- United States

- /

- Food and Staples Retail

- /

- NYSE:KR

Kroger (NYSE:KR) Updates Earnings Guidance, Reports Flat Sales And Income For Q1 2025

Reviewed by Simply Wall St

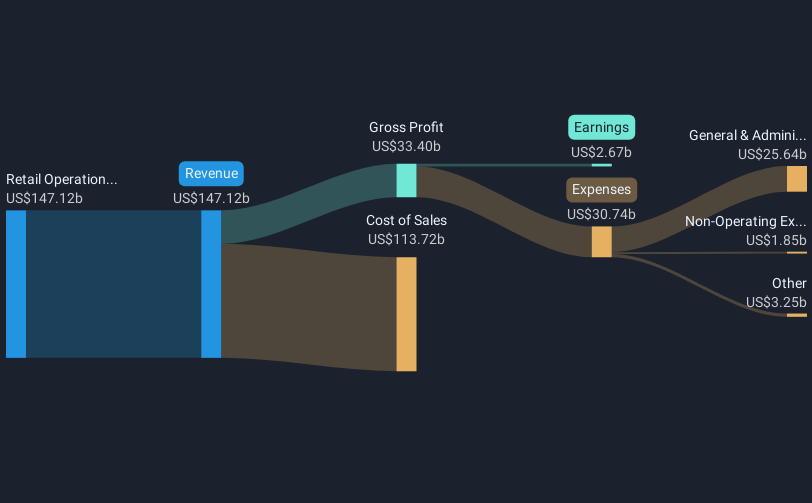

Kroger (NYSE:KR) recently updated its earnings guidance for 2025, forecasting identical sales growth of 2.25% to 3.25%. This comes on the heels of their first quarter report showing a slight decline in both sales and net income compared to the same period last year, though earnings per share remained steady. Despite these results, the company’s stock price remained flat over the last quarter. This stability aligns with broader market trends, where geopolitical uncertainties and a steady interest rate environment influenced overall market movement. The update, alongside recent product launches and legal settlements, may add context to the stock's performance amidst a largely unchanged market.

Kroger has 3 warning signs we think you should know about.

The recent update on Kroger's earnings guidance for 2025, projecting a 2.25% to 3.25% growth in identical sales, aligns with its strategic emphasis on "Our Brands" and digital sales. This guidance provides a clearer context for the company's focused initiatives to drive sales volume and improve customer loyalty through fresh and affordable offerings. Additionally, the legal settlements and new product launches mentioned may have implications for future revenue streams, potentially enhancing margins and overall earnings. Over the last five years, Kroger’s total shareholder return, including dividends, achieved a significant 123.14% growth. Such a long-term perspective underscores the potential benefit to investors despite recent flat performance.

Kroger has outperformed the US Consumer Retailing industry over the past year, which returned 22.3%, showcasing its relative resilience and competitive edge amidst industry challenges. Looking forward, the emphasis on automation and high-margin growth areas like Media and wellness could affect revenue and earnings trajectories, which analysts expect to rise to US$157.1 billion and US$3.2 billion, respectively, by May 2028. The company’s current share price of US$72.97 is slightly above the analyst consensus price target of US$68.19, indicating a modest overvaluation according to some market analyses. Investors should interpret this against the backdrop of expected market conditions, assuming ongoing cost pressures and interest rates could continue to influence performance metrics.

Evaluate Kroger's prospects by accessing our earnings growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kroger might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KR

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives