- United States

- /

- Medical Equipment

- /

- NasdaqGM:LNTH

Lantheus Holdings (NasdaqGM:LNTH) Joins FIBRE Consortium To Transform Fibrotic Disease Treatment

Reviewed by Simply Wall St

The launch of the FIBRE Consortium, which includes Lantheus Holdings (NasdaqGM:LNTH) collaborating with Pfizer and Lumina Pharmaceuticals, aims to improve treatment for fibrotic diseases using advanced imaging biomarkers, potentially strengthening the company's market position. Additionally, Lantheus' presentation of oncology radiodiagnostic data may have bolstered investor confidence in its diagnostic capabilities. Despite a 5% stock price increase, the market remained largely flat amid geopolitical tensions and inflation concerns. The company's strategic alliances and product advancements likely provided a positive counterbalance to broader market uncertainties during this period.

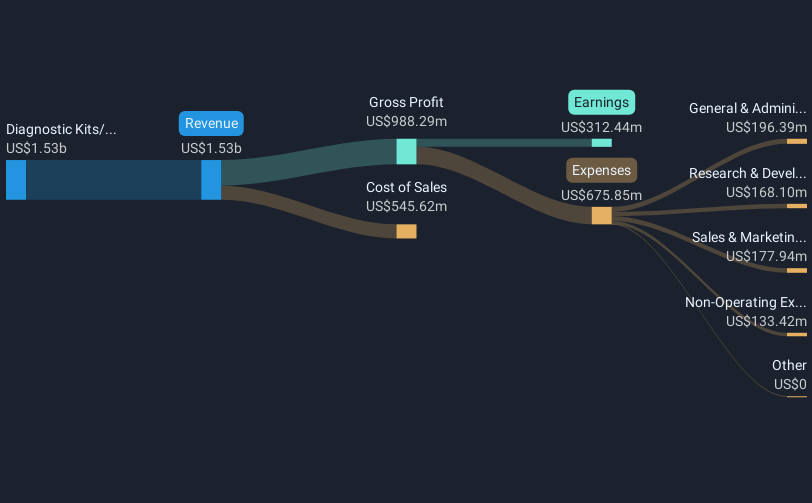

The announcement of the FIBRE Consortium collaboration between Lantheus Holdings, Pfizer, and Lumina Pharmaceuticals is anticipated to significantly influence the company's future pursuits, particularly in the expanding diagnostics market. This strategic alliance could enhance revenue diversification and strengthen Lantheus' position in the market for fibrotic diseases treatment. With a revenue of US$1.54 billion and earnings of US$254.32 million, the company's foundation looks poised for growth, especially with the potential boost from advanced imaging biomarkers.

Looking at historical performance, Lantheus shares have delivered a very large total return of 493.02% over the past five years. However, in the last year, the company's performance trailed the US Medical Equipment industry, which achieved a 5.3% return, and the broader US market, which returned 10.4%. This indicates a long-term growth streak with recent underperformance potentially linked to current market conditions.

Revenue and earnings projections appear strong, with analysts forecasting revenue growth of 11.0% annually and an increase in profit margins to 27.8% by 2028. The news surrounding the FIBRE Consortium might bolster these forecasts by potentially opening up new revenue streams and improving diagnostic capabilities. Moreover, the current share price of US$104.84 reflects a discount to the analysts' consensus price target of US$129.31, suggesting a 22.3% potential upside if forecasts align with expectations. Such potential growth highlights the importance of these new strategic partnerships in enhancing shareholder value.

Gain insights into Lantheus Holdings' historical outcomes by reviewing our past performance report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:LNTH

Lantheus Holdings

Develops, manufactures, and commercializes diagnostic and therapeutic products that assist clinicians in diagnosis and treatment of heart, cancer, and other diseases worldwide.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives