- India

- /

- Construction

- /

- NSEI:JMCPROJECT

JMC Projects (India) (NSE:JMCPROJECT) Share Prices Have Dropped 55% In The Last Year

While it may not be enough for some shareholders, we think it is good to see the JMC Projects (India) Limited (NSE:JMCPROJECT) share price up 11% in a single quarter. But that's small comfort given the dismal price performance over the last year. Specifically, the stock price slipped by 55% in that time. The share price recovery is not so impressive when you consider the fall. You could argue that the sell-off was too severe.

View our latest analysis for JMC Projects (India)

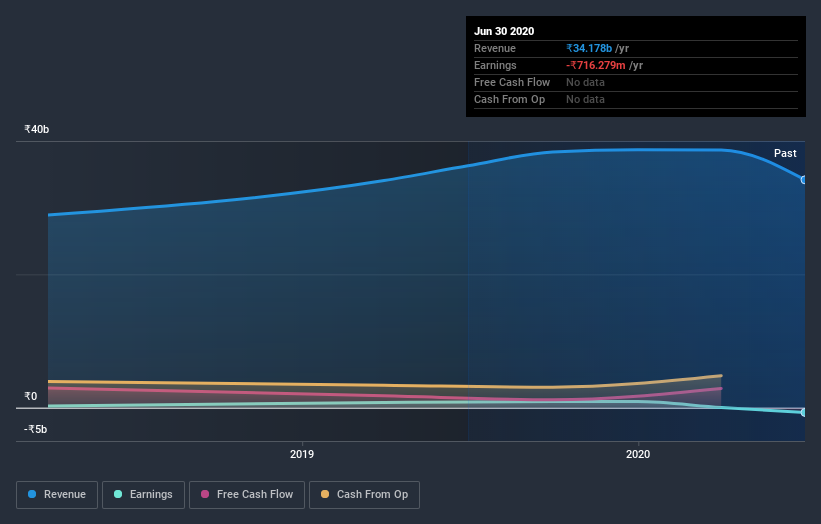

Given that JMC Projects (India) didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In just one year JMC Projects (India) saw its revenue fall by 5.9%. That's not what investors generally want to see. In the absence of profits, it's not unreasonable that the share price fell 55%. Having said that, if growth is coming in the future, the stock may have better days ahead. We don't generally like to own companies with falling revenues and no profits, so we're pretty cautious of this one, at the moment.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between JMC Projects (India)'s total shareholder return (TSR) and its share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Its history of dividend payouts mean that JMC Projects (India)'s TSR, which was a 54% drop over the last year, was not as bad as the share price return.

A Different Perspective

While the broader market gained around 7.6% in the last year, JMC Projects (India) shareholders lost 54% (even including dividends). Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. On the bright side, long term shareholders have made money, with a gain of 6.6% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with JMC Projects (India) (at least 1 which is significant) , and understanding them should be part of your investment process.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

When trading JMC Projects (India) or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:JMCPROJECT

JMC Projects (India)

JMC Projects (India) Limited engages in the business of engineering, procurement, and construction relating to infrastructure sector in India, Ethiopia, Sri Lanka, and Mongolia.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives