- United States

- /

- Chemicals

- /

- NYSE:LYB

LyondellBasell Industries (LYB) Reports Q2 Sales Drop To US$7,658 Million

Reviewed by Simply Wall St

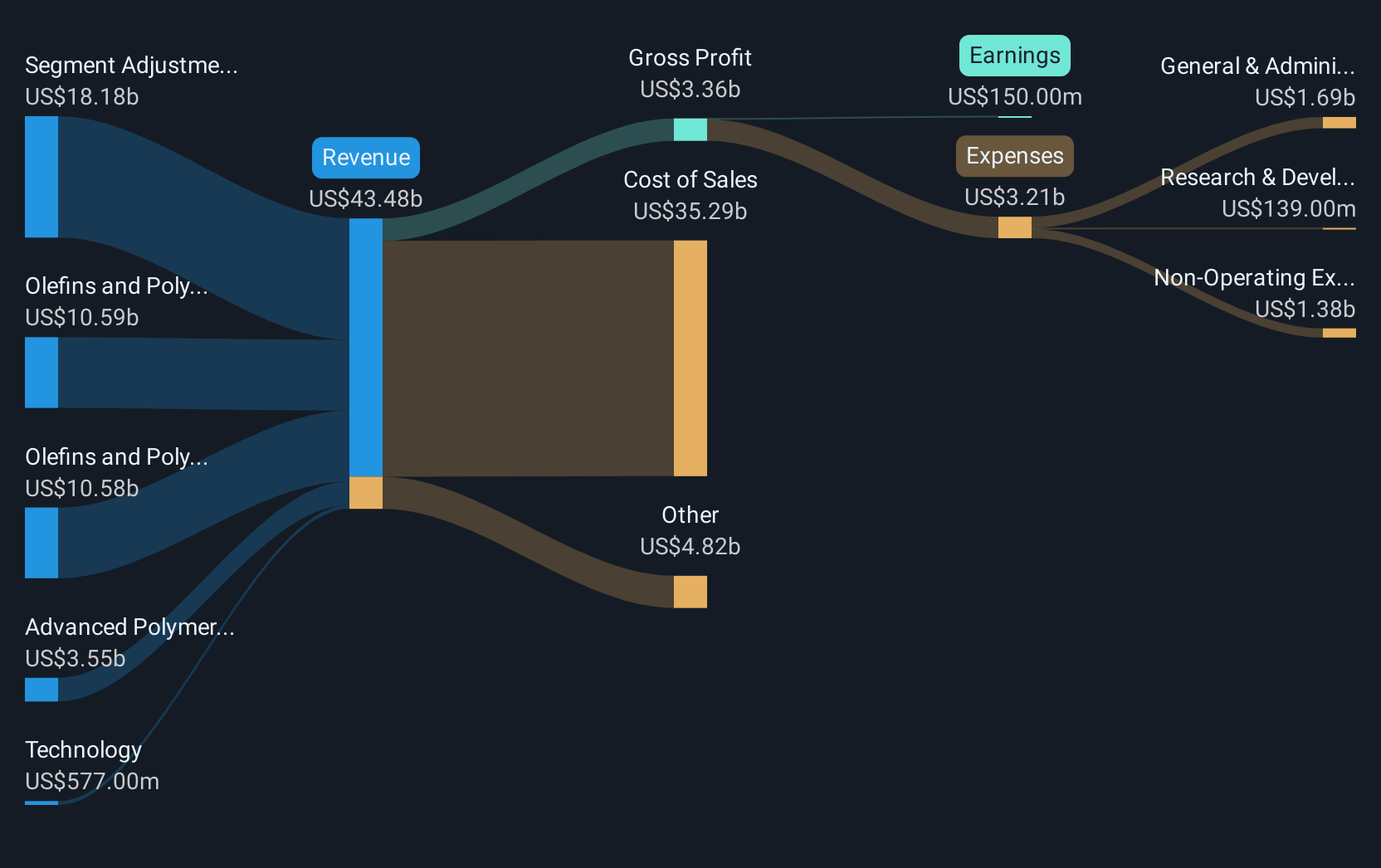

LyondellBasell Industries (LYB) declared a $1.37 per share dividend on August 4, 2025 and announced earnings on August 1, reporting Q2 sales of $7,658 million, down from the previous year. Despite these efforts, LYB shares declined 12% over the last quarter. This decline occurred even as major indexes like the Dow Jones and Nasdaq achieved solid weekly gains. The company's reduced sales and net income likely weighed against broader market movements, which saw investor optimism return as concerns about tariffs and the economic outlook moderated, reflecting broader market resilience despite LYB's challenges.

Rare earth metals are the new gold rush. Find out which 26 stocks are leading the charge.

Despite LyondellBasell Industries' recent dividend declaration and quarterly earnings announcement, the 12% drop in share price over the last quarter highlights the market's reaction to decreasing sales and net income. This downturn is noteworthy considering the relative resilience of major market indexes during the same period. Over the longer term, LYB's total shareholder return, including dividends, was a 0.22% decline over five years, showcasing a challenging period for investors. Within the past year, LYB underperformed both the overall US market and the US Chemicals industry, which returned 19.9% and recorded lower declines, respectively. This underperformance underscores the company's struggle to keep pace with broader market trends.

The market's response to the news may influence future revenue and earnings expectations. Analysts have factored in declining revenue forecasts, with predictions of a 7.5% annual decline over the next three years. However, they anticipate a significant increase in earnings growth by 39.7% annually. The company's strategic focus on recycling and low-cost region investments is seen as critical to achieving these projections. Despite a current share price of US$50.17, below the consensus price target of US$62.11, which implies a potential upside of approximately 23%, market skepticism may persist if short-term performance fails to meet forecasts. Investors are encouraged to carefully evaluate these projections against the backdrop of industry dynamics and LYB's evolving strategic priorities.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LYB

LyondellBasell Industries

Operates as a chemical company in the United States, Germany, Mexico, Italy, Poland, France, Japan, China, the Netherlands, and internationally.

Average dividend payer slight.

Similar Companies

Market Insights

Community Narratives