- United States

- /

- Transportation

- /

- NasdaqGS:LYFT

Lyft (LYFT) Sees Net Income Increase As Q2 Sales Hit US$1,588 Million

Reviewed by Simply Wall St

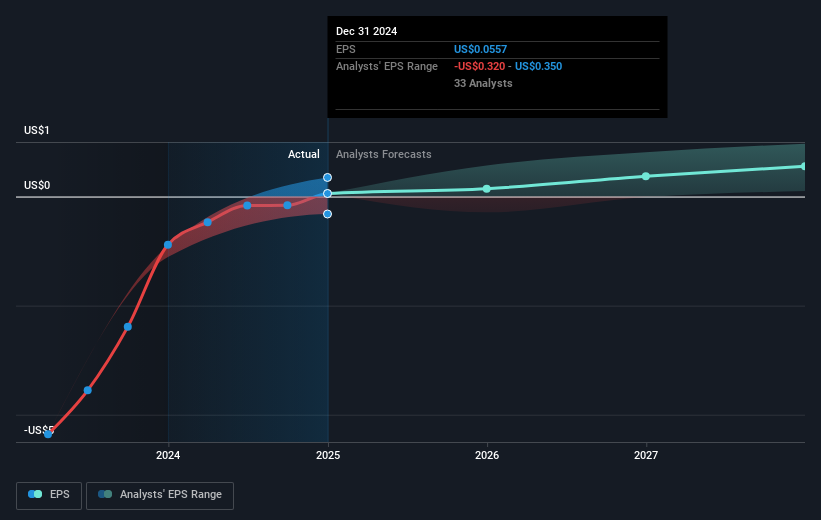

Lyft (LYFT) recently announced its second quarter results, showcasing impressive growth in sales and a substantial increase in net income, marking a strong turnaround from previous losses. Additionally, a new partnership with Baidu to deploy autonomous vehicles in Europe aims to enhance Lyft's market reach. Despite these positive developments, Lyft's share price remained flat over the past week at a time when the broader market was slightly oscillating due to tariff concerns and other corporate earnings. These events likely provided stability to Lyft's stock amid a predominantly stable market environment.

Buy, Hold or Sell Lyft? View our complete analysis and fair value estimate and you decide.

The strategic expansion of Lyft through its partnership with Baidu to deploy autonomous vehicles in Europe is likely to bolster the company's market reach and may positively influence future revenue and earnings forecasts. While recent financial results demonstrated a successful turnaround in net income, these developments could further support Lyft's aim to enhance margins and operational efficiency. The recent announcement aligns with Lyft’s ongoing efforts to expand high-margin offerings, like Price Lock and in-app advertising, potentially increasing rider loyalty and satisfaction which directly impacts revenue growth.

Over a longer-term period, Lyft's total shareholder return, including dividends, was 38.93% for the last year. In the context of share price movement, the company's shares are currently priced at US$13.99 with a consensus price target of US$17.41. This represents a significant potential upside from the current level. Comparatively, over the past year, Lyft's performance has outpaced the US Transportation industry, which delivered a 9.7% return. In relation to the broader US market, which had a 22.4% return over the past year, Lyft's return has also been favorable.

Learn about Lyft's historical performance here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LYFT

Lyft

Operates a peer-to-peer marketplace for on-demand ridesharing in the United States and Canada.

High growth potential and fair value.

Similar Companies

Market Insights

Community Narratives