Kingfa Science & Technology (India) Limited (NSE:KINGFA) Not Flying Under The Radar

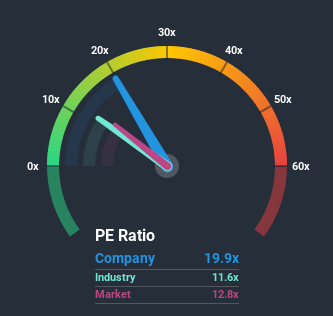

With a price-to-earnings (or "P/E") ratio of 19.9x Kingfa Science & Technology (India) Limited (NSE:KINGFA) may be sending very bearish signals at the moment, given that almost half of all companies in India have P/E ratios under 12x and even P/E's lower than 6x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

Kingfa Science & Technology (India) has been doing a good job lately as it's been growing earnings at a solid pace. It might be that many expect the respectable earnings performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Kingfa Science & Technology (India)

Does Growth Match The High P/E?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Kingfa Science & Technology (India)'s to be considered reasonable.

If we review the last year of earnings growth, the company posted a terrific increase of 28%. Pleasingly, EPS has also lifted 69% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing earnings over that time.

Weighing the recent medium-term upward earnings trajectory against the broader market's one-year forecast for contraction of 5.0% shows it's a great look while it lasts.

In light of this, it's understandable that Kingfa Science & Technology (India)'s P/E sits above the majority of other companies. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the bourse. Nonetheless, with most other businesses facing an uphill battle, staying on its current earnings path is no certainty.

The Bottom Line On Kingfa Science & Technology (India)'s P/E

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Kingfa Science & Technology (India) revealed its growing earnings over the medium-term are contributing to its high P/E, given the market is set to shrink. Right now shareholders are comfortable with the P/E as they are quite confident earnings aren't under threat. Our only concern is whether its earnings trajectory can keep outperforming under these tough market conditions. Otherwise, it's hard to see the share price falling strongly in the near future if its earnings performance persists.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Kingfa Science & Technology (India) that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a P/E ratio below 20x).

If you decide to trade Kingfa Science & Technology (India), use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Kingfa Science & Technology (India) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:KINGFA

Kingfa Science & Technology (India)

Manufactures and supplies reinforced polypropylene compounds, thermoplastics elastomers, fiber re-enforced composites, and personal protective equipment masks and gloves in India.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives