- United States

- /

- Software

- /

- NasdaqCM:MARA

MARA Holdings (NasdaqCM:MARA) Sees New Chief Product Officer Appointment Shake-Up

Reviewed by Simply Wall St

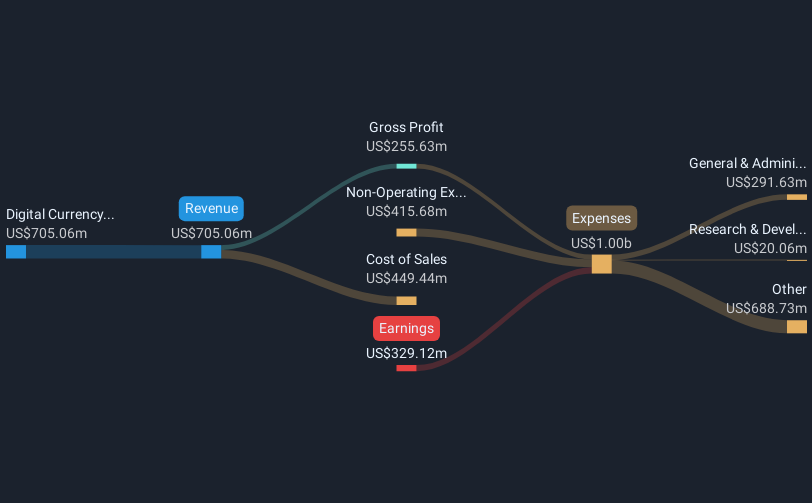

MARA Holdings (NasdaqCM:MARA) experienced a 52% increase in its stock price over the last quarter, amid several key developments. The appointment of Nir Rikovitch as Chief Product Officer could strengthen product strategy and drive commercialization, potentially boosting investor confidence. The recent drop in MARA's index presence, alongside production inconsistencies, may counterbalance market optimism, but the strategic collaboration with TAE Power Solutions provides a positive outlook for innovation. Despite broader market steadiness, MARA's focus on enhancing operational efficiency and capitalizing on crypto's strength, with Bitcoin hitting record highs, aligns with its substantial price appreciation.

MARA Holdings has 2 warning signs we think you should know about.

The recent leadership change at MARA Holdings, with Nir Rikovitch's appointment, might enhance product development and bring operational efficiencies, potentially impacting the company's push into AI and energy sectors. With a focus on expanding energy capacity and adopting AI solutions, MARA aims to adjust costs substantially, a factor that could positively influence future revenue and earnings forecasts. However, the strategic ventures entail significant execution and geopolitical risks that must be managed to align these expectations with analyst revenue growth forecasts of 21.6% annually over the next three years.

Over the last five years, MARA Holdings achieved a very large total return of 1969.19%, showcasing substantial growth, though past year performance lagged both the broader US Market and the Software industry. Despite the impressive long-term gain, shareholder return was unable to match the stock performance of an 11.4% market return and an 18.9% industry return in the past year. MARA's current share price of US$13.15 sits at a discount to the consensus price target of US$19.46, indicating potential upside. This discrepancy suggests that while the company is not forecast to achieve profitability in the next few years, there's market optimism regarding its transformational strategy and future potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:MARA

MARA Holdings

Operates as a digital asset technology company in the United States.

Very low and overvalued.

Similar Companies

Market Insights

Community Narratives