- United States

- /

- Aerospace & Defense

- /

- NasdaqGS:KTOS

Kratos Defense & Security Solutions (NasdaqGS:KTOS) Raises US$500 Million Through Equity Offering

Reviewed by Simply Wall St

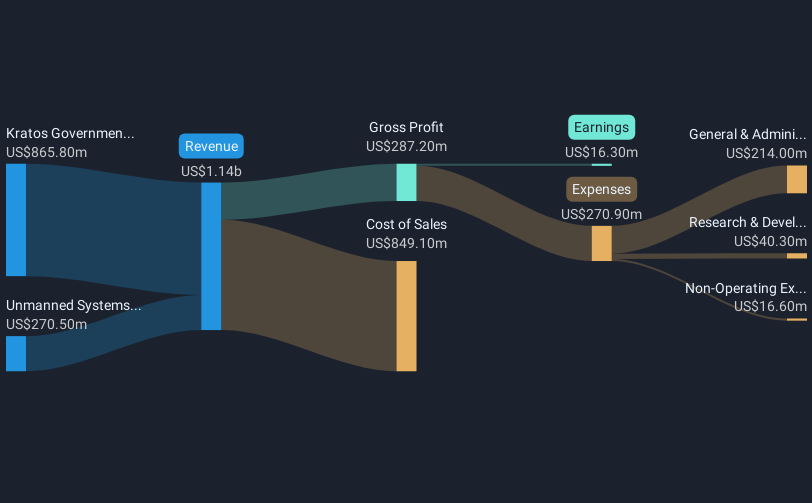

Kratos Defense & Security Solutions (NasdaqGS:KTOS) recently completed a $500 million follow-on equity offering, a move that underscores its focus on growth and capital raising. This event coincided with a 34% share price increase over the last quarter, contrasting with the broader market's 12% rise over the past year. The expansion plans for a new manufacturing facility and strategic alliances with GE Aerospace likely supported this growth, reinforcing investor confidence. Although earnings rose, these market reactions highlight external growth strategies as significant contributors to the company's stock performance compared to the relatively stable broader market uptrend.

You should learn about the 1 risk we've spotted with Kratos Defense & Security Solutions.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

The recent share price gains for Kratos Defense & Security Solutions, following its $500 million follow-on equity offering, have implications for its growth narrative. The fresh capital could support enhancements in manufacturing capacity and partnerships like with GE Aerospace, thus potentially boosting both revenue and earnings forecasts. Over the past three years, Kratos has achieved a total return, including share price and dividends, of 208.3%. This figure underscores a robust long-term trajectory, contrasting with a more modest market return over the past year.

When viewed against the broader market, the company's stock appreciated significantly more over the past year, outperforming the market's 12% increase. This suggests a divergence driven by Kratos' external growth strategies and successful expansion initiatives. The share price's relatively small discount compared to the analysts' consensus price target of approximately US$34.82 suggests a largely in-line market assessment, with the current price around US$36.23. Revenue growth and future earnings potential could further impact this equilibrium through increased operational leverage from new contracts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kratos Defense & Security Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:KTOS

Kratos Defense & Security Solutions

A technology company, provides technology, products, and system and software for the defense, national security, and commercial markets in the United States, other North America, the Asia Pacific, the Middle East, Europe, and Internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives