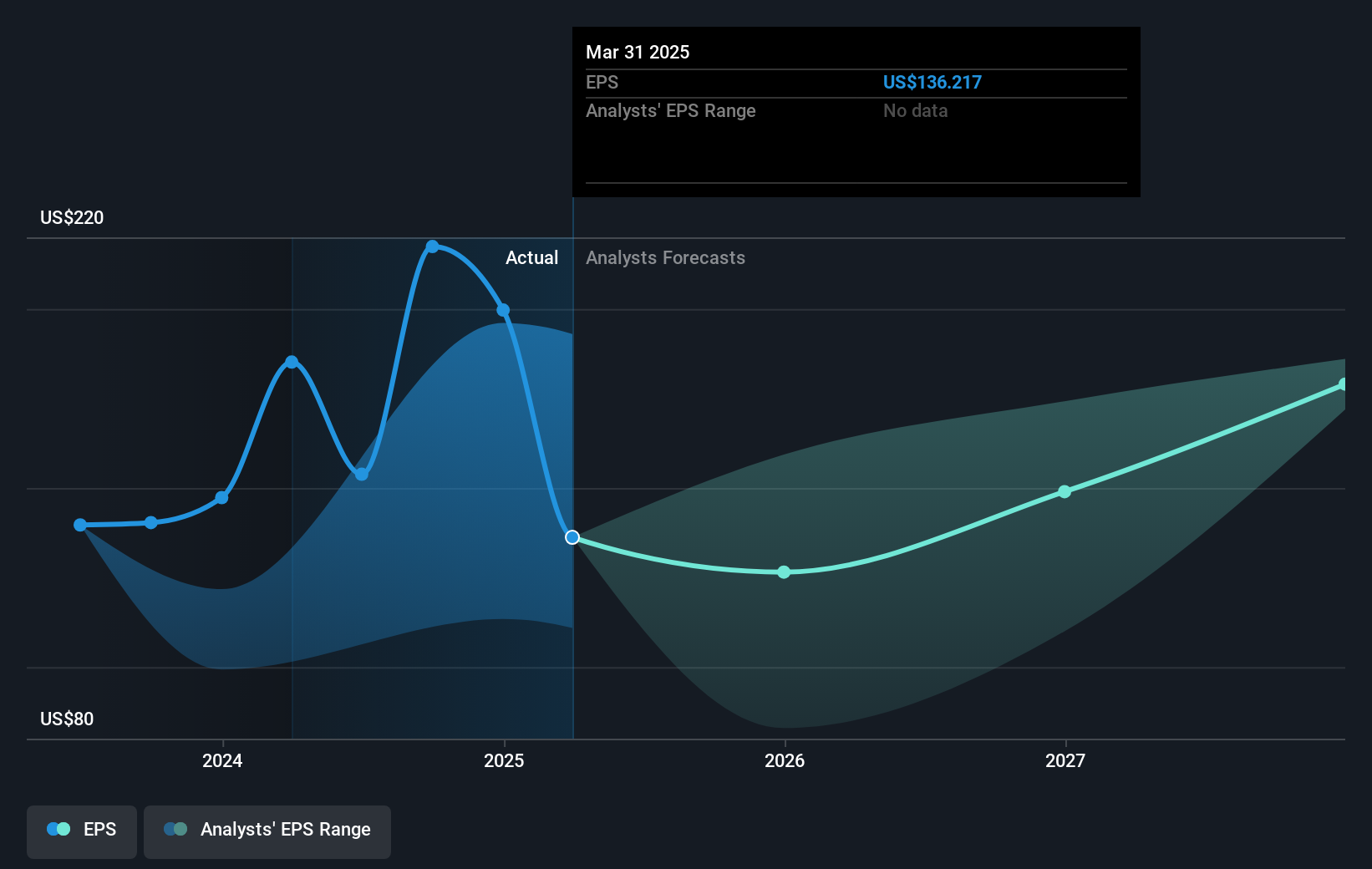

The recent amendment in Markel Group's bylaws, following the redemption of its Series A Preferred Shares, reflects a shift in its capital structure that could influence the company's long-term financial strategy. By simplifying its operations, the company may enhance capital efficiency and support its revenue and earnings growth. This move could also impact analysts' forecasts and potentially lead to adjustments in their revenue and earnings estimates. As the company continues to focus on profitable lines in its insurance business and leverages technology to drive operational efficiency, the financial outlook remains a key point of interest for stakeholders.

Over a longer five-year period, Markel Group's total return, inclusive of share price appreciation and dividends, was 96.41%. This strong performance underscores the company's capability to deliver value to shareholders, significantly exceeding the broader market's or industry's (if available) one-year return. In the past year, Markel matched the US Insurance industry's performance, returning 19.6%, while exceeding the general US market's 12.6% return.

Although Markel's share price recently rose by 3% in line with broader market trends, it remains near the consensus analyst price target of US$1849.2. This close proximity, with the current price at US$1874.43, suggests a fairly valued position based on current expectations. Stakeholders should consider these dynamics and their implications on future performance, as they relate to Markel's strategic shifts and financial forecasts.

Review our historical performance report to gain insights into Markel Group's track record.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MKL

Markel Group

Through its subsidiaries, engages in the insurance business in the United States and internationally.

Excellent balance sheet with questionable track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion