- United States

- /

- Metals and Mining

- /

- OTCPK:TMRC

MacroGenics And 2 Other Promising Penny Stocks To Consider

Reviewed by Simply Wall St

Amid a backdrop of trade policy uncertainties and fluctuating market indices, the U.S. stock market remains near record highs, reflecting a complex mix of investor sentiment. In this setting, penny stocks—often associated with smaller or emerging companies—still present intriguing opportunities for those seeking growth potential. These stocks can offer significant returns when supported by strong financial fundamentals, and we'll explore three examples that stand out for their balance sheet strength and promise for long-term success.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Waterdrop (WDH) | $1.41 | $509.94M | ✅ 4 ⚠️ 0 View Analysis > |

| WM Technology (MAPS) | $1.01 | $169.86M | ✅ 4 ⚠️ 1 View Analysis > |

| Perfect (PERF) | $2.24 | $228.14M | ✅ 3 ⚠️ 0 View Analysis > |

| Tuniu (TOUR) | $0.9326 | $100.41M | ✅ 3 ⚠️ 1 View Analysis > |

| Safe Bulkers (SB) | $4.11 | $420.49M | ✅ 2 ⚠️ 3 View Analysis > |

| Cardno (COLD.F) | $0.1701 | $6.64M | ✅ 2 ⚠️ 4 View Analysis > |

| BAB (BABB) | $0.84765 | $6.16M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $4.88 | $109.38M | ✅ 3 ⚠️ 2 View Analysis > |

| North European Oil Royalty Trust (NRT) | $4.84 | $44.48M | ✅ 2 ⚠️ 2 View Analysis > |

| Tandy Leather Factory (TLF) | $3.296 | $28.06M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 421 stocks from our US Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

MacroGenics (MGNX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: MacroGenics, Inc. is a clinical-stage biopharmaceutical company focused on discovering, developing, manufacturing, and commercializing antibody-based therapeutics for cancer treatment in the United States with a market cap of $101.58 million.

Operations: The company generates revenue of $154.05 million from its segment focused on the development and commercialization of monoclonal antibody-based therapeutics.

Market Cap: $101.58M

MacroGenics, Inc., with a market cap of US$101.58 million, is navigating challenges typical for clinical-stage biopharmaceutical companies. Despite generating US$154.05 million in revenue from monoclonal antibody therapeutics, the company remains unprofitable and was recently removed from multiple Russell indices. However, it secured a US$70 million upfront payment through a royalty purchase agreement with Sagard for ZYNYZ sales rights, bolstering its cash position to support operations until mid-2027. Management's seasoned experience and strategic cost-reduction initiatives may help stabilize its financial footing amidst high share price volatility and declining earnings forecasts over the next three years.

- Navigate through the intricacies of MacroGenics with our comprehensive balance sheet health report here.

- Gain insights into MacroGenics' future direction by reviewing our growth report.

TrueCar (TRUE)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: TrueCar, Inc. is an internet-based company in the United States that provides information, technology, and communication services, with a market cap of approximately $171 million.

Operations: The company generates $179.36 million in revenue from its Internet Information Providers segment.

Market Cap: $170.97M

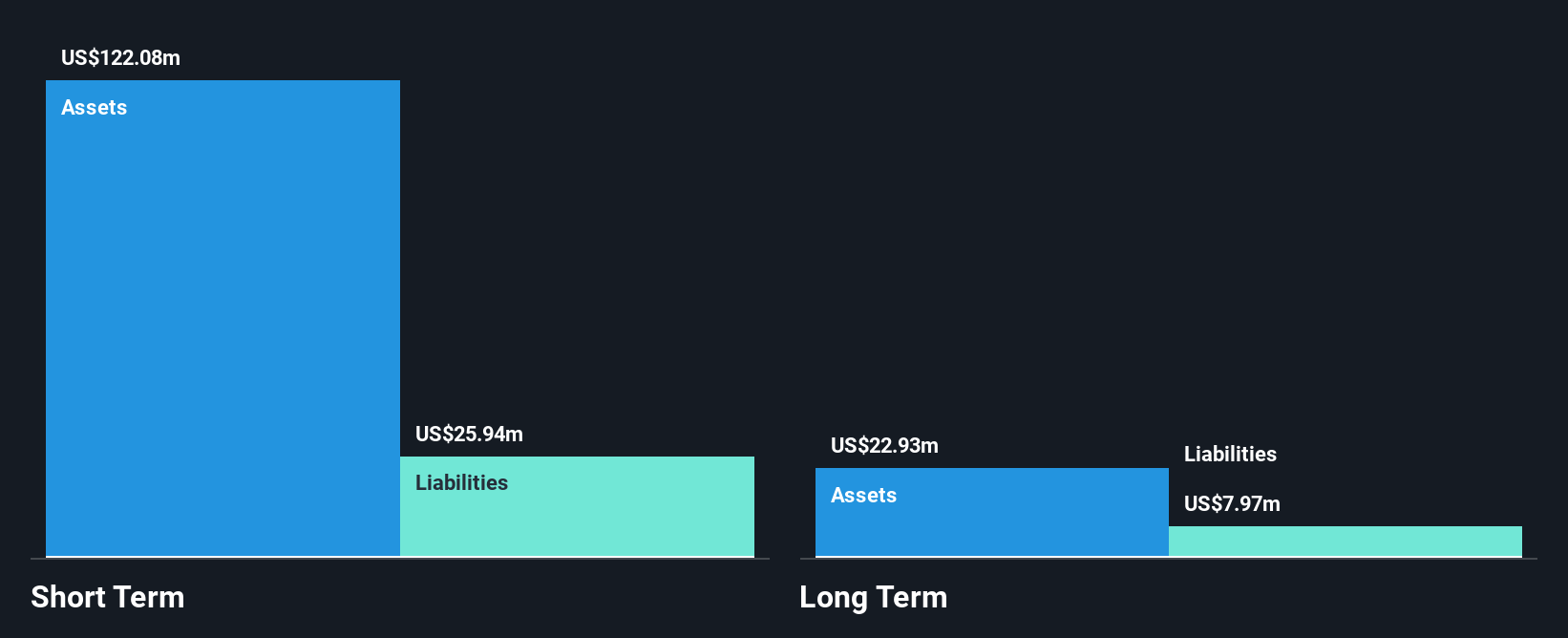

TrueCar, Inc., with a market cap of approximately US$171 million, demonstrates typical characteristics of penny stocks with high volatility and an unprofitable status. Despite trading at 92% below its estimated fair value and having a negative return on equity, the company remains debt-free and has sufficient cash runway for over three years. Recent strategic collaborations, such as the partnership with GasBuddy to enhance its car buying program's reach, highlight efforts to expand market presence. However, increasing net losses underscore ongoing financial challenges even as revenue is forecasted to grow annually by 8.94%.

- Click to explore a detailed breakdown of our findings in TrueCar's financial health report.

- Examine TrueCar's earnings growth report to understand how analysts expect it to perform.

Texas Mineral Resources (TMRC)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Texas Mineral Resources Corp. acquires, explores, and develops mineral properties in the United States with a market cap of $58.04 million.

Operations: Texas Mineral Resources Corp. does not report any specific revenue segments.

Market Cap: $58.04M

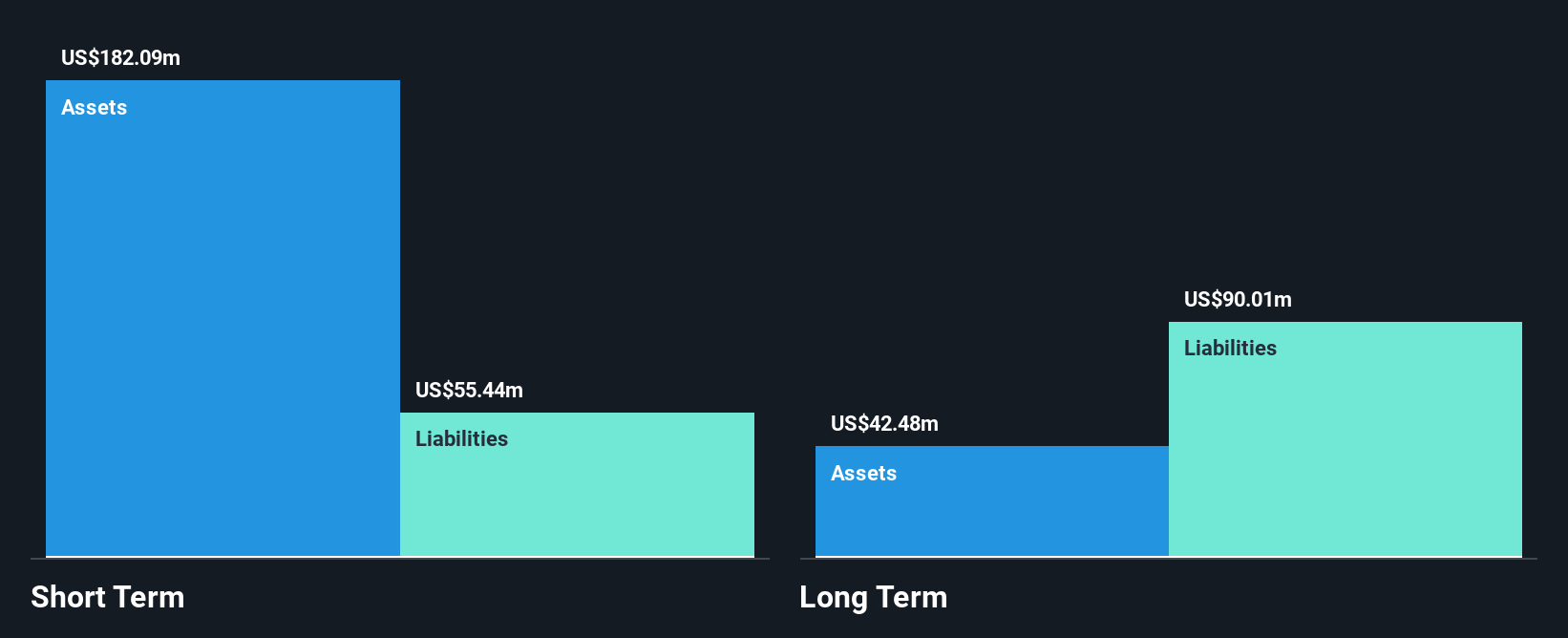

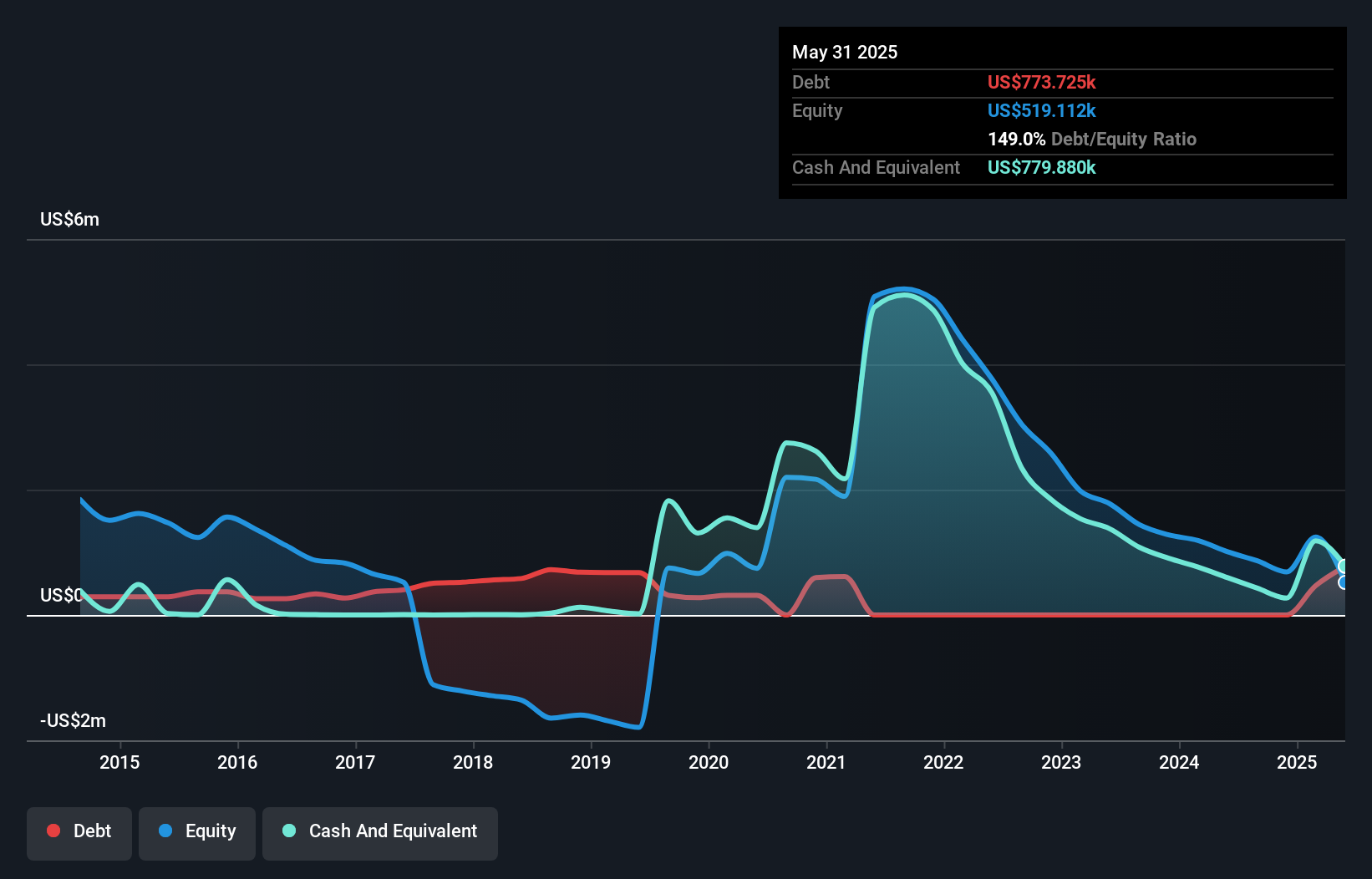

Texas Mineral Resources Corp., with a market cap of US$58.04 million, is a pre-revenue company in the mining sector, facing typical challenges associated with penny stocks. The company's financials reveal no significant revenue and increasing losses over the past five years at an annual rate of 8.1%. Despite this, Texas Mineral Resources has more cash than total debt and sufficient short-term assets to cover liabilities. Recent board changes include the appointment of Jonathan Beigle, bringing extensive industry experience which may influence strategic direction. However, high share price volatility and negative return on equity remain concerns for investors.

- Take a closer look at Texas Mineral Resources' potential here in our financial health report.

- Learn about Texas Mineral Resources' historical performance here.

Turning Ideas Into Actions

- Navigate through the entire inventory of 421 US Penny Stocks here.

- Contemplating Other Strategies? AI is about to change healthcare. These 28 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Texas Mineral Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OTCPK:TMRC

Texas Mineral Resources

Acquires, explores, and develops mineral properties in the United States.

Moderate risk with imperfect balance sheet.

Market Insights

Community Narratives