- Australia

- /

- Metals and Mining

- /

- ASX:MAU

Magnetic Resources Joins 2 Other ASX Penny Stocks Worth Watching

Reviewed by Simply Wall St

The Australian market has experienced a mixed performance recently, with significant declines in materials and financials contrasted by gains in the energy sector. Despite these fluctuations, investors continue to seek opportunities beyond the major players, exploring areas like penny stocks for potential growth. While the term "penny stock" might seem outdated, these smaller or newer companies can still offer surprising value when backed by strong financials and stability.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.40 | A$114.64M | ✅ 3 ⚠️ 3 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.14 | A$100.95M | ✅ 4 ⚠️ 3 View Analysis > |

| GTN (ASX:GTN) | A$0.59 | A$112.49M | ✅ 3 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$3.00 | A$462.55M | ✅ 4 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$2.38 | A$2.71B | ✅ 5 ⚠️ 1 View Analysis > |

| Southern Cross Electrical Engineering (ASX:SXE) | A$1.78 | A$470.65M | ✅ 4 ⚠️ 1 View Analysis > |

| Regal Partners (ASX:RPL) | A$2.90 | A$975.05M | ✅ 4 ⚠️ 2 View Analysis > |

| Navigator Global Investments (ASX:NGI) | A$1.815 | A$889.49M | ✅ 5 ⚠️ 3 View Analysis > |

| Austco Healthcare (ASX:AHC) | A$0.38 | A$138.44M | ✅ 4 ⚠️ 1 View Analysis > |

| CTI Logistics (ASX:CLX) | A$1.86 | A$149.81M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 464 stocks from our ASX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Magnetic Resources (ASX:MAU)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Magnetic Resources NL is involved in the exploration of mineral tenements in Western Australia and has a market cap of A$411.91 million.

Operations: Currently, there are no reported revenue segments for the company.

Market Cap: A$411.91M

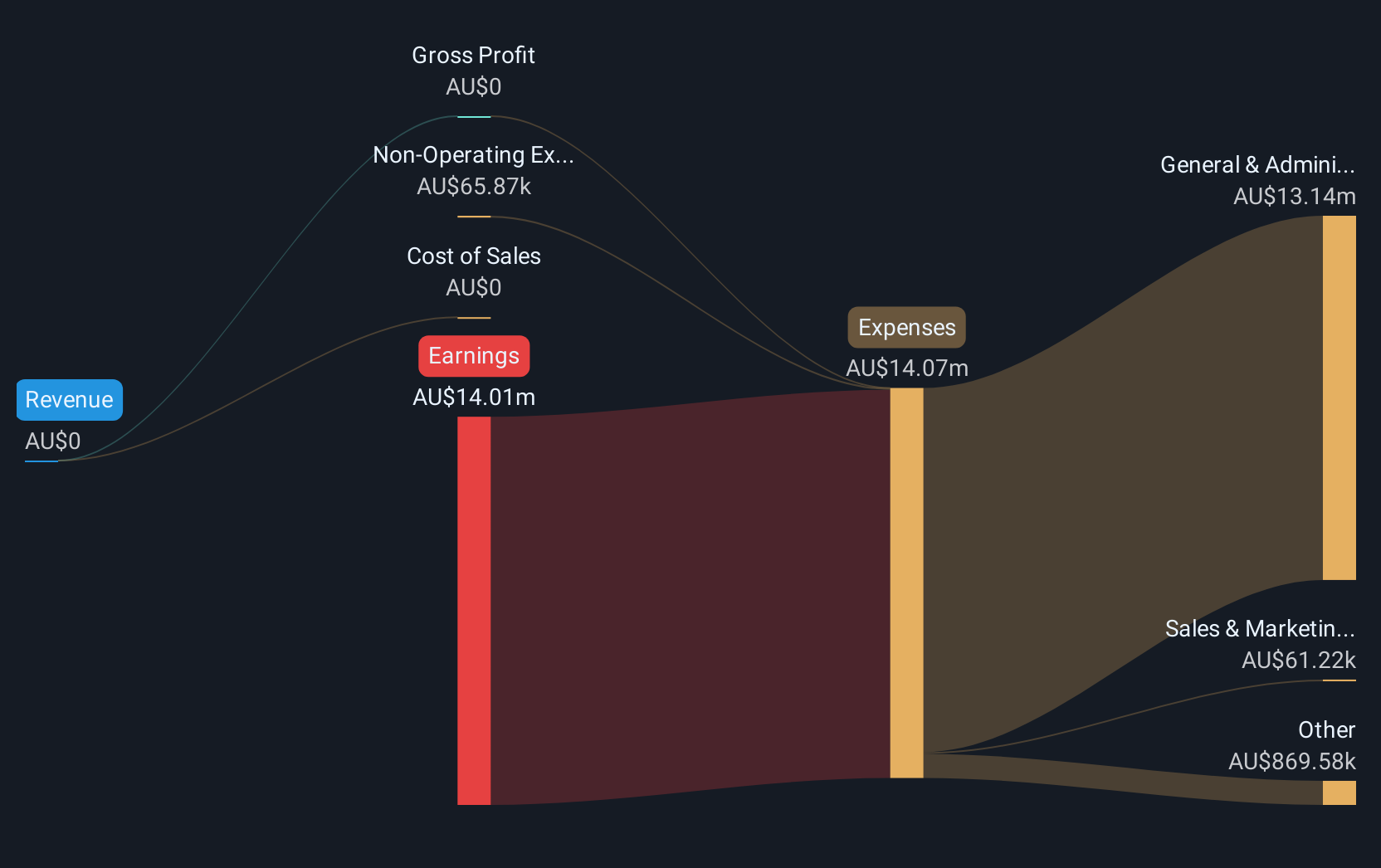

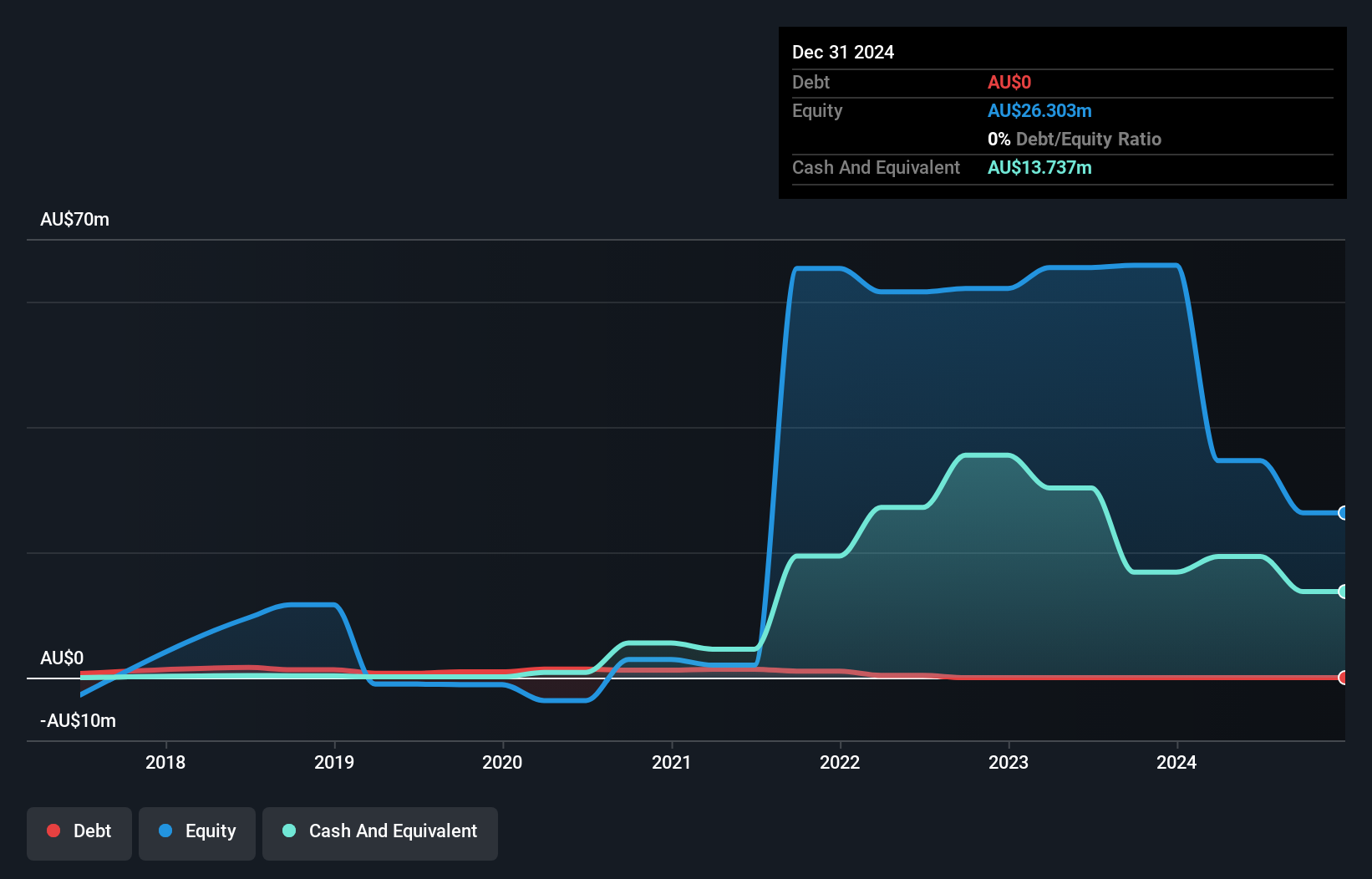

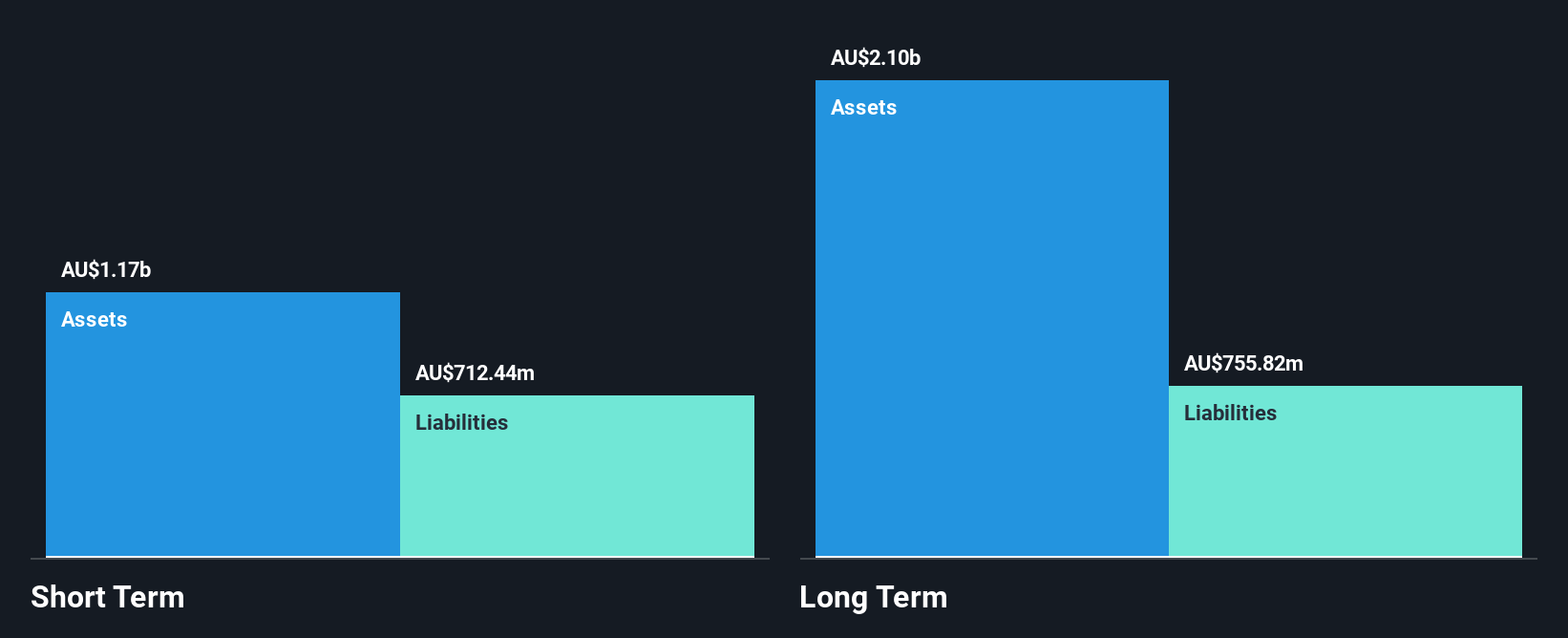

Magnetic Resources NL, with a market cap of A$411.91 million, is currently pre-revenue and unprofitable, lacking significant revenue streams. The company has less than a year of cash runway based on its current free cash flow and no long-term liabilities or debt. Its short-term assets significantly surpass short-term liabilities, indicating sound financial management despite its challenges. Recent board changes include the appointment of Aaron Sim as an alternate director, bringing extensive financial advisory experience to the table. Earnings are forecast to grow significantly annually; however, past losses have increased over five years at 18.8% per year.

- Take a closer look at Magnetic Resources' potential here in our financial health report.

- Learn about Magnetic Resources' future growth trajectory here.

NextEd Group (ASX:NXD)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: NextEd Group Limited offers educational services across Australia, Europe, and South America with a market cap of A$51.09 million.

Operations: NextEd Group's revenue is primarily derived from its International Vocational segment at A$73.79 million, followed by Technology & Design at A$11.29 million, Domestic Vocational at A$9.22 million, and Go Study Group contributing A$6.16 million.

Market Cap: A$51.09M

NextEd Group Limited, with a market cap of A$51.09 million, primarily generates revenue from its International Vocational segment. Despite being unprofitable and not expected to achieve profitability in the next three years, it benefits from a strong cash runway exceeding three years due to positive free cash flow growth. The company is debt-free but faces challenges with short-term assets not covering liabilities. Recent leadership changes include appointing Andrew Nye as Chief Financial Officer, bringing extensive financial management expertise. Although NextEd trades at good value compared to peers, losses have increased significantly over the past five years.

- Dive into the specifics of NextEd Group here with our thorough balance sheet health report.

- Examine NextEd Group's earnings growth report to understand how analysts expect it to perform.

Perenti (ASX:PRN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Perenti Limited is a global mining services company with a market capitalization of A$1.64 billion.

Operations: Perenti's revenue is primarily derived from Contract Mining Services at A$2.50 billion, followed by Drilling Services at A$750.65 million, and Mining Services and Idoba contributing A$229.77 million.

Market Cap: A$1.64B

Perenti Limited, with a market cap of A$1.64 billion, primarily derives revenue from Contract Mining Services (A$2.50 billion). Despite negative earnings growth over the past year and lower profit margins (2.5% compared to last year's 3.9%), the company is trading at a significant discount to its estimated fair value. Perenti's debt management has improved, with a reduced debt-to-equity ratio now at 45.5%, and its short-term assets exceed both short- and long-term liabilities, indicating solid financial footing. Earnings are forecasted to grow annually by 24.84%, supported by high-quality past earnings performance and stable weekly volatility (5%).

- Get an in-depth perspective on Perenti's performance by reading our balance sheet health report here.

- Evaluate Perenti's prospects by accessing our earnings growth report.

Summing It All Up

- Jump into our full catalog of 464 ASX Penny Stocks here.

- Ready To Venture Into Other Investment Styles? AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:MAU

Magnetic Resources

Engages in the exploration of mineral tenements in Western Australia.

Adequate balance sheet with moderate growth potential.

Market Insights

Community Narratives