- United States

- /

- Specialty Stores

- /

- NYSE:LOW

Lowe's Companies (NYSE:LOW) Exits Russell 1000 Dynamic Index

Reviewed by Simply Wall St

Lowe's Companies (NYSE: LOW) experienced a 2% price increase last week, against the backdrop of its removal from the Russell 1000 Dynamic Index as of June 30, 2025. This index change may have exerted some influence on the stock's performance. However, the upward trend in Lowe's stock aligns with the broader rally in major indexes, such as the S&P 500 and Nasdaq, each rising around 3% due to positive market sentiments, including eased geopolitical tensions. Although the index exclusion is specific to Lowe's, the broader market rally likely counteracted any negative impact of this removal on the company's shares.

The recent removal of Lowe's Companies from the Russell 1000 Dynamic Index, while potentially limiting its index-fund exposure, should be weighed against its longer-term performance. Over the past five years, the company's total return, including share price appreciation and dividends, was 80.07%. This performance indicates solid shareholder value generation over the long term, though it has underperformed the US Specialty Retail industry, which returned 7.4% over the past year.

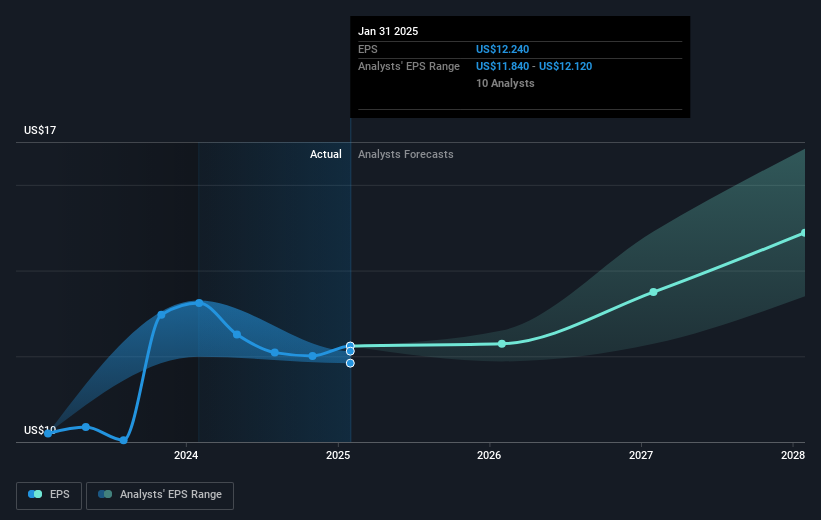

Lowe's emphasis on expanding its Pro market engagement and tech enhancement initiatives is expected to positively influence its revenue and earnings in the future. The initiatives, along with the Total Home Strategy, aim to strengthen Lowe's market position despite elevated mortgage rates and competition concerns. Analysts forecast revenue growth of 3.1% and anticipate that future profit margins will improve, potentially offset by macroeconomic challenges.

Despite a recent 2% rise in its share price, Lowe's is still trading at a discount to the analyst consensus price target of US$263.74, offering potential upside. Current price trends reflect broader market movements, but the stock's trajectory may align closer to analysts' expectations as revenue and earnings forecasts develop. This potential for growth will need to be reconciled with any broader market adjustments following the index change and other external factors impacting the retail sector.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LOW

Lowe's Companies

Operates as a home improvement retailer in the United States.

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives