- United States

- /

- Software

- /

- NasdaqGM:CD

June 2025's Top Penny Stocks To Consider

Reviewed by Simply Wall St

Over the last 7 days, the market has remained flat, but it is up 11% over the past year with earnings expected to grow by 14% per annum in the coming years. In such a landscape, identifying stocks that combine financial strength with growth potential can be particularly rewarding. Although often seen as a relic of past trading days, penny stocks still present valuable opportunities when backed by solid fundamentals; this article will explore three such companies that stand out for their promising prospects.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Imperial Petroleum (IMPP) | $3.12 | $103.93M | ✅ 4 ⚠️ 1 View Analysis > |

| New Horizon Aircraft (HOVR) | $0.90 | $30.44M | ✅ 4 ⚠️ 5 View Analysis > |

| Waterdrop (WDH) | $1.45 | $542.49M | ✅ 4 ⚠️ 0 View Analysis > |

| Greenland Technologies Holding (GTEC) | $2.01 | $35.14M | ✅ 2 ⚠️ 5 View Analysis > |

| WM Technology (MAPS) | $1.08 | $179.74M | ✅ 4 ⚠️ 1 View Analysis > |

| Perfect (PERF) | $1.81 | $183.33M | ✅ 4 ⚠️ 0 View Analysis > |

| Table Trac (TBTC) | $4.77 | $22.44M | ✅ 2 ⚠️ 2 View Analysis > |

| Flexible Solutions International (FSI) | $4.37 | $55.14M | ✅ 1 ⚠️ 2 View Analysis > |

| BAB (BABB) | $0.8313 | $6.1M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.37 | $76.21M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 714 stocks from our US Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Mercurity Fintech Holding (MFH)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Mercurity Fintech Holding Inc. is a digital fintech company that offers AI-powered infrastructure, blockchain, and digital asset services in the United States, with a market cap of $241.37 million.

Operations: The company's revenue is primarily generated from its B2B online e-commerce platform, which accounted for $1.01 million.

Market Cap: $241.37M

Mercurity Fintech Holding Inc., with a market cap of US$241.37 million, remains pre-revenue as it reported only US$1.01 million in revenue last year and continues to incur losses, with net loss increasing to US$1.69 million for the four months ending April 2025. Despite its unprofitability, the company has a strong cash position exceeding its debt and liabilities, providing a runway of over three years even if cash flow declines. Recent strategic partnerships aim to enhance digital asset capabilities and expand into tokenized real-world assets, potentially opening new revenue streams while maintaining regulatory compliance across key markets.

- Click here and access our complete financial health analysis report to understand the dynamics of Mercurity Fintech Holding.

- Explore historical data to track Mercurity Fintech Holding's performance over time in our past results report.

3D Systems (DDD)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: 3D Systems Corporation offers 3D printing and digital manufacturing solutions across various regions globally, with a market cap of approximately $227.81 million.

Operations: The company's revenue is derived from two main segments: Healthcare, contributing $185.64 million, and Industrial, accounting for $246.12 million.

Market Cap: $227.81M

3D Systems Corporation, with a market cap of US$227.81 million, faces challenges as it reported declining revenues of US$94.54 million for Q1 2025 and a net loss of US$36.99 million. The company withdrew its full-year guidance for 2025 due to anticipated weak customer capital spending but remains focused on profitability through its diverse product portfolio in healthcare and industrial segments. Despite high volatility and increased debt levels, 3D Systems holds sufficient short-term assets to cover liabilities and continues innovating in digital dentistry and personalized medical solutions, positioning itself for potential growth when market conditions improve.

- Take a closer look at 3D Systems' potential here in our financial health report.

- Examine 3D Systems' earnings growth report to understand how analysts expect it to perform.

SmartRent (SMRT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: SmartRent, Inc. is an enterprise real estate technology company offering management software and applications to rental property stakeholders globally, with a market cap of approximately $171.02 million.

Operations: The company's revenue is primarily derived from its Electronic Security Devices segment, totaling $165.74 million.

Market Cap: $171.02M

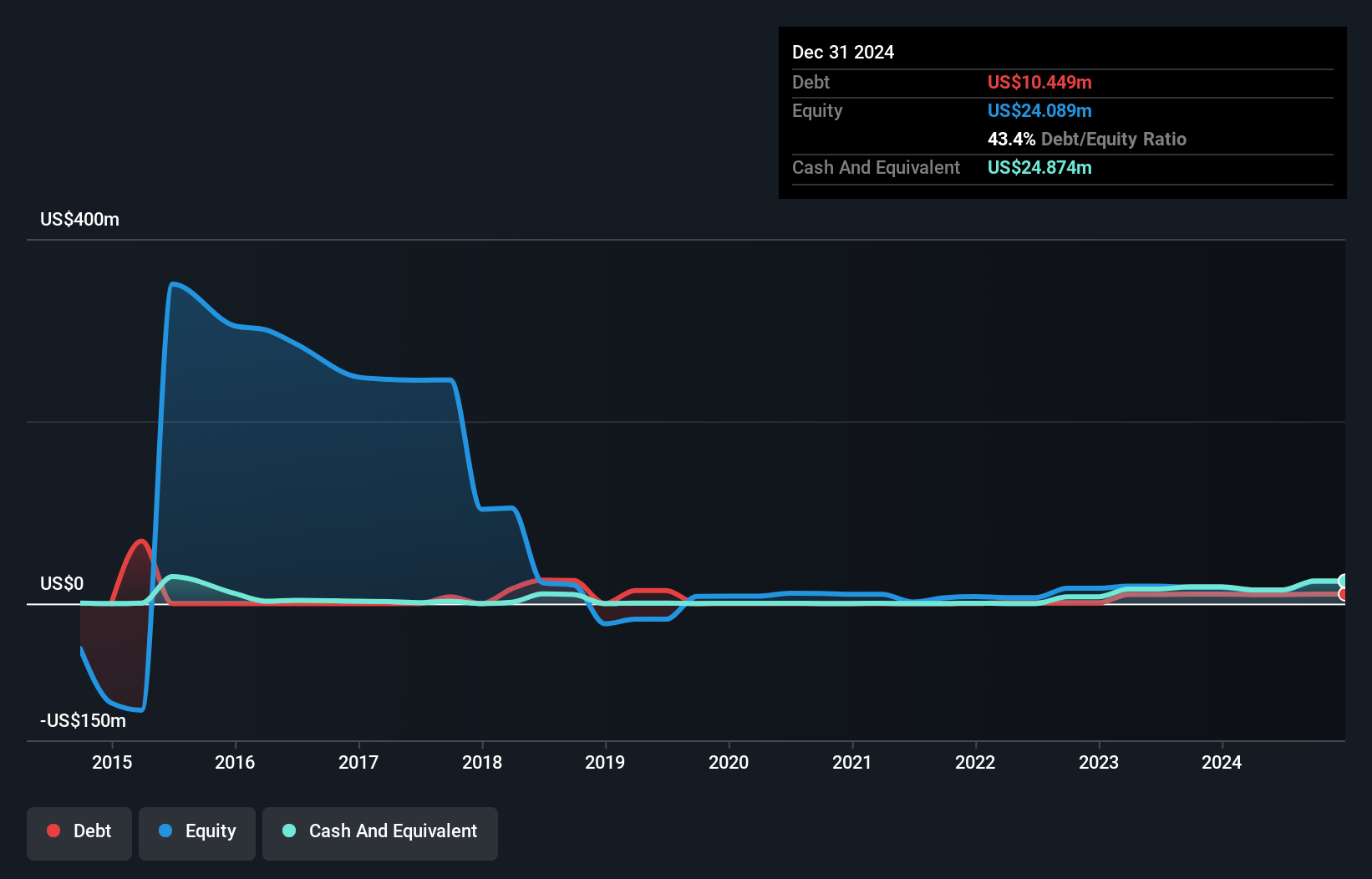

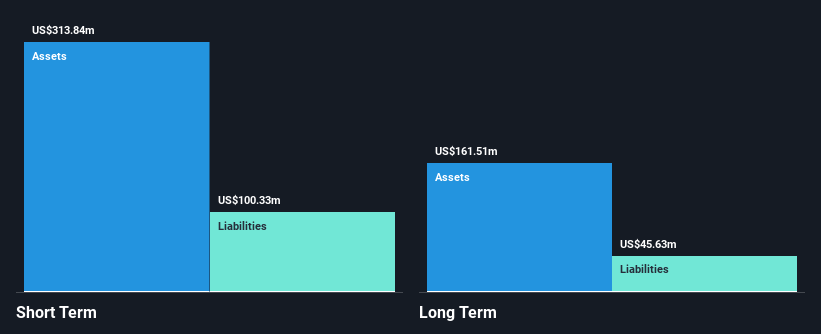

SmartRent, Inc., with a market cap of US$171.02 million, is navigating volatility with recent innovations like SMRT IQ and enhanced energy management tools aimed at optimizing property operations. Despite a significant net loss of US$40.18 million for Q1 2025 and a goodwill impairment charge of US$24.9 million, the company remains debt-free and holds sufficient short-term assets to cover liabilities. However, it faces challenges maintaining NYSE listing standards due to its low share price, prompting potential measures such as a reverse stock split to regain compliance while continuing its focus on platform advancements and operational efficiency improvements in the rental housing sector.

- Get an in-depth perspective on SmartRent's performance by reading our balance sheet health report here.

- Gain insights into SmartRent's future direction by reviewing our growth report.

Turning Ideas Into Actions

- Click this link to deep-dive into the 714 companies within our US Penny Stocks screener.

- Ready To Venture Into Other Investment Styles? Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 24 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:CD

Chaince Digital Holdings

A digital fintech company, provides access to the AI-powered infrastructure, blockchain, and digital assets in the United States.

Excellent balance sheet with slight risk.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion