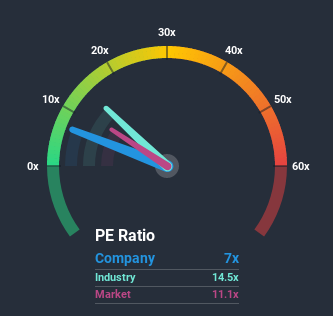

FACC AG's (VIE:FACC) price-to-earnings (or "P/E") ratio of 7x might make it look like a buy right now compared to the market in Austria, where around half of the companies have P/E ratios above 12x and even P/E's above 22x are quite common. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Recent times have been advantageous for FACC as its earnings have been rising faster than most other companies. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

View our latest analysis for FACC

Is There Any Growth For FACC?

The only time you'd be truly comfortable seeing a P/E as low as FACC's is when the company's growth is on track to lag the market.

Retrospectively, the last year delivered an exceptional 45% gain to the company's bottom line. The strong recent performance means it was also able to grow EPS by 157% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Turning to the outlook, the next three years should bring diminished returns, with earnings decreasing 27% per annum as estimated by the five analysts watching the company. That's not great when the rest of the market is expected to grow by 2.0% per annum.

With this information, we are not surprised that FACC is trading at a P/E lower than the market. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Bottom Line On FACC's P/E

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of FACC's analyst forecasts revealed that its outlook for shrinking earnings is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Having said that, be aware FACC is showing 3 warning signs in our investment analysis, you should know about.

You might be able to find a better investment than FACC. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a P/E below 20x (but have proven they can grow earnings).

When trading FACC or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About WBAG:FACC

FACC

Engages in the development, production, and maintenance of aircraft components worldwide.

Reasonable growth potential with mediocre balance sheet.

Market Insights

Community Narratives