Kanani Industries Limited's (NSE:KANANIIND) Share Price Matching Investor Opinion

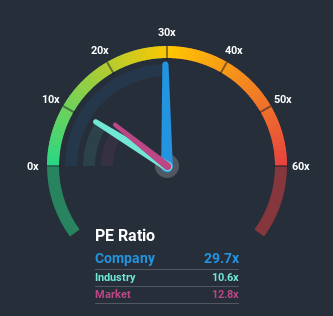

With a price-to-earnings (or "P/E") ratio of 29.7x Kanani Industries Limited (NSE:KANANIIND) may be sending very bearish signals at the moment, given that almost half of all companies in India have P/E ratios under 12x and even P/E's lower than 6x are not unusual. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

For instance, Kanani Industries' receding earnings in recent times would have to be some food for thought. One possibility is that the P/E is high because investors think the company will still do enough to outperform the broader market in the near future. If not, then existing shareholders may be quite nervous about the viability of the share price.

Check out our latest analysis for Kanani Industries

How Is Kanani Industries' Growth Trending?

In order to justify its P/E ratio, Kanani Industries would need to produce outstanding growth well in excess of the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 20%. However, a few very strong years before that means that it was still able to grow EPS by an impressive 194% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Weighing the recent medium-term upward earnings trajectory against the broader market's one-year forecast for contraction of 5.0% shows it's a great look while it lasts.

In light of this, it's understandable that Kanani Industries' P/E sits above the majority of other companies. Investors are willing to pay more for a stock they hope will buck the trend of the broader market going backwards. However, its current earnings trajectory will be very difficult to maintain against the headwinds other companies are facing at the moment.

The Final Word

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

As we suspected, our examination of Kanani Industries revealed its growing earnings over the medium-term are contributing to its high P/E, given the market is set to shrink. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. We still remain cautious about the company's ability to stay its recent course and swim against the current of the broader market turmoil. Although, if the company's relative performance doesn't change it will continue to provide strong support to the share price.

Before you take the next step, you should know about the 3 warning signs for Kanani Industries (2 are potentially serious!) that we have uncovered.

If P/E ratios interest you, you may wish to see this free collection of other companies that have grown earnings strongly and trade on P/E's below 20x.

If you decide to trade Kanani Industries, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Kanani Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:KANANIIND

Kanani Industries

Engages in the manufacture and export of diamond studded jewellery in India.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives