- United States

- /

- Software

- /

- NasdaqCM:MARA

MARA Holdings (NasdaqCM:MARA) Reports Drop In BTC Production For June 2025

Reviewed by Simply Wall St

MARA Holdings (NasdaqCM:MARA) recently announced a 26% increase in its stock price over the last quarter, a period highlighted by a mixed production performance and significant market shifts. The company's operating results showed a reduction in Bitcoin production from 950 BTC in May to 713 BTC in June 2025, reflecting challenges in maintaining steady output levels. Additionally, MARA was removed from several indexes, adding to volatility. Meanwhile, broader crypto market strength offered some balance, as the recovery in Bitcoin's price to near $110,000 likely supported investor sentiment. Overall, these developments mirrored broader market trends but underscored sector-specific challenges.

Every company has risks, and we've spotted 2 risks for MARA Holdings you should know about.

Rare earth metals are the new gold rush. Find out which 25 stocks are leading the charge.

The recent developments at MARA Holdings, such as the increase in stock price and mixed production results, underscore both challenges and opportunities in the company's strategy. The reduction in Bitcoin production highlights operational hurdles, while the growing strength of the broader crypto market, marked by Bitcoin nearing US$110,000, is likely bolstering investor sentiment. Despite MARA's removal from several indices, which has introduced volatility, its long-term transformation into an integrated energy and technology provider holds potential for cost reductions and diversification in revenue streams.

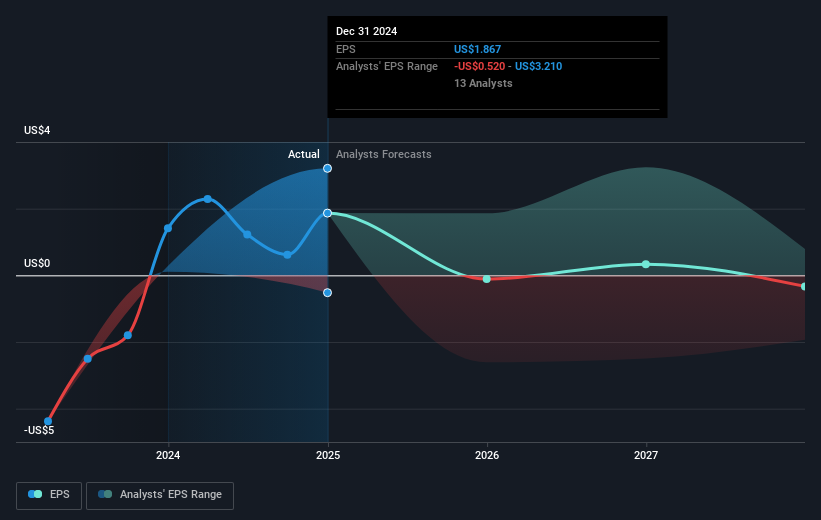

Over the past five years, the company's total shareholder return reached a very large figure, reflecting substantial long-term growth compared to more recent performance where MARA underperformed the US Software industry. This contrast highlights the volatility and potential within emerging markets like cryptocurrency and energy solutions. The company's forecasted revenue increase, despite anticipated continued unprofitability in the near term, underscores a forward-looking strategy that could be influenced by external factors such as geopolitical risks and technological advancements.

With a current share price of US$13.15, the analyst price target of US$19.46 suggests potential upside, implying that recent positive momentum might partially align with future earnings expectations and market valuations. However, achieving these projections requires overcoming execution risks and maintaining growth in core business areas amidst market fluctuations. The consensus among analysts indicates optimism, though diverging views reflect varying levels of confidence about MARA's trajectory, especially against a backdrop of an expanding share base and the challenges associated with its ambitious strategic initiatives.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:MARA

MARA Holdings

Operates as a digital asset technology company in the United States.

Very low and overvalued.

Similar Companies

Market Insights

Community Narratives