- United States

- /

- Banks

- /

- NYSE:JPM

JPMorgan Chase (NYSE:JPM) Announces US$50 Billion Share Repurchase Program

Reviewed by Simply Wall St

JPMorgan Chase (NYSE:JPM) recently announced a substantial share repurchase program, allowing the buyback of up to $50 billion worth of shares, which aligns with the company's strong performance, illustrated by an 18% price increase over the last quarter. This price move likely aligned with the broader market recovery, as equity markets, particularly the S&P 500 and Nasdaq, reached record highs. The financial giant's consistent dividend payouts and positive earnings reports further reinforced its market position. In a period marked by significant economic developments and policy discussions, JPMorgan's strategic initiatives notably complemented the general market trends.

Outshine the giants: these 22 early-stage AI stocks could fund your retirement.

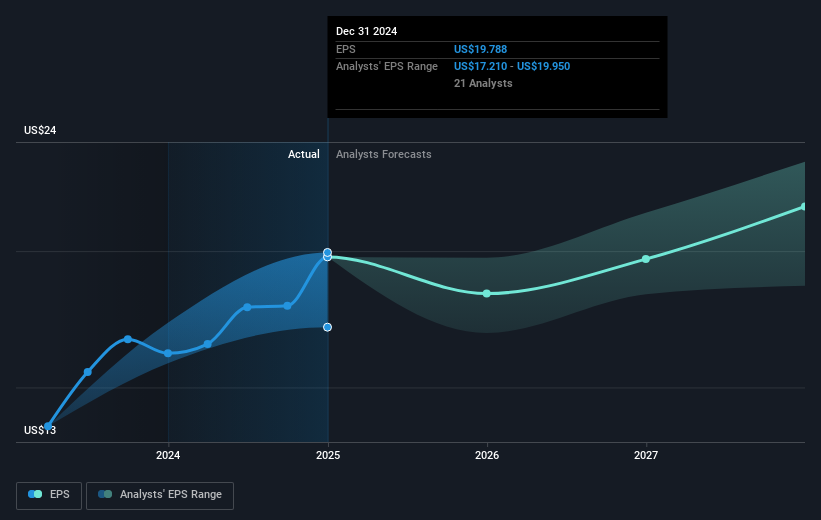

The recent announcement of JPMorgan Chase's US$50 billion share buyback program might influence future earnings forecasts and market sentiment, despite concerns over higher credit losses and expenses. While this move suggests confidence in its long-term potential, it raises questions about the firm's ability to maintain net and operating margins under the given financial constraints. This repurchase, aimed at enhancing shareholder value, may offset some of the anticipated pressures on earnings and revenue growth, offering resilience in the face of economic headwinds.

Over the past five years, JPMorgan Chase's total return, including share price and dividends, surged 258.02%. In contrast, its share price climbed 18% in just the past quarter, driven by the share buyback announcement and a broader market recovery. However, on a one-year basis, JPMorgan outperformed the US Banks industry, which returned 27.4%, demonstrating solid performance. Despite a temporary boost, concerns persist as revenue is forecasted to grow slower than both the market and historical averages. Analysts suggest a possible earnings decline averaging 3% per year over three years, potentially pressuring profitability.

The current share price of US$249.39 remains below consensus and bearish price targets, signaling varied market expectations. The recent price move aligns closer to the consensus target of US$258.2 but remains above the bearish outlook of US$195.37. If downward earnings pressure continues and bearish projections align, investor reliance on strategic interventions like share repurchases will become increasingly crucial to fostering confidence and achieving sustainable returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JPM

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives